Citibank On Deposit Vs Available Now

Citibank On Deposit Vs Available Now - You don't have to get to the bank or even the atm to deposit funds. Citi offers fixed rate, no penalty and step up cds in various term lengths. After transferring, it says the money will be available in 3 business days even though the funds have left my other account already. Deposits of $5,000 or less usually clear within 3 business days. Once funds are available, you may withdraw the funds in cash or use them to pay checks and other items. Deposits of more than $5,000 usually take 4 business days to. In some cases, we may place longer. Citi bank's mobile deposit feature offers convenience, but understanding the common scenarios that affect fund availability is crucial. All three cds require a $500 minimum deposit. $30k in deposits is usually reserved for higher end accounts that offer free atm usage and other reduced fee bank.

$30k in deposits is usually reserved for higher end accounts that offer free atm usage and other reduced fee bank. Citi bank's mobile deposit feature offers convenience, but understanding the common scenarios that affect fund availability is crucial. Deposits of $5,000 or less usually clear within 3 business days. Citi offers fixed rate, no penalty and step up cds in various term lengths. Once funds are available, you may withdraw the funds in cash or use them to pay checks and other items. After transferring, it says the money will be available in 3 business days even though the funds have left my other account already. All three cds require a $500 minimum deposit. Make a deposit without making a trip to the bank. Deposits of more than $5,000 usually take 4 business days to. You don't have to get to the bank or even the atm to deposit funds.

After transferring, it says the money will be available in 3 business days even though the funds have left my other account already. Citi bank's mobile deposit feature offers convenience, but understanding the common scenarios that affect fund availability is crucial. You don't have to get to the bank or even the atm to deposit funds. In some cases, we may place longer. Deposits of $5,000 or less usually clear within 3 business days. Deposits of more than $5,000 usually take 4 business days to. Make a deposit without making a trip to the bank. Once funds are available, you may withdraw the funds in cash or use them to pay checks and other items. Citi offers fixed rate, no penalty and step up cds in various term lengths. All three cds require a $500 minimum deposit.

How To Find CITI Bank Direct Deposit Form 🔴 YouTube

Citi offers fixed rate, no penalty and step up cds in various term lengths. Deposits of $5,000 or less usually clear within 3 business days. Citi bank's mobile deposit feature offers convenience, but understanding the common scenarios that affect fund availability is crucial. $30k in deposits is usually reserved for higher end accounts that offer free atm usage and other.

How to Find Out Card Withdrawal Limit of Citibank Daily Purchase and

Citi bank's mobile deposit feature offers convenience, but understanding the common scenarios that affect fund availability is crucial. All three cds require a $500 minimum deposit. Once funds are available, you may withdraw the funds in cash or use them to pay checks and other items. After transferring, it says the money will be available in 3 business days even.

Which Banks Have the Best Time Deposit Rates

After transferring, it says the money will be available in 3 business days even though the funds have left my other account already. Make a deposit without making a trip to the bank. Citi bank's mobile deposit feature offers convenience, but understanding the common scenarios that affect fund availability is crucial. You don't have to get to the bank or.

Citibank Login

Once funds are available, you may withdraw the funds in cash or use them to pay checks and other items. All three cds require a $500 minimum deposit. $30k in deposits is usually reserved for higher end accounts that offer free atm usage and other reduced fee bank. After transferring, it says the money will be available in 3 business.

20 banks with the most deposits American Banker

Deposits of more than $5,000 usually take 4 business days to. Make a deposit without making a trip to the bank. Citi bank's mobile deposit feature offers convenience, but understanding the common scenarios that affect fund availability is crucial. Deposits of $5,000 or less usually clear within 3 business days. $30k in deposits is usually reserved for higher end accounts.

Citi Up To 2,000 Personal Checking/Savings Bonus Available

Deposits of more than $5,000 usually take 4 business days to. Once funds are available, you may withdraw the funds in cash or use them to pay checks and other items. Citi offers fixed rate, no penalty and step up cds in various term lengths. After transferring, it says the money will be available in 3 business days even though.

How to Deposit Citibank Mobile Check Deposit step by step YouTube

After transferring, it says the money will be available in 3 business days even though the funds have left my other account already. Citi bank's mobile deposit feature offers convenience, but understanding the common scenarios that affect fund availability is crucial. All three cds require a $500 minimum deposit. Once funds are available, you may withdraw the funds in cash.

How To Deposit A Check Online Citibank (How To Complete Mobile Check

Deposits of more than $5,000 usually take 4 business days to. After transferring, it says the money will be available in 3 business days even though the funds have left my other account already. You don't have to get to the bank or even the atm to deposit funds. Citi bank's mobile deposit feature offers convenience, but understanding the common.

Citibank CD Rates For June 2025

$30k in deposits is usually reserved for higher end accounts that offer free atm usage and other reduced fee bank. Deposits of $5,000 or less usually clear within 3 business days. Make a deposit without making a trip to the bank. You don't have to get to the bank or even the atm to deposit funds. All three cds require.

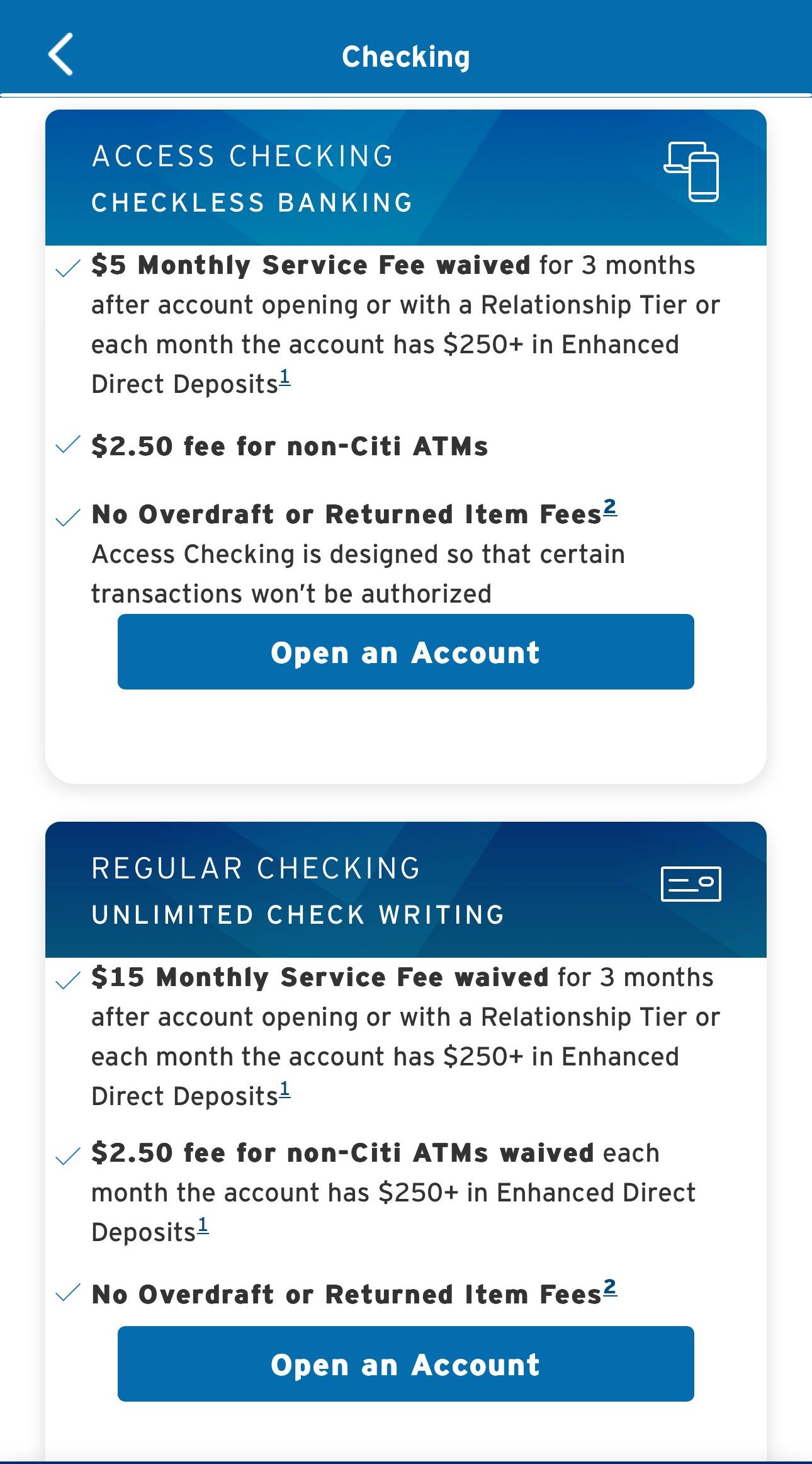

Citi Access Account vs Citi Regular Banking How They Compare?

All three cds require a $500 minimum deposit. Deposits of $5,000 or less usually clear within 3 business days. Deposits of more than $5,000 usually take 4 business days to. Once funds are available, you may withdraw the funds in cash or use them to pay checks and other items. Citi offers fixed rate, no penalty and step up cds.

You Don't Have To Get To The Bank Or Even The Atm To Deposit Funds.

Citi offers fixed rate, no penalty and step up cds in various term lengths. $30k in deposits is usually reserved for higher end accounts that offer free atm usage and other reduced fee bank. Deposits of more than $5,000 usually take 4 business days to. Citi bank's mobile deposit feature offers convenience, but understanding the common scenarios that affect fund availability is crucial.

In Some Cases, We May Place Longer.

Once funds are available, you may withdraw the funds in cash or use them to pay checks and other items. After transferring, it says the money will be available in 3 business days even though the funds have left my other account already. Make a deposit without making a trip to the bank. Deposits of $5,000 or less usually clear within 3 business days.