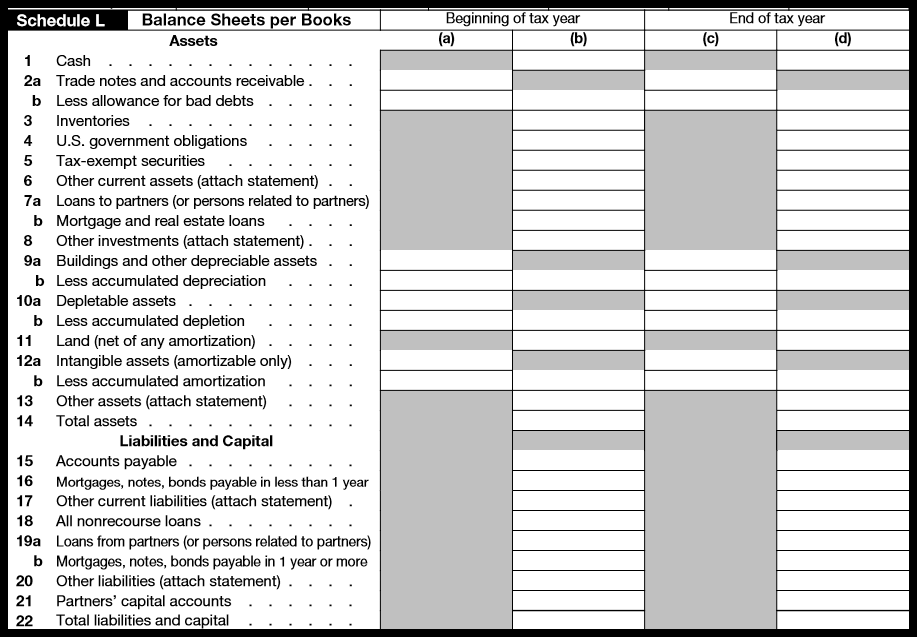

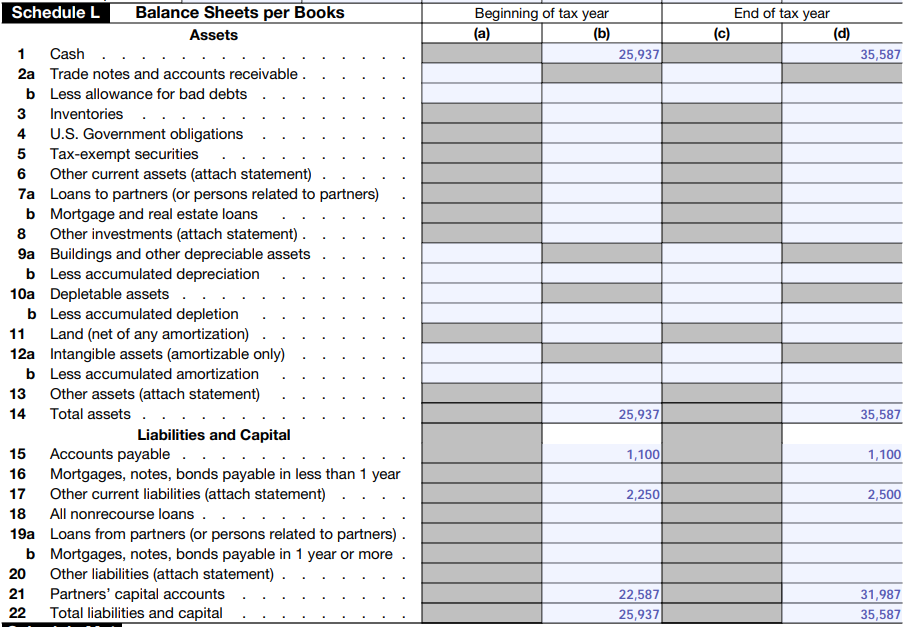

1065 Balance Sheet Requirements

1065 Balance Sheet Requirements - Form 1065 isn't considered to be a return unless it's signed by a partner or llc member. Do i need to include a balance sheet with form 1065? Yes, partnerships are required to include a balance sheet (using. When a return is made for a partnership by a receiver,. A partnership has to complete a schedule l (balance sheet); Schedule l is required when the partnership does not meet the four requirements outlined in schedule b (form 1065), line 4. When the requirements for form 1065, schedule b, question 4 are met, the balance sheet information isn't required with the return, per the.

When the requirements for form 1065, schedule b, question 4 are met, the balance sheet information isn't required with the return, per the. Form 1065 isn't considered to be a return unless it's signed by a partner or llc member. Do i need to include a balance sheet with form 1065? Schedule l is required when the partnership does not meet the four requirements outlined in schedule b (form 1065), line 4. Yes, partnerships are required to include a balance sheet (using. A partnership has to complete a schedule l (balance sheet); When a return is made for a partnership by a receiver,.

Form 1065 isn't considered to be a return unless it's signed by a partner or llc member. When a return is made for a partnership by a receiver,. Do i need to include a balance sheet with form 1065? When the requirements for form 1065, schedule b, question 4 are met, the balance sheet information isn't required with the return, per the. Yes, partnerships are required to include a balance sheet (using. Schedule l is required when the partnership does not meet the four requirements outlined in schedule b (form 1065), line 4. A partnership has to complete a schedule l (balance sheet);

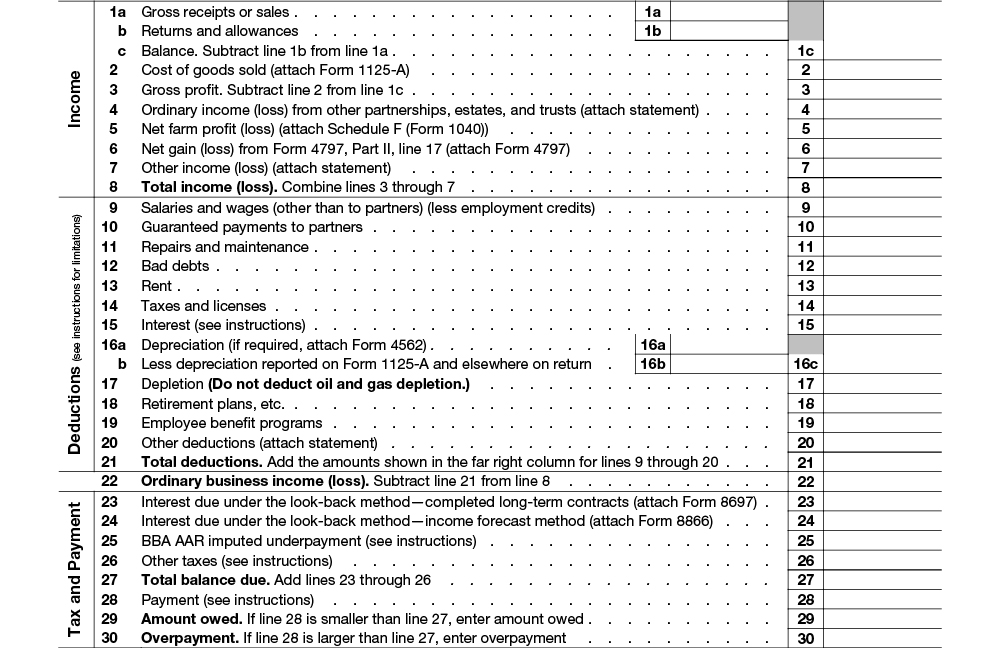

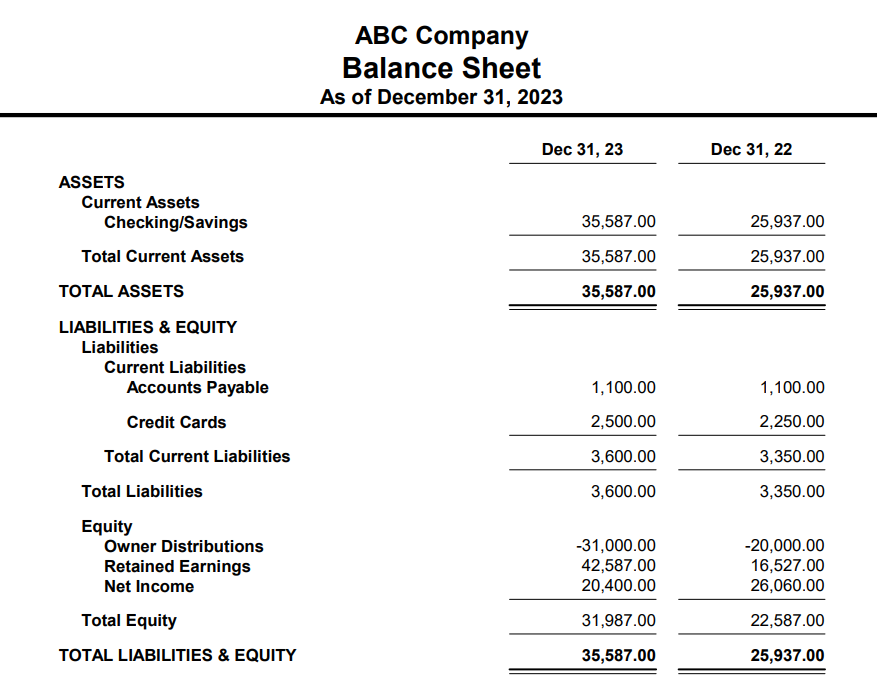

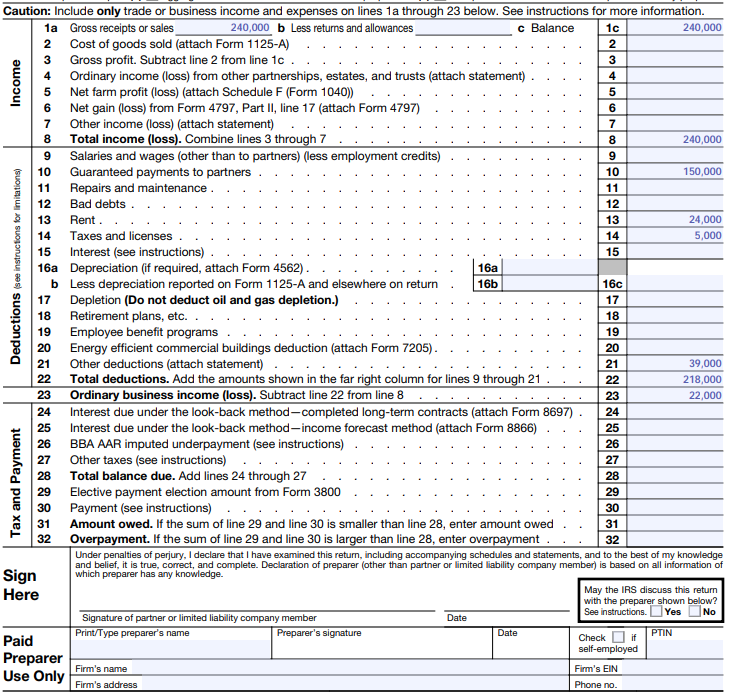

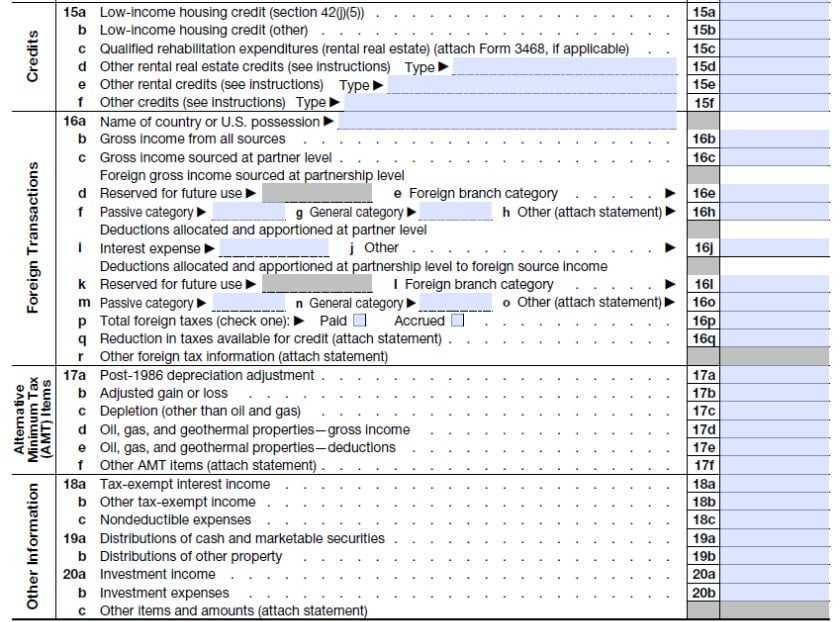

How to fill out an LLC 1065 IRS Tax form

Do i need to include a balance sheet with form 1065? A partnership has to complete a schedule l (balance sheet); Yes, partnerships are required to include a balance sheet (using. Schedule l is required when the partnership does not meet the four requirements outlined in schedule b (form 1065), line 4. When a return is made for a partnership.

How To Complete Form 1065 US Return of Partnership

Do i need to include a balance sheet with form 1065? Yes, partnerships are required to include a balance sheet (using. Schedule l is required when the partnership does not meet the four requirements outlined in schedule b (form 1065), line 4. When a return is made for a partnership by a receiver,. A partnership has to complete a schedule.

Form 1065 StepbyStep Instructions (+Free Checklist)

A partnership has to complete a schedule l (balance sheet); Form 1065 isn't considered to be a return unless it's signed by a partner or llc member. Do i need to include a balance sheet with form 1065? When a return is made for a partnership by a receiver,. When the requirements for form 1065, schedule b, question 4 are.

Form 1065 Instructions U.S. Return of Partnership

A partnership has to complete a schedule l (balance sheet); Do i need to include a balance sheet with form 1065? Schedule l is required when the partnership does not meet the four requirements outlined in schedule b (form 1065), line 4. Form 1065 isn't considered to be a return unless it's signed by a partner or llc member. When.

IRS Form 1065 Schedules L, M1, and M2 (2022) Balance Sheets (L

Do i need to include a balance sheet with form 1065? When the requirements for form 1065, schedule b, question 4 are met, the balance sheet information isn't required with the return, per the. Schedule l is required when the partnership does not meet the four requirements outlined in schedule b (form 1065), line 4. Form 1065 isn't considered to.

Form 1065 StepbyStep Instructions (+Free Checklist)

Yes, partnerships are required to include a balance sheet (using. When the requirements for form 1065, schedule b, question 4 are met, the balance sheet information isn't required with the return, per the. When a return is made for a partnership by a receiver,. A partnership has to complete a schedule l (balance sheet); Form 1065 isn't considered to be.

Form 1065 StepbyStep Instructions (+Free Checklist)

When a return is made for a partnership by a receiver,. Form 1065 isn't considered to be a return unless it's signed by a partner or llc member. Schedule l is required when the partnership does not meet the four requirements outlined in schedule b (form 1065), line 4. Yes, partnerships are required to include a balance sheet (using. Do.

IRS Form 1065 Schedules L, M1, and M2 (2020) Balance Sheets (L

Yes, partnerships are required to include a balance sheet (using. When a return is made for a partnership by a receiver,. When the requirements for form 1065, schedule b, question 4 are met, the balance sheet information isn't required with the return, per the. A partnership has to complete a schedule l (balance sheet); Schedule l is required when the.

Form 1065BU.S. Return of for Electing Large Partnerships

Yes, partnerships are required to include a balance sheet (using. A partnership has to complete a schedule l (balance sheet); Schedule l is required when the partnership does not meet the four requirements outlined in schedule b (form 1065), line 4. When a return is made for a partnership by a receiver,. When the requirements for form 1065, schedule b,.

Form 1065 StepbyStep Instructions (+ Free Checklist)

When a return is made for a partnership by a receiver,. Schedule l is required when the partnership does not meet the four requirements outlined in schedule b (form 1065), line 4. Form 1065 isn't considered to be a return unless it's signed by a partner or llc member. Do i need to include a balance sheet with form 1065?.

Form 1065 Isn't Considered To Be A Return Unless It's Signed By A Partner Or Llc Member.

Do i need to include a balance sheet with form 1065? Schedule l is required when the partnership does not meet the four requirements outlined in schedule b (form 1065), line 4. When the requirements for form 1065, schedule b, question 4 are met, the balance sheet information isn't required with the return, per the. When a return is made for a partnership by a receiver,.

Yes, Partnerships Are Required To Include A Balance Sheet (Using.

A partnership has to complete a schedule l (balance sheet);