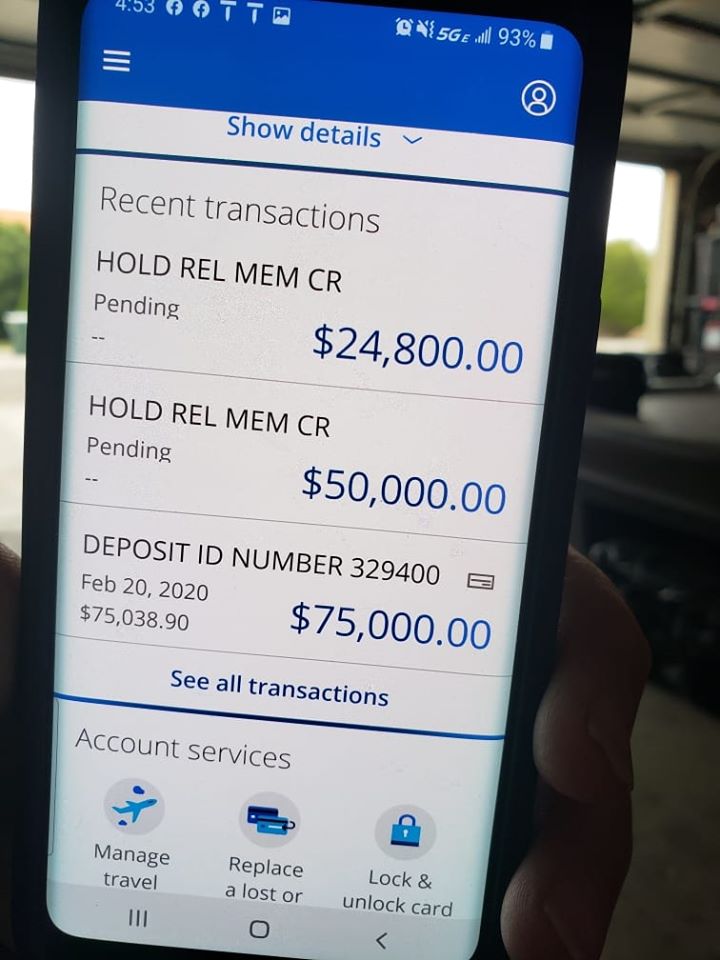

Chase Hold Rel Mem Cr But Funds Are Available Meaning

Chase Hold Rel Mem Cr But Funds Are Available Meaning - Hold rel mem cr means that the bank has released the hold on your deposited funds after verifying their legitimacy. This is a much bigger issue for folks who can't rely on using credit or a personal loan to cover themselves until their funds are available. It’s a banking term that indicates a temporary hold on funds has been lifted, and the transaction is now processed as a credit to your account. Learn what hold rel mem cr means for chase, why funds are on hold, and how to resolve deposited item returns. It means chase placed a temporary hold on your deposit, usually a check, and has now. What does hold rel mem cr mean for chase?

Learn what hold rel mem cr means for chase, why funds are on hold, and how to resolve deposited item returns. This is a much bigger issue for folks who can't rely on using credit or a personal loan to cover themselves until their funds are available. What does hold rel mem cr mean for chase? Hold rel mem cr means that the bank has released the hold on your deposited funds after verifying their legitimacy. It means chase placed a temporary hold on your deposit, usually a check, and has now. It’s a banking term that indicates a temporary hold on funds has been lifted, and the transaction is now processed as a credit to your account.

It’s a banking term that indicates a temporary hold on funds has been lifted, and the transaction is now processed as a credit to your account. Hold rel mem cr means that the bank has released the hold on your deposited funds after verifying their legitimacy. What does hold rel mem cr mean for chase? Learn what hold rel mem cr means for chase, why funds are on hold, and how to resolve deposited item returns. It means chase placed a temporary hold on your deposit, usually a check, and has now. This is a much bigger issue for folks who can't rely on using credit or a personal loan to cover themselves until their funds are available.

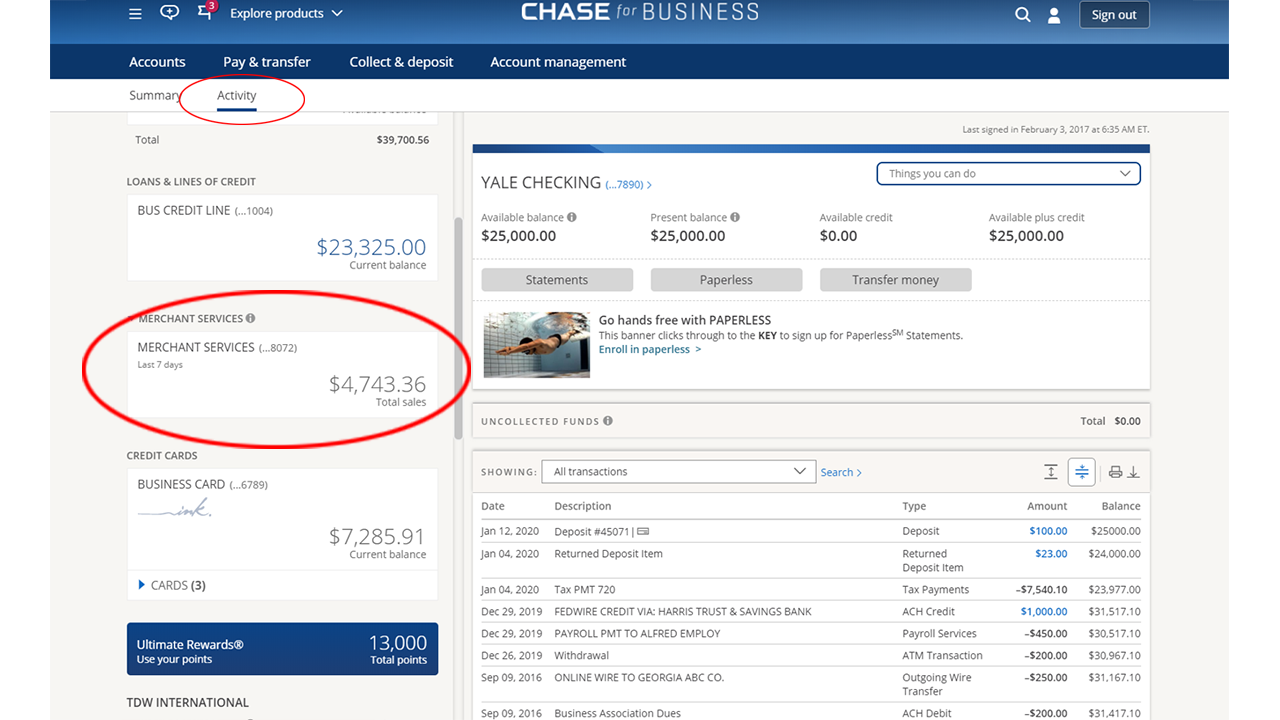

What Is A Hold Memo Dr Chase Bank at Heather Rodgers blog

It’s a banking term that indicates a temporary hold on funds has been lifted, and the transaction is now processed as a credit to your account. Learn what hold rel mem cr means for chase, why funds are on hold, and how to resolve deposited item returns. This is a much bigger issue for folks who can't rely on using.

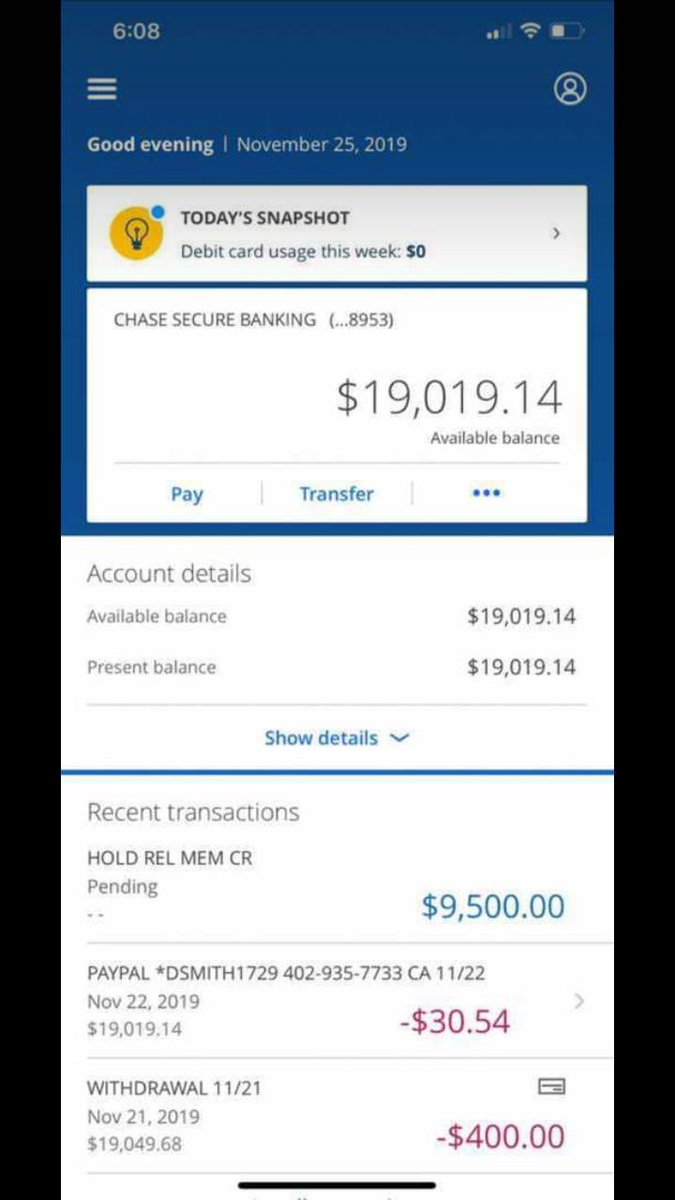

Unlocking The Hold Rel Mem CR Mystery A Game Changer Truth or Fiction

It’s a banking term that indicates a temporary hold on funds has been lifted, and the transaction is now processed as a credit to your account. This is a much bigger issue for folks who can't rely on using credit or a personal loan to cover themselves until their funds are available. It means chase placed a temporary hold on.

Chase Account Hold Routing And Number Examples And Forms

It’s a banking term that indicates a temporary hold on funds has been lifted, and the transaction is now processed as a credit to your account. Learn what hold rel mem cr means for chase, why funds are on hold, and how to resolve deposited item returns. Hold rel mem cr means that the bank has released the hold on.

Hold Rel Mem CR What It Means for Your Chase Account

What does hold rel mem cr mean for chase? It means chase placed a temporary hold on your deposit, usually a check, and has now. This is a much bigger issue for folks who can't rely on using credit or a personal loan to cover themselves until their funds are available. Learn what hold rel mem cr means for chase,.

Deposit Holds and Funds Availability Rules

What does hold rel mem cr mean for chase? Hold rel mem cr means that the bank has released the hold on your deposited funds after verifying their legitimacy. It means chase placed a temporary hold on your deposit, usually a check, and has now. This is a much bigger issue for folks who can't rely on using credit or.

What does HOLD REL MEM CR mean at Chase Bank?

It means chase placed a temporary hold on your deposit, usually a check, and has now. Learn what hold rel mem cr means for chase, why funds are on hold, and how to resolve deposited item returns. It’s a banking term that indicates a temporary hold on funds has been lifted, and the transaction is now processed as a credit.

How to Write a Chase Check (with Example)

It’s a banking term that indicates a temporary hold on funds has been lifted, and the transaction is now processed as a credit to your account. This is a much bigger issue for folks who can't rely on using credit or a personal loan to cover themselves until their funds are available. What does hold rel mem cr mean for.

Deposit Item Returned Hold Rel Mem Cr Letter For Returning A Check

This is a much bigger issue for folks who can't rely on using credit or a personal loan to cover themselves until their funds are available. What does hold rel mem cr mean for chase? Hold rel mem cr means that the bank has released the hold on your deposited funds after verifying their legitimacy. It means chase placed a.

What Is A Hold Memo Dr Chase Bank at Heather Rodgers blog

It means chase placed a temporary hold on your deposit, usually a check, and has now. This is a much bigger issue for folks who can't rely on using credit or a personal loan to cover themselves until their funds are available. Learn what hold rel mem cr means for chase, why funds are on hold, and how to resolve.

Hold Rel Mem Cr downrup

It means chase placed a temporary hold on your deposit, usually a check, and has now. Hold rel mem cr means that the bank has released the hold on your deposited funds after verifying their legitimacy. It’s a banking term that indicates a temporary hold on funds has been lifted, and the transaction is now processed as a credit to.

What Does Hold Rel Mem Cr Mean For Chase?

It’s a banking term that indicates a temporary hold on funds has been lifted, and the transaction is now processed as a credit to your account. Hold rel mem cr means that the bank has released the hold on your deposited funds after verifying their legitimacy. It means chase placed a temporary hold on your deposit, usually a check, and has now. This is a much bigger issue for folks who can't rely on using credit or a personal loan to cover themselves until their funds are available.

:max_bytes(150000):strip_icc()/funds-availability-315448-Final-5c58582d46e0fb0001c08aee.png)