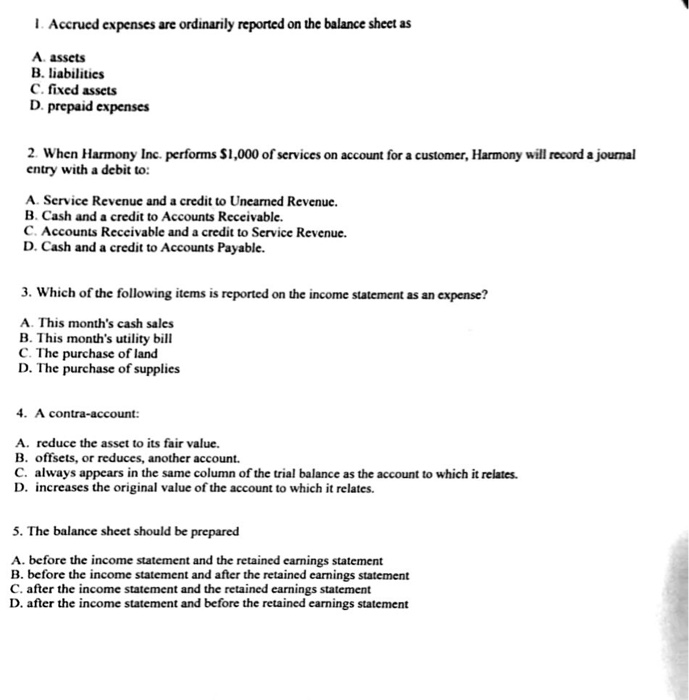

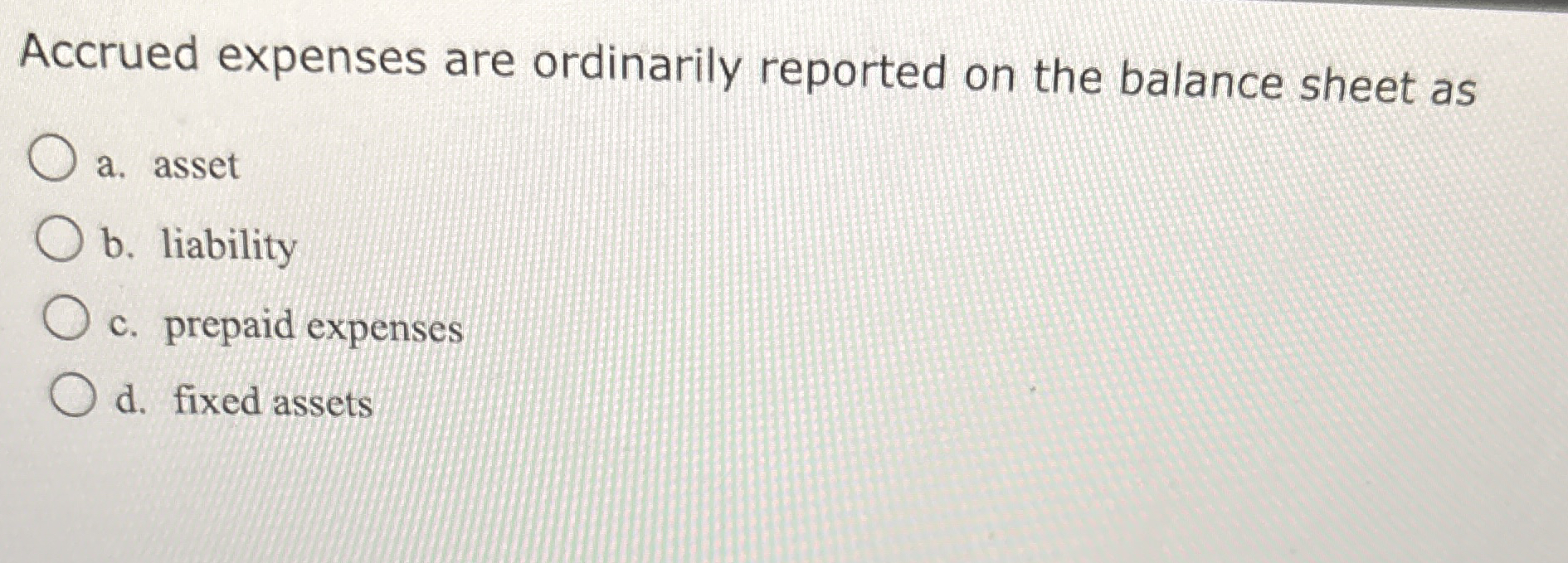

Accrued Expenses Are Ordinarily Reported On The Balance Sheet As

Accrued Expenses Are Ordinarily Reported On The Balance Sheet As - Correct answer is option ‘b’ liabilities: These expenses are reflected on the business's balance sheet under. For example, an accrued expense for unpaid wages would also be. Accrued expenses are reported on balance sh. Since accrued expenses represent a company’s obligation to make future cash payments, they are shown on a company’s balance sheet as current liabilities. The meaning of accrued expenses signifies expenses incurred but not paid by the business during the accounting period. Therefore, when you accrue an expense, it appears in the current liabilities portion of the balance sheet. There are 3 steps to solve this one.

These expenses are reflected on the business's balance sheet under. For example, an accrued expense for unpaid wages would also be. Correct answer is option ‘b’ liabilities: Since accrued expenses represent a company’s obligation to make future cash payments, they are shown on a company’s balance sheet as current liabilities. There are 3 steps to solve this one. Therefore, when you accrue an expense, it appears in the current liabilities portion of the balance sheet. Accrued expenses are reported on balance sh. The meaning of accrued expenses signifies expenses incurred but not paid by the business during the accounting period.

There are 3 steps to solve this one. Accrued expenses are reported on balance sh. Correct answer is option ‘b’ liabilities: The meaning of accrued expenses signifies expenses incurred but not paid by the business during the accounting period. Therefore, when you accrue an expense, it appears in the current liabilities portion of the balance sheet. For example, an accrued expense for unpaid wages would also be. These expenses are reflected on the business's balance sheet under. Since accrued expenses represent a company’s obligation to make future cash payments, they are shown on a company’s balance sheet as current liabilities.

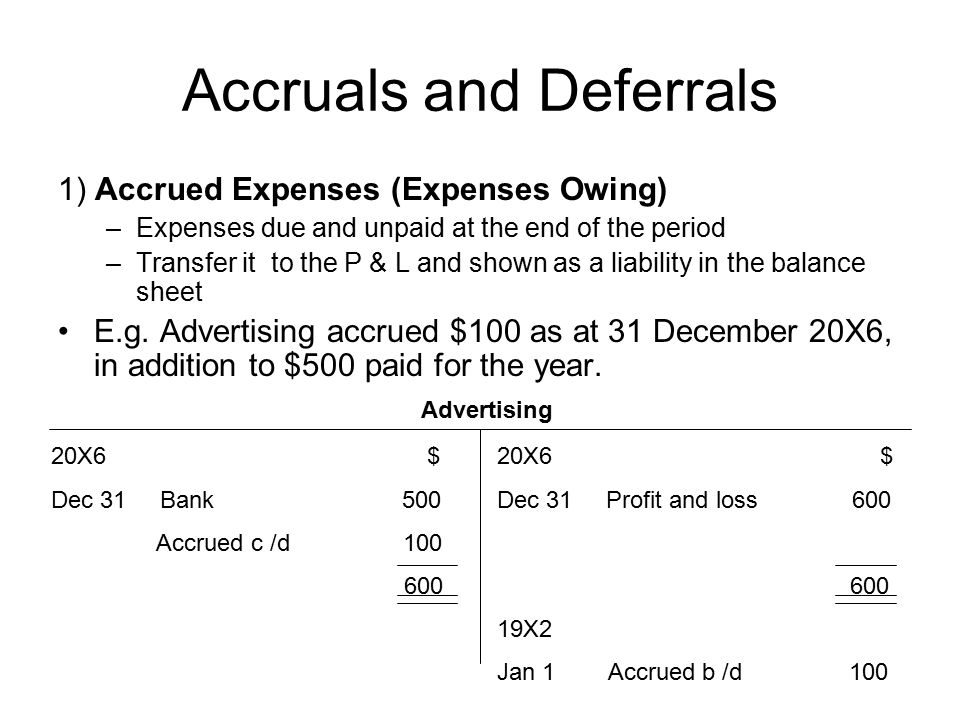

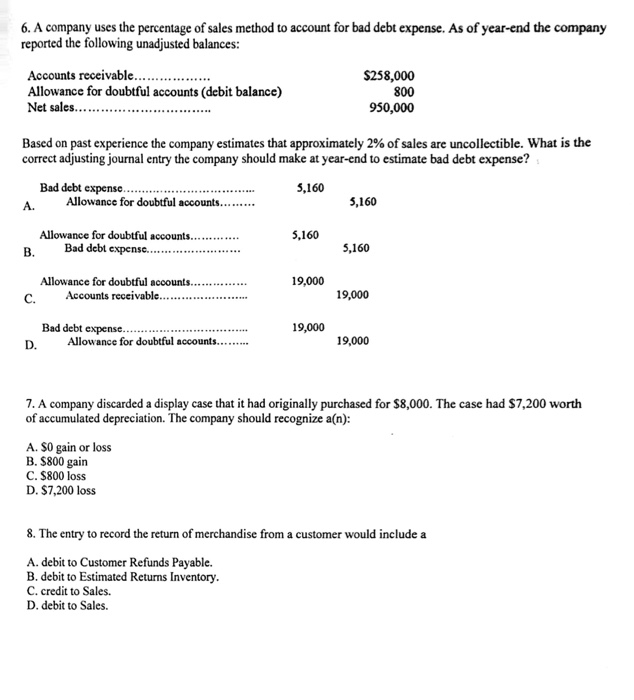

The accrual basis of accounting Business Accounting

For example, an accrued expense for unpaid wages would also be. Correct answer is option ‘b’ liabilities: There are 3 steps to solve this one. Since accrued expenses represent a company’s obligation to make future cash payments, they are shown on a company’s balance sheet as current liabilities. Accrued expenses are reported on balance sh.

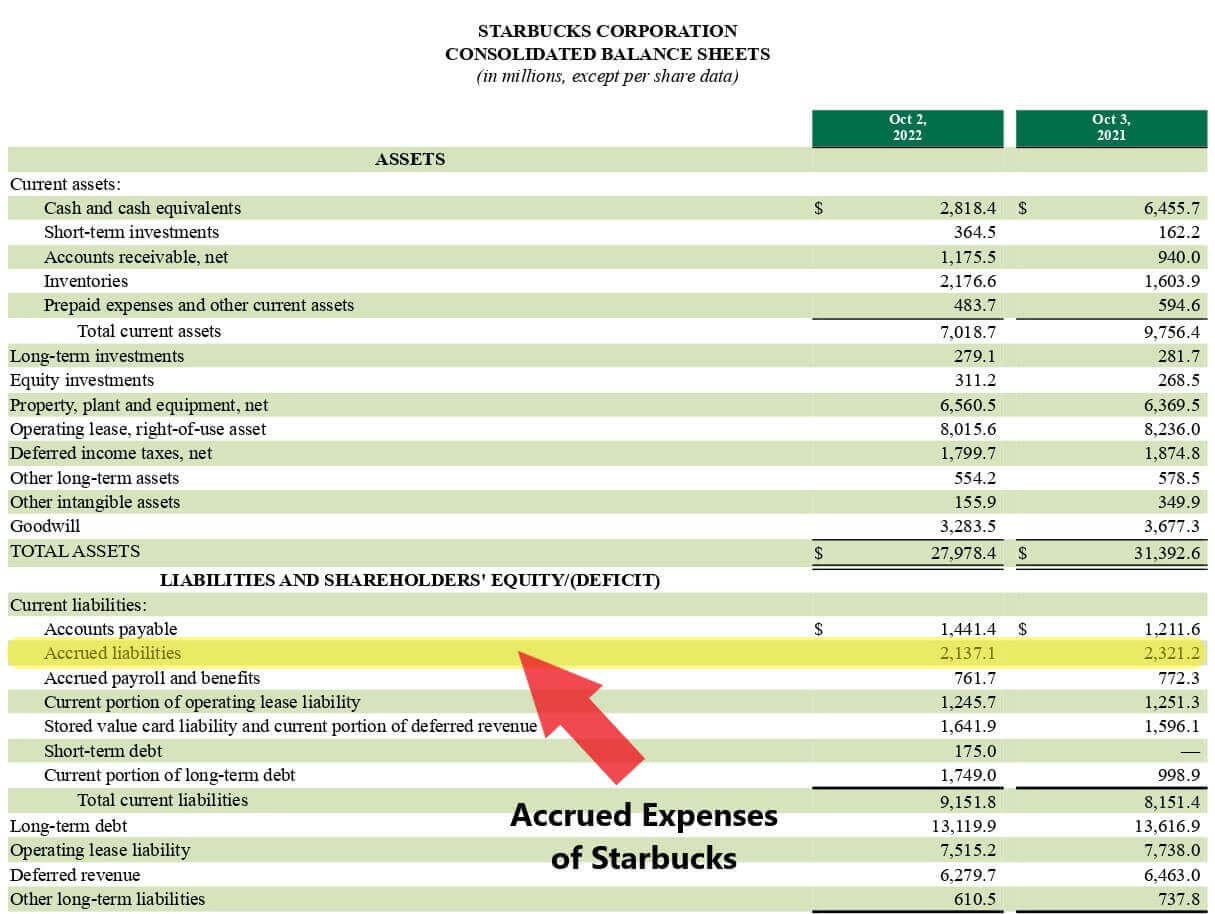

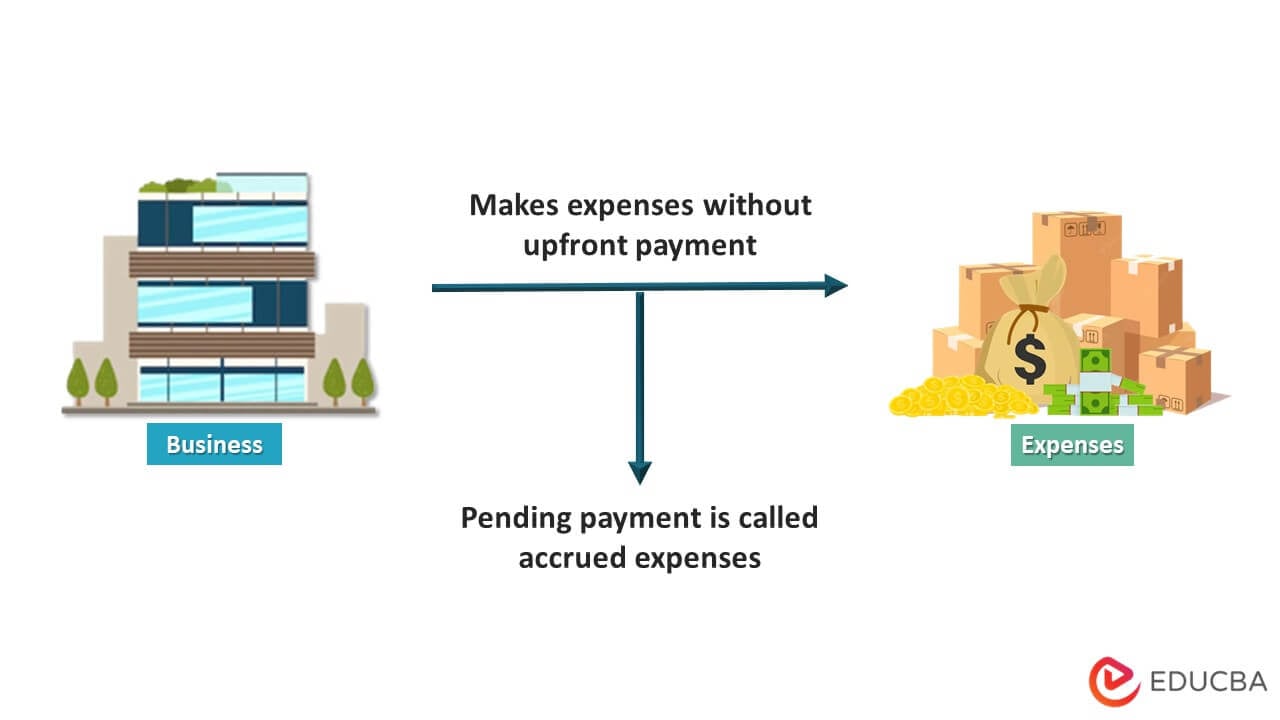

Accrued Expense Examples of Accrued Expenses

The meaning of accrued expenses signifies expenses incurred but not paid by the business during the accounting period. Correct answer is option ‘b’ liabilities: These expenses are reflected on the business's balance sheet under. For example, an accrued expense for unpaid wages would also be. Therefore, when you accrue an expense, it appears in the current liabilities portion of the.

Accrued Expense Examples of Accrued Expenses

Therefore, when you accrue an expense, it appears in the current liabilities portion of the balance sheet. Since accrued expenses represent a company’s obligation to make future cash payments, they are shown on a company’s balance sheet as current liabilities. There are 3 steps to solve this one. These expenses are reflected on the business's balance sheet under. For example,.

Solved I. Accrued expenses are ordinarily reported on the

These expenses are reflected on the business's balance sheet under. Therefore, when you accrue an expense, it appears in the current liabilities portion of the balance sheet. Correct answer is option ‘b’ liabilities: The meaning of accrued expenses signifies expenses incurred but not paid by the business during the accounting period. Accrued expenses are reported on balance sh.

Solved I. Accrued expenses are ordinarily reported on the

These expenses are reflected on the business's balance sheet under. For example, an accrued expense for unpaid wages would also be. There are 3 steps to solve this one. Accrued expenses are reported on balance sh. Correct answer is option ‘b’ liabilities:

Solved Accrued expenses are ordinarily reported on the

These expenses are reflected on the business's balance sheet under. Therefore, when you accrue an expense, it appears in the current liabilities portion of the balance sheet. There are 3 steps to solve this one. Correct answer is option ‘b’ liabilities: Accrued expenses are reported on balance sh.

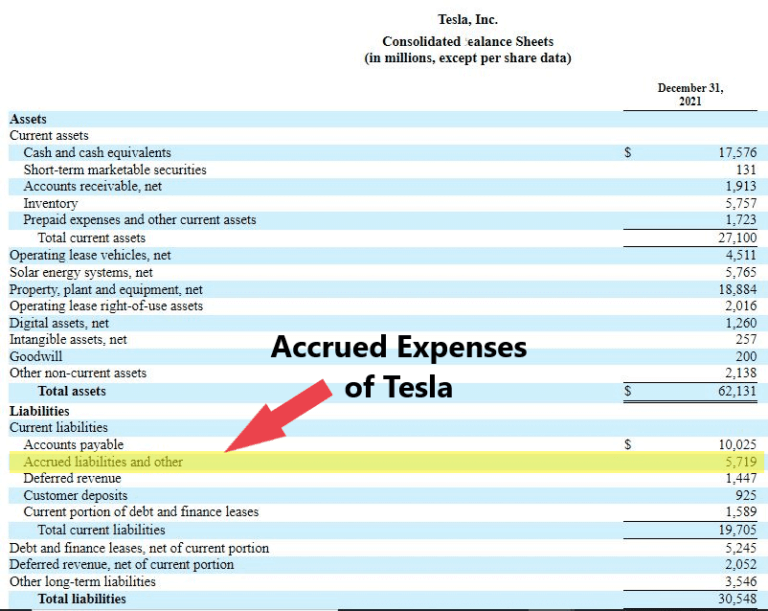

Accrued Expense Examples of Accrued Expenses

These expenses are reflected on the business's balance sheet under. For example, an accrued expense for unpaid wages would also be. Since accrued expenses represent a company’s obligation to make future cash payments, they are shown on a company’s balance sheet as current liabilities. Correct answer is option ‘b’ liabilities: Accrued expenses are reported on balance sh.

Accrued Expense Definition And Guide vrogue.co

There are 3 steps to solve this one. Accrued expenses are reported on balance sh. Therefore, when you accrue an expense, it appears in the current liabilities portion of the balance sheet. Correct answer is option ‘b’ liabilities: Since accrued expenses represent a company’s obligation to make future cash payments, they are shown on a company’s balance sheet as current.

Accrued Expense Meaning, Accounting Treatment And More

There are 3 steps to solve this one. Correct answer is option ‘b’ liabilities: Therefore, when you accrue an expense, it appears in the current liabilities portion of the balance sheet. Accrued expenses are reported on balance sh. The meaning of accrued expenses signifies expenses incurred but not paid by the business during the accounting period.

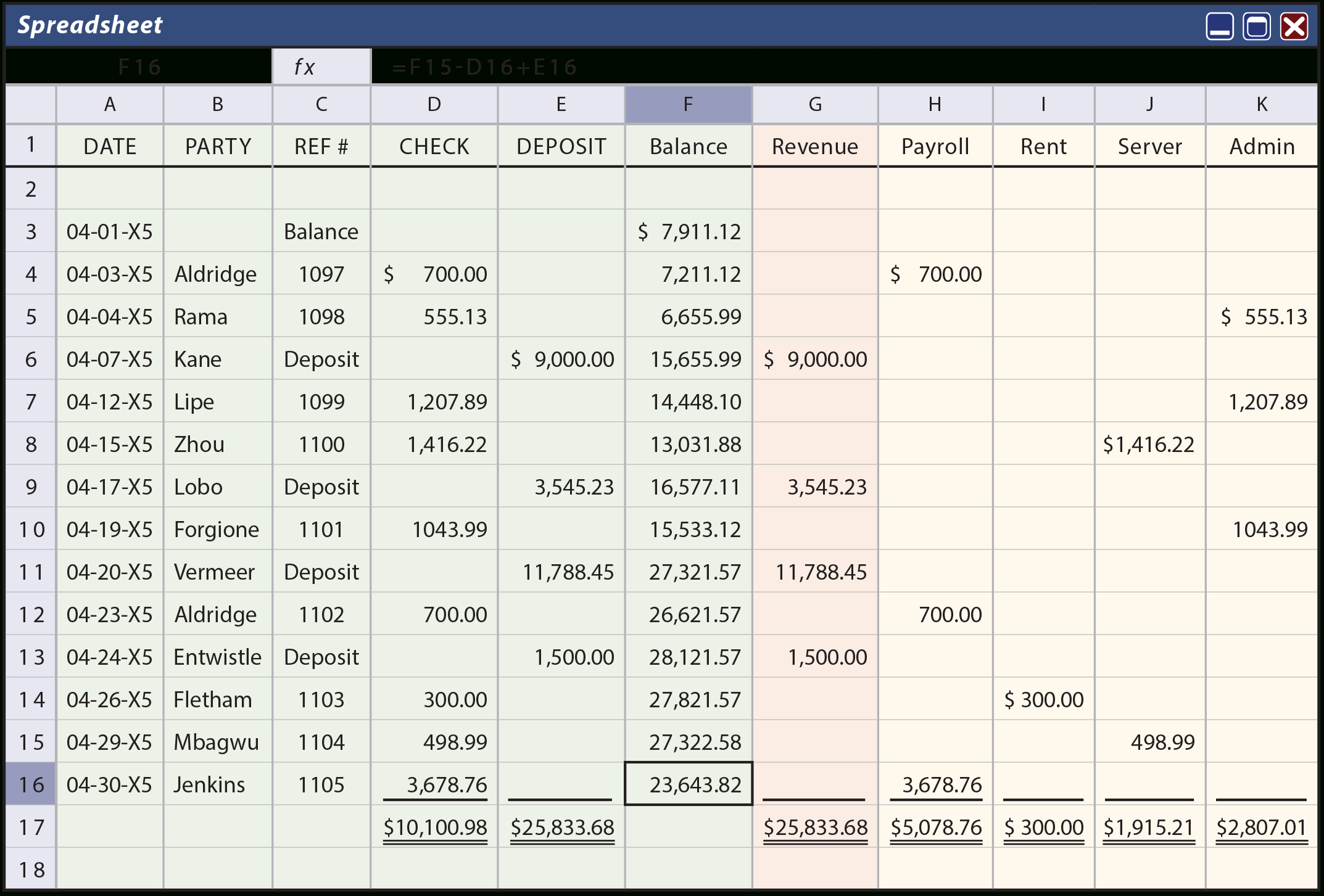

Expense Accrual Spreadsheet Template Spreadsheet Downloa expense

Since accrued expenses represent a company’s obligation to make future cash payments, they are shown on a company’s balance sheet as current liabilities. Accrued expenses are reported on balance sh. There are 3 steps to solve this one. The meaning of accrued expenses signifies expenses incurred but not paid by the business during the accounting period. Therefore, when you accrue.

Therefore, When You Accrue An Expense, It Appears In The Current Liabilities Portion Of The Balance Sheet.

Since accrued expenses represent a company’s obligation to make future cash payments, they are shown on a company’s balance sheet as current liabilities. For example, an accrued expense for unpaid wages would also be. The meaning of accrued expenses signifies expenses incurred but not paid by the business during the accounting period. There are 3 steps to solve this one.

These Expenses Are Reflected On The Business's Balance Sheet Under.

Correct answer is option ‘b’ liabilities: Accrued expenses are reported on balance sh.