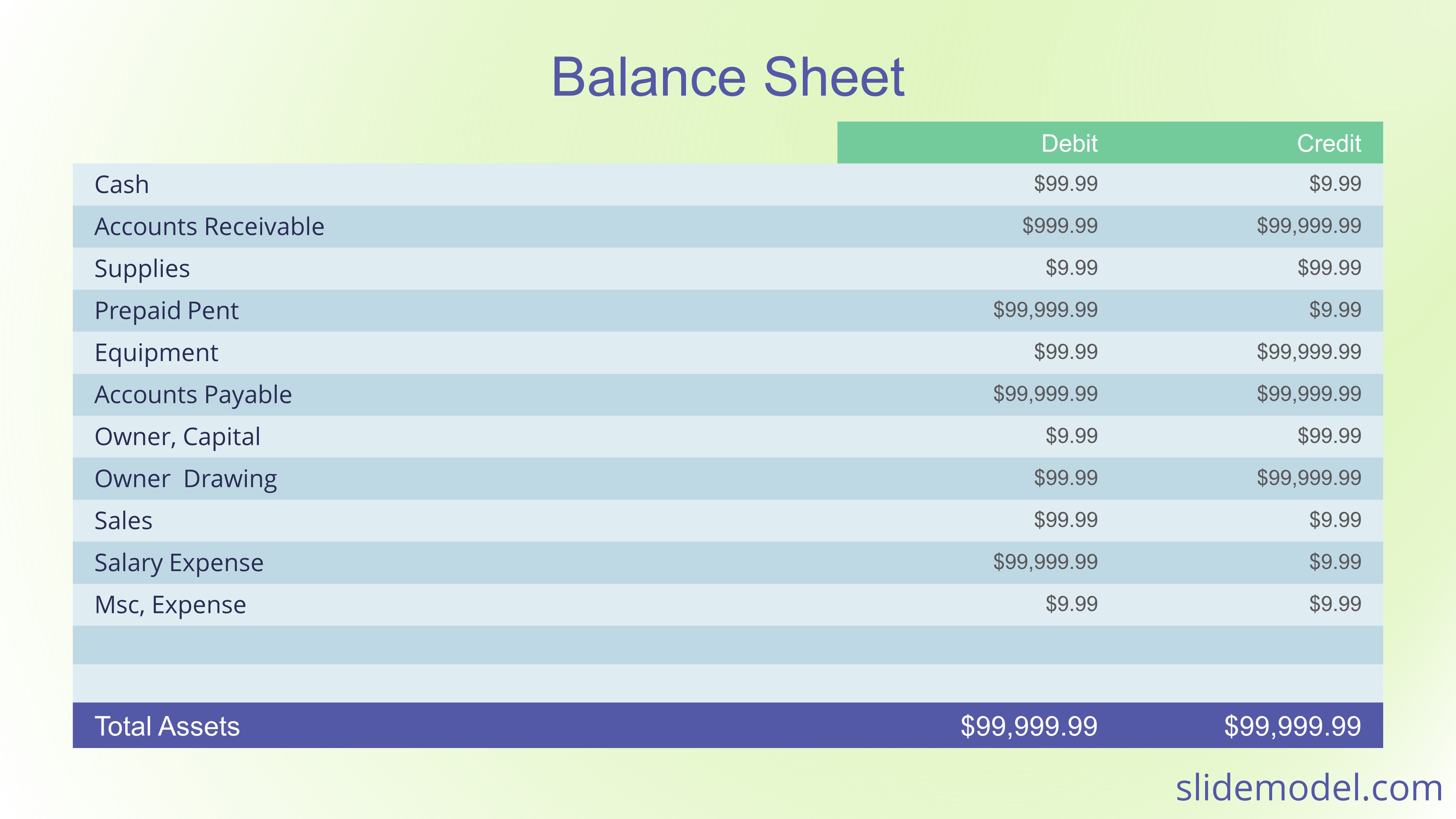

Are Retained Earnings On A Balance Sheet

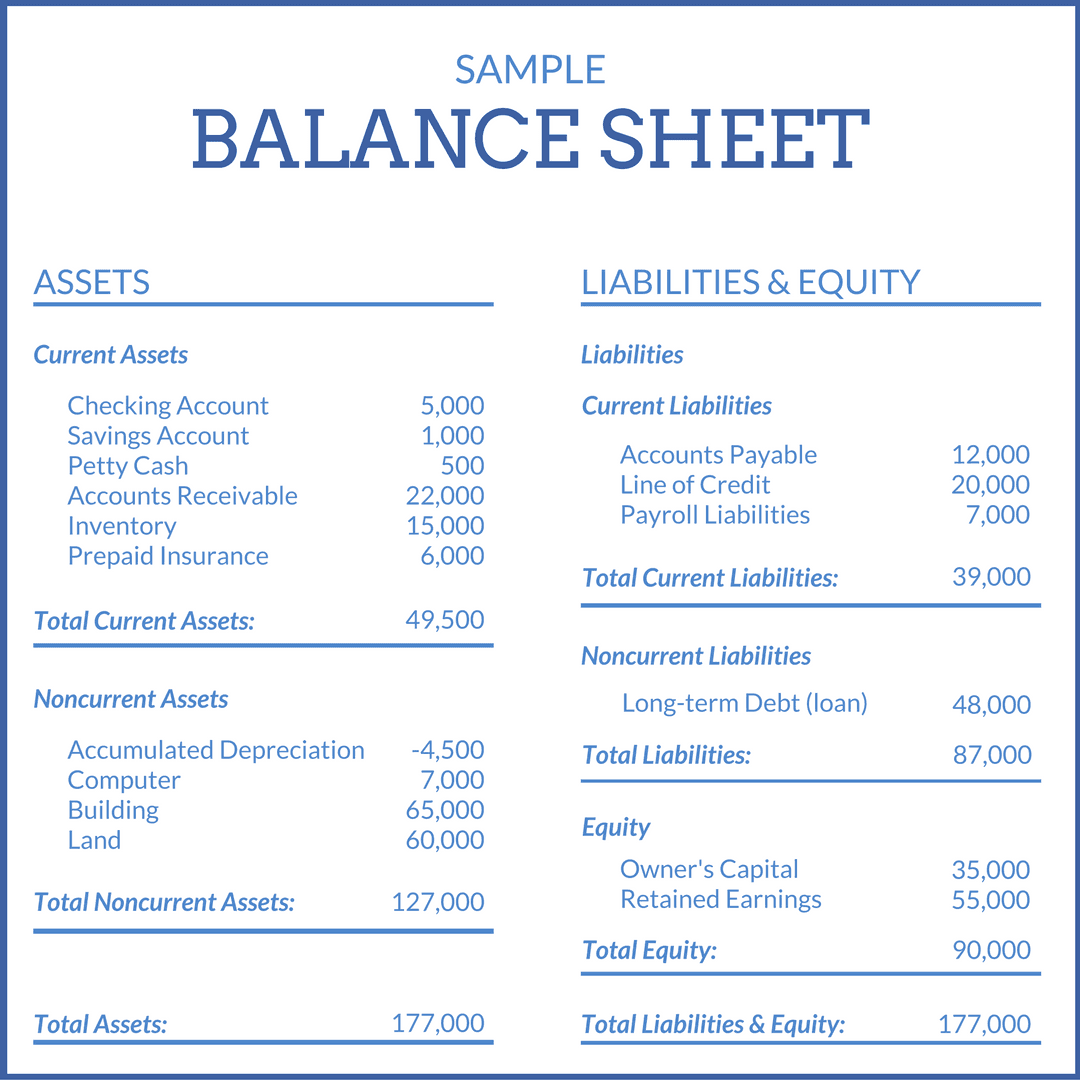

Are Retained Earnings On A Balance Sheet - Retained earnings are a portion of every year’s net profit retained after payment of tax and dividend payout. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds. Retained earnings are calculated by adding the current period’s net income to the previous period’s balance and subtracting. A company’s retained earnings balance can be found on the shareholder’s equity section of the balance sheet (one of the 3 core financial. Retained earnings are considered an. Retained earnings on a balance sheet are the amount of net income remaining after a company pays out dividends to its.

Retained earnings are a portion of every year’s net profit retained after payment of tax and dividend payout. Retained earnings are considered an. A company’s retained earnings balance can be found on the shareholder’s equity section of the balance sheet (one of the 3 core financial. Retained earnings are calculated by adding the current period’s net income to the previous period’s balance and subtracting. Retained earnings on a balance sheet are the amount of net income remaining after a company pays out dividends to its. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds.

Retained earnings are considered an. Retained earnings are calculated by adding the current period’s net income to the previous period’s balance and subtracting. Retained earnings on a balance sheet are the amount of net income remaining after a company pays out dividends to its. A company’s retained earnings balance can be found on the shareholder’s equity section of the balance sheet (one of the 3 core financial. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds. Retained earnings are a portion of every year’s net profit retained after payment of tax and dividend payout.

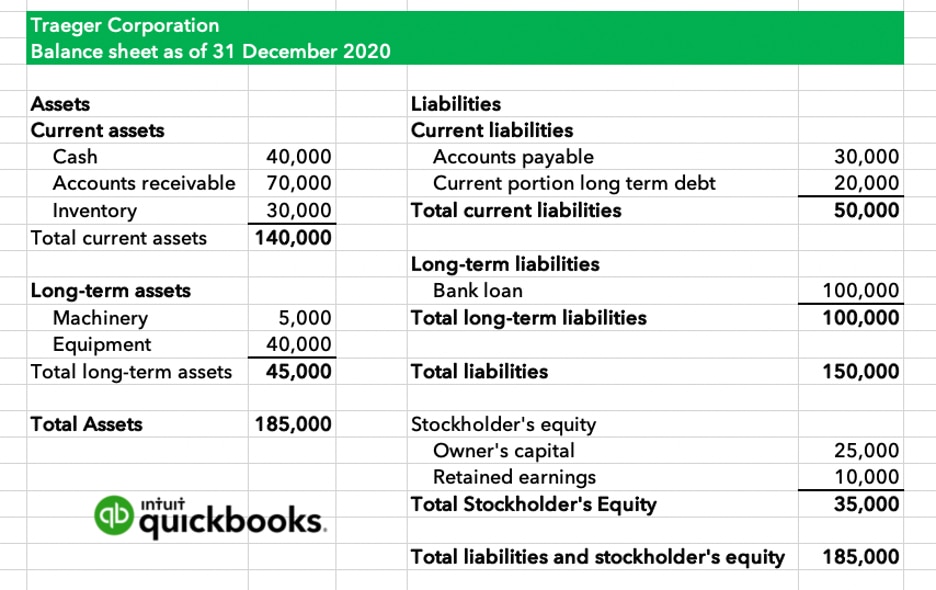

Looking Good Retained Earnings Formula In Balance Sheet Difference

Retained earnings are a portion of every year’s net profit retained after payment of tax and dividend payout. A company’s retained earnings balance can be found on the shareholder’s equity section of the balance sheet (one of the 3 core financial. Retained earnings are considered an. The retained earnings on the balance sheet refer to the cumulative profits kept by.

What are retained earnings? QuickBooks Australia

Retained earnings are a portion of every year’s net profit retained after payment of tax and dividend payout. Retained earnings are calculated by adding the current period’s net income to the previous period’s balance and subtracting. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds. Retained earnings on.

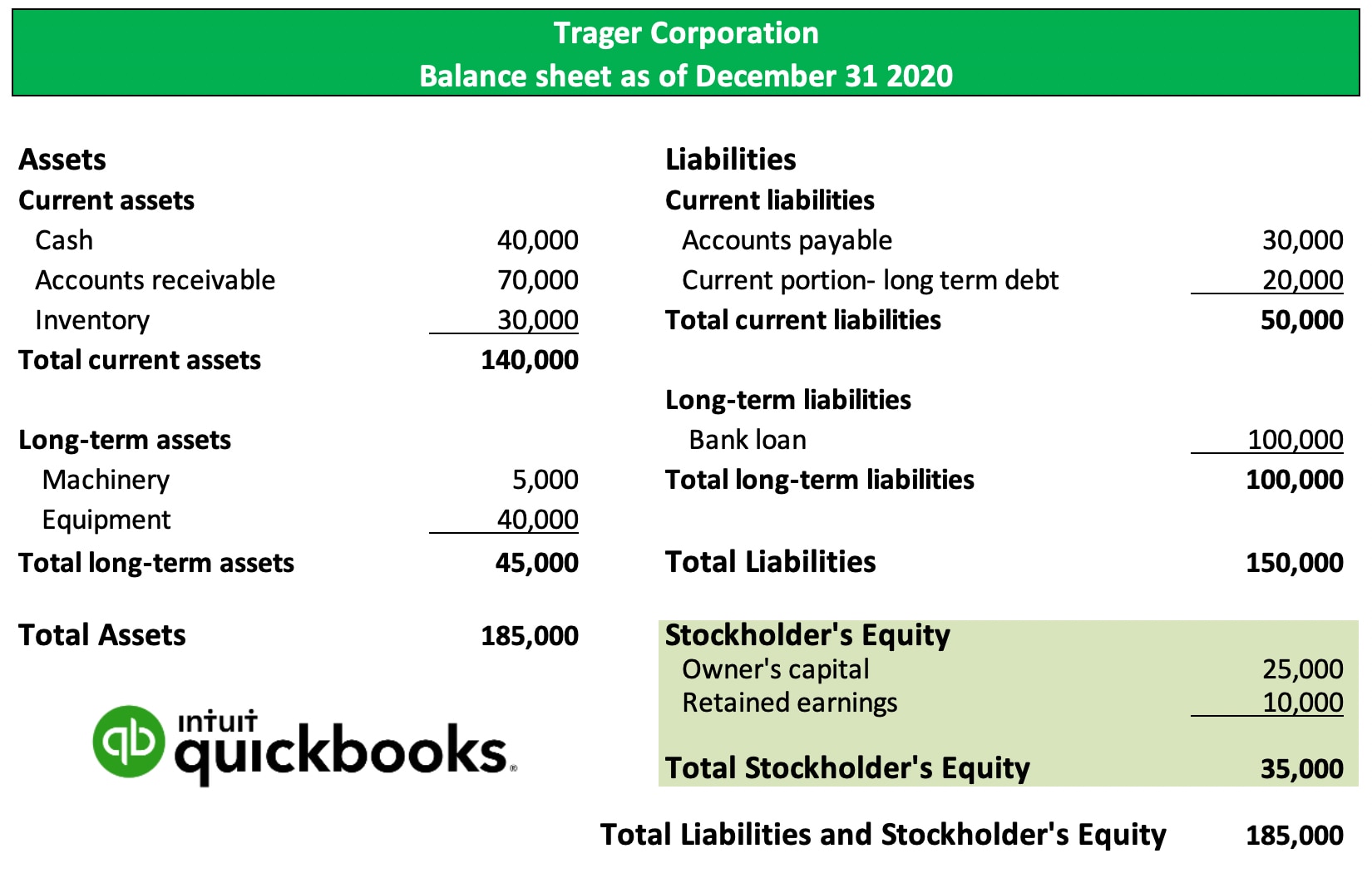

Retained Earnings Definition, Formula, and Example

Retained earnings are calculated by adding the current period’s net income to the previous period’s balance and subtracting. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds. Retained earnings are considered an. Retained earnings on a balance sheet are the amount of net income remaining after a company.

What Is Meant By Retained Earnings in Balance sheet Financial

Retained earnings are considered an. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds. Retained earnings are a portion of every year’s net profit retained after payment of tax and dividend payout. Retained earnings are calculated by adding the current period’s net income to the previous period’s balance.

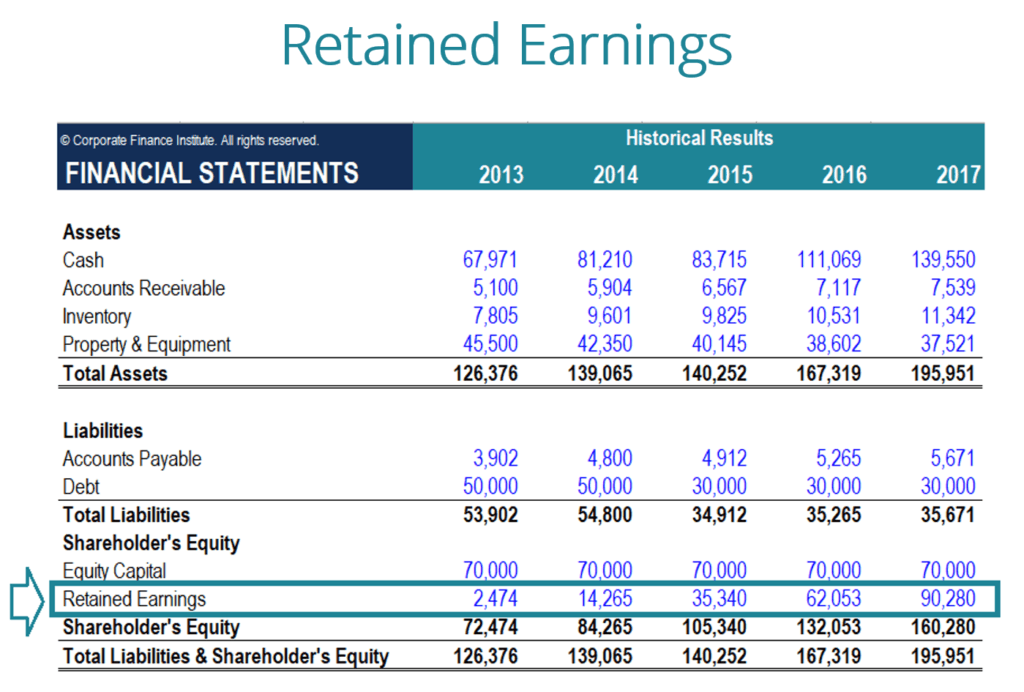

What are Retained Earnings? Guide, Formula, and Examples

Retained earnings are a portion of every year’s net profit retained after payment of tax and dividend payout. Retained earnings on a balance sheet are the amount of net income remaining after a company pays out dividends to its. Retained earnings are considered an. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation,.

Retained Earnings Calculation Balance Sheet at Wayne Owen blog

Retained earnings are considered an. Retained earnings are a portion of every year’s net profit retained after payment of tax and dividend payout. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds. Retained earnings on a balance sheet are the amount of net income remaining after a company.

Looking Good Retained Earnings Formula In Balance Sheet Difference

Retained earnings on a balance sheet are the amount of net income remaining after a company pays out dividends to its. Retained earnings are a portion of every year’s net profit retained after payment of tax and dividend payout. Retained earnings are considered an. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation,.

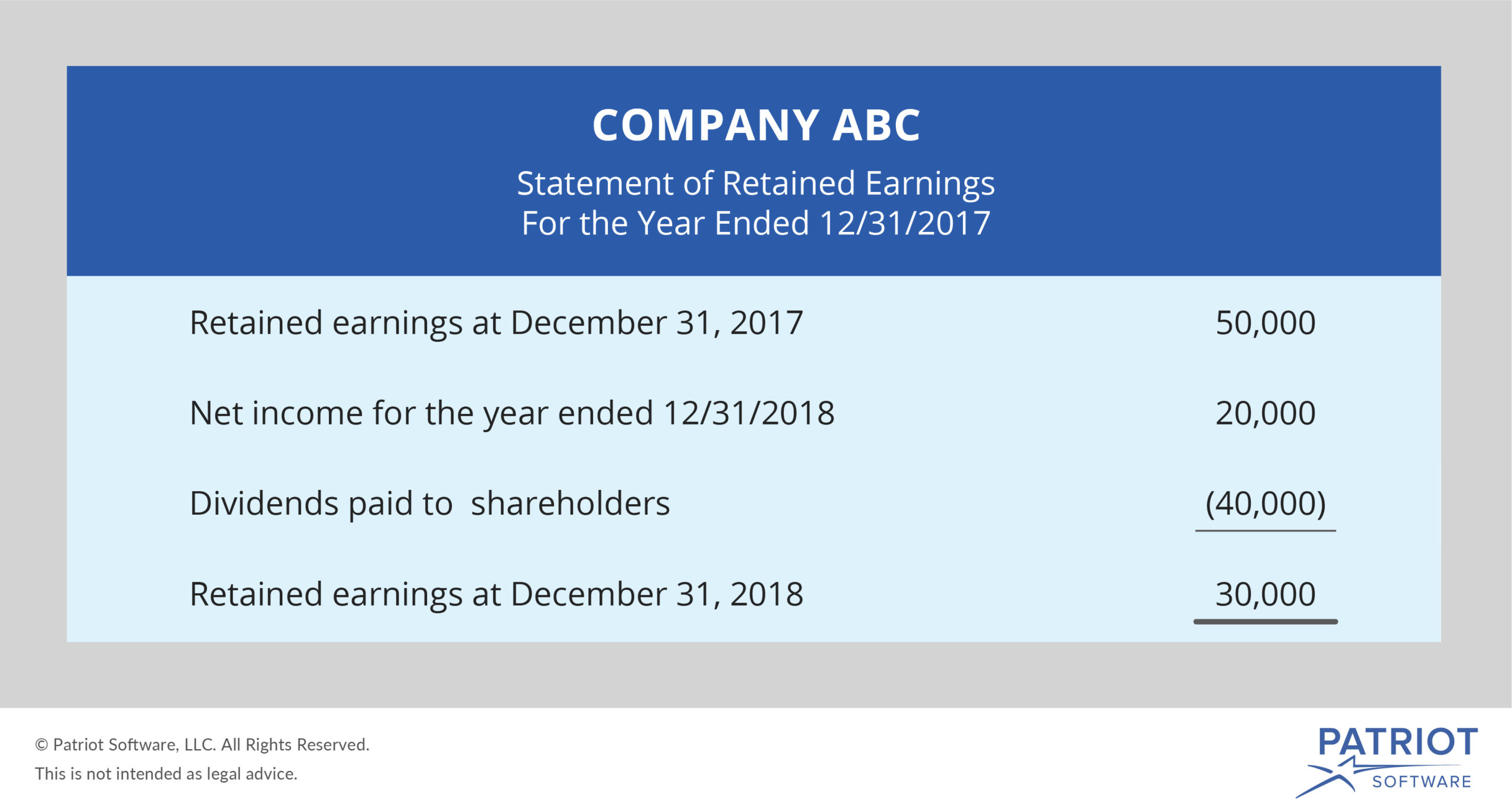

Balance Sheet and Statement of Retained Earnings YouTube

Retained earnings are considered an. Retained earnings are calculated by adding the current period’s net income to the previous period’s balance and subtracting. Retained earnings on a balance sheet are the amount of net income remaining after a company pays out dividends to its. A company’s retained earnings balance can be found on the shareholder’s equity section of the balance.

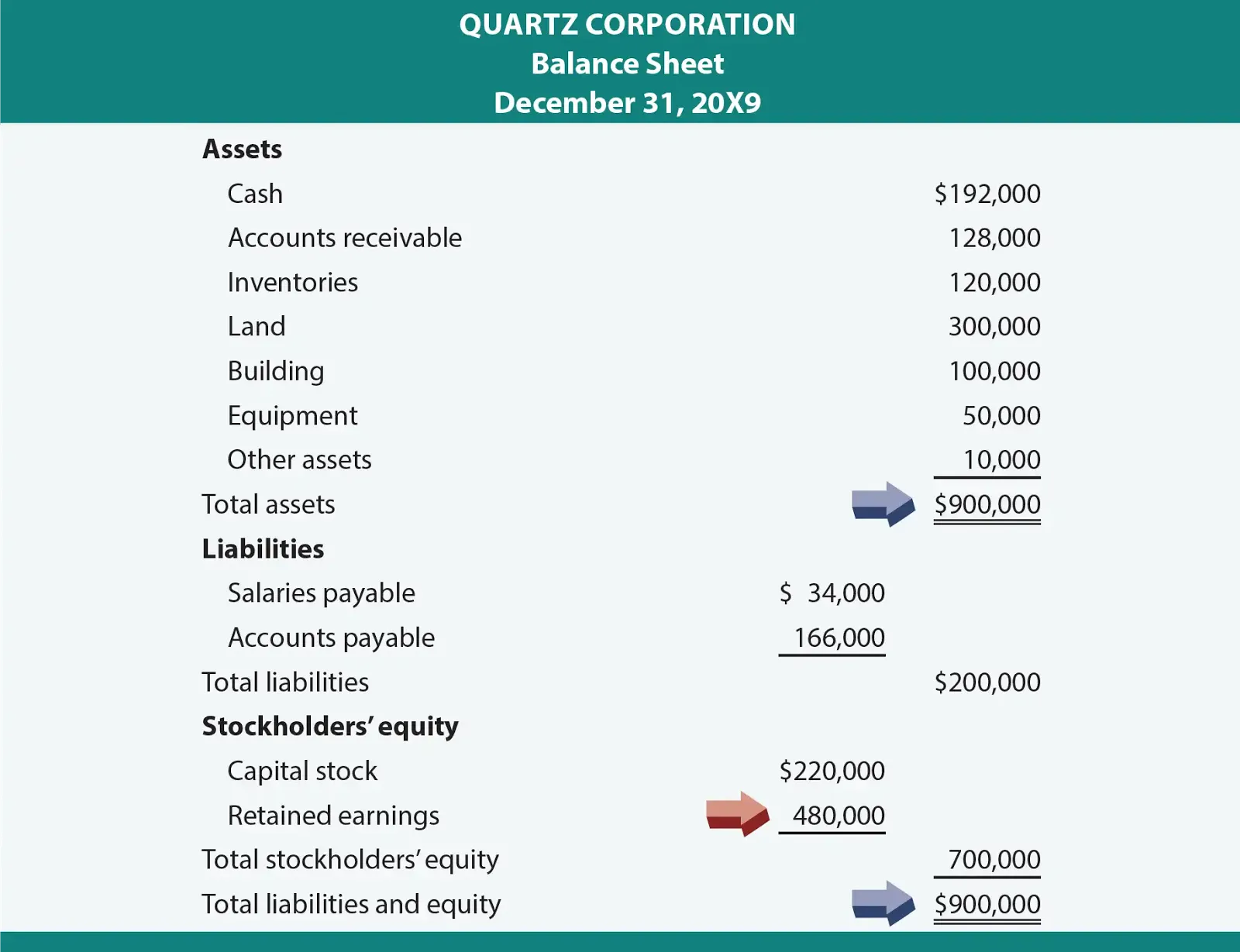

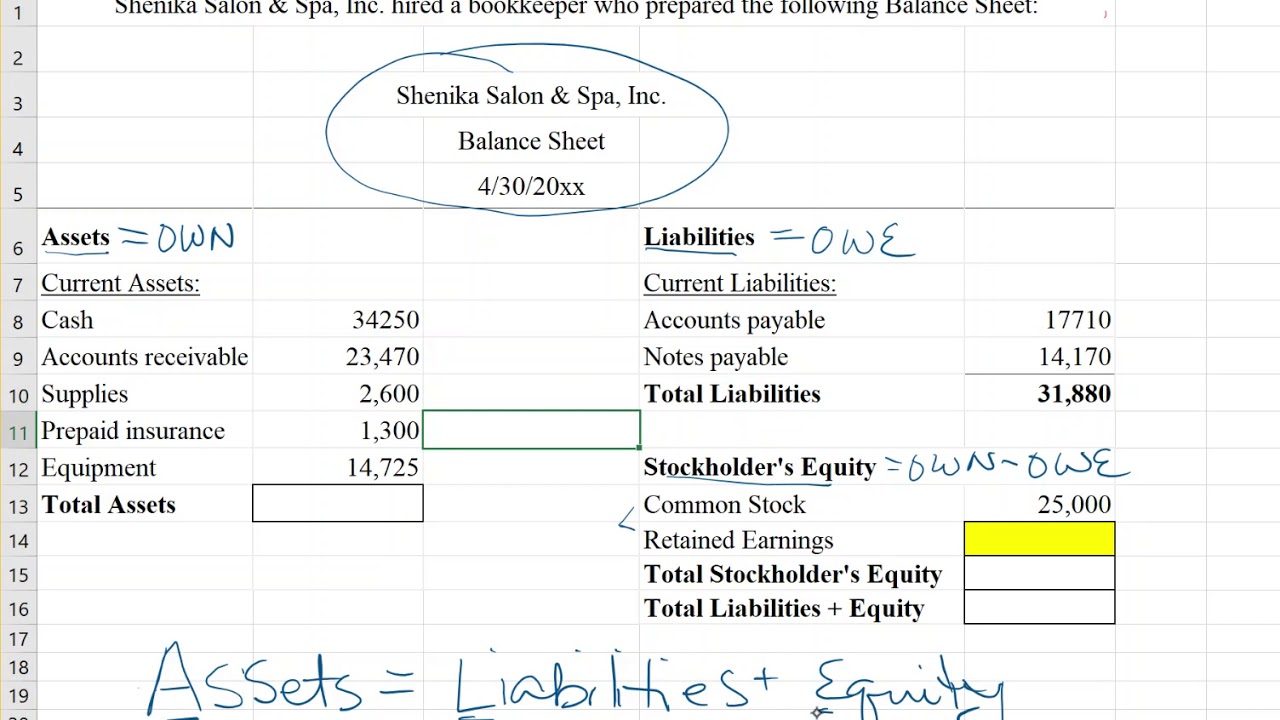

Complete a Balance Sheet by solving for Retained Earnings YouTube

A company’s retained earnings balance can be found on the shareholder’s equity section of the balance sheet (one of the 3 core financial. Retained earnings are a portion of every year’s net profit retained after payment of tax and dividend payout. Retained earnings are calculated by adding the current period’s net income to the previous period’s balance and subtracting. Retained.

Retained Earnings What Are They, and How Do You Calculate Them?

Retained earnings are a portion of every year’s net profit retained after payment of tax and dividend payout. Retained earnings are considered an. A company’s retained earnings balance can be found on the shareholder’s equity section of the balance sheet (one of the 3 core financial. Retained earnings on a balance sheet are the amount of net income remaining after.

Retained Earnings On A Balance Sheet Are The Amount Of Net Income Remaining After A Company Pays Out Dividends To Its.

Retained earnings are considered an. A company’s retained earnings balance can be found on the shareholder’s equity section of the balance sheet (one of the 3 core financial. Retained earnings are a portion of every year’s net profit retained after payment of tax and dividend payout. Retained earnings are calculated by adding the current period’s net income to the previous period’s balance and subtracting.