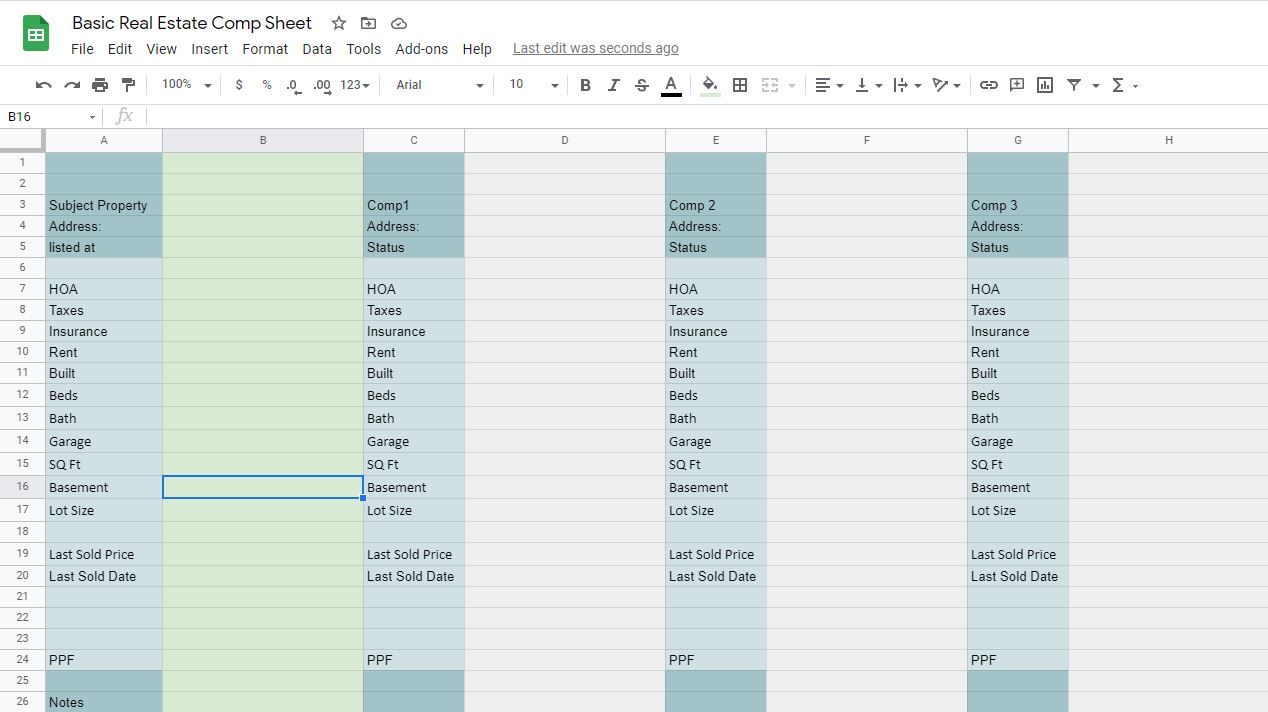

Comp Sheet

Comp Sheet - Comparable company analysis is a relative valuation method in which a company’s value is derived from comparisons to the current stock prices of similar companies in the market. Comparable company analysis is valuable for determining a company's fair value. To value a company with cca, follow these steps: Comparable company analysis (or “comps” for short) is a valuation methodology that looks at ratios of. Comps are valuable metrics used by retailers to identify the profitability of a current store. When used to gauge the performance of retail operations, comps is used in the context. Select an appropriate set of comparable public companies. Enter your name and email in the form below and download the free template now! Determine the metrics and multiples you want to use. It involves identifying similar companies, selecting appropriate valuation methods, and creating a.

Determine the metrics and multiples you want to use. Enter your name and email in the form below and download the free template now! When used to gauge the performance of retail operations, comps is used in the context. Comparable company analysis is a relative valuation method in which a company’s value is derived from comparisons to the current stock prices of similar companies in the market. Comparable company analysis is valuable for determining a company's fair value. Comparable company analysis (or “comps” for short) is a valuation methodology that looks at ratios of. Comps are valuable metrics used by retailers to identify the profitability of a current store. Select an appropriate set of comparable public companies. It involves identifying similar companies, selecting appropriate valuation methods, and creating a. To value a company with cca, follow these steps:

Enter your name and email in the form below and download the free template now! Comparable company analysis is a relative valuation method in which a company’s value is derived from comparisons to the current stock prices of similar companies in the market. Select an appropriate set of comparable public companies. It involves identifying similar companies, selecting appropriate valuation methods, and creating a. Comparable company analysis is valuable for determining a company's fair value. To value a company with cca, follow these steps: Comps are valuable metrics used by retailers to identify the profitability of a current store. When used to gauge the performance of retail operations, comps is used in the context. Determine the metrics and multiples you want to use. Comparable company analysis (or “comps” for short) is a valuation methodology that looks at ratios of.

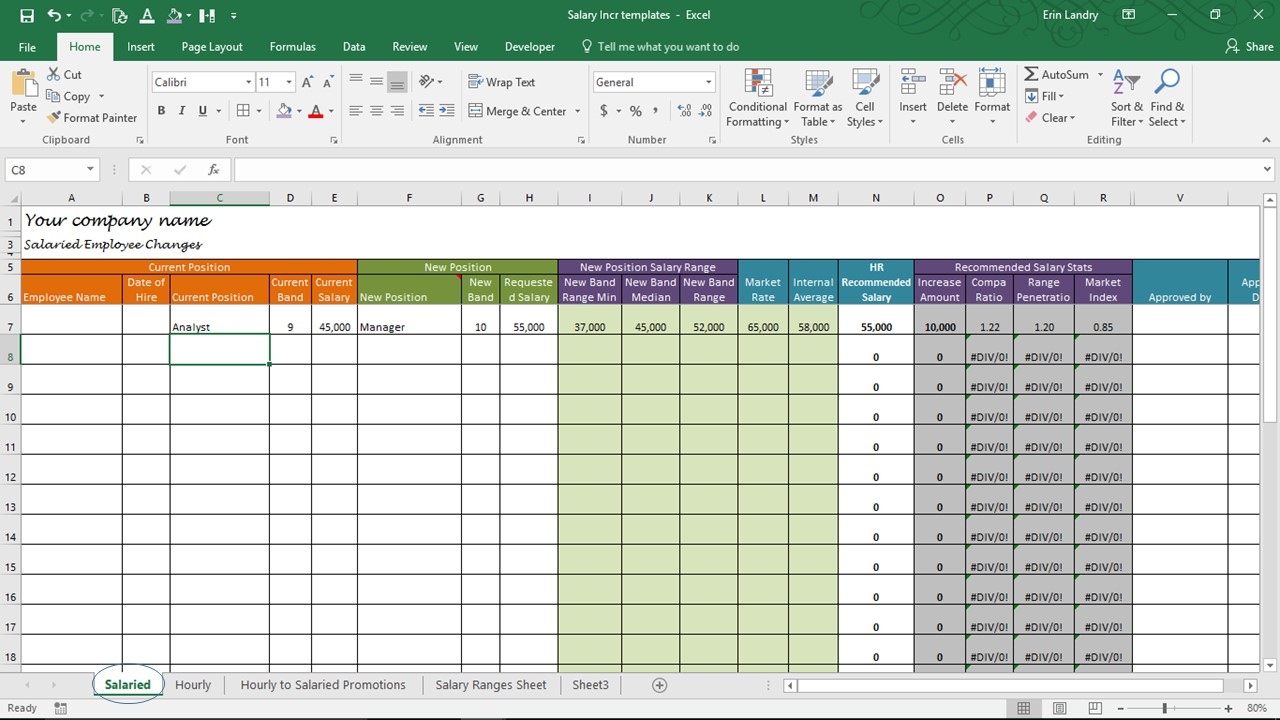

Compensation Sheet Template

Enter your name and email in the form below and download the free template now! Comparable company analysis is valuable for determining a company's fair value. Comparable company analysis (or “comps” for short) is a valuation methodology that looks at ratios of. Comparable company analysis is a relative valuation method in which a company’s value is derived from comparisons to.

How To Run Comps in Real Estate On Your Own For Free

Comps are valuable metrics used by retailers to identify the profitability of a current store. When used to gauge the performance of retail operations, comps is used in the context. It involves identifying similar companies, selecting appropriate valuation methods, and creating a. Enter your name and email in the form below and download the free template now! Select an appropriate.

Compensation Sheet Template

It involves identifying similar companies, selecting appropriate valuation methods, and creating a. Comparable company analysis is a relative valuation method in which a company’s value is derived from comparisons to the current stock prices of similar companies in the market. Comparable company analysis (or “comps” for short) is a valuation methodology that looks at ratios of. Select an appropriate set.

Anatomy Of A Home Appraisal Report What Do The Differ vrogue.co

Comparable company analysis is valuable for determining a company's fair value. To value a company with cca, follow these steps: It involves identifying similar companies, selecting appropriate valuation methods, and creating a. When used to gauge the performance of retail operations, comps is used in the context. Select an appropriate set of comparable public companies.

Comp Card Templates Free Beautiful Tracking Spreadsheet Time for

It involves identifying similar companies, selecting appropriate valuation methods, and creating a. Comparable company analysis is valuable for determining a company's fair value. Select an appropriate set of comparable public companies. Comps are valuable metrics used by retailers to identify the profitability of a current store. Comparable company analysis (or “comps” for short) is a valuation methodology that looks at.

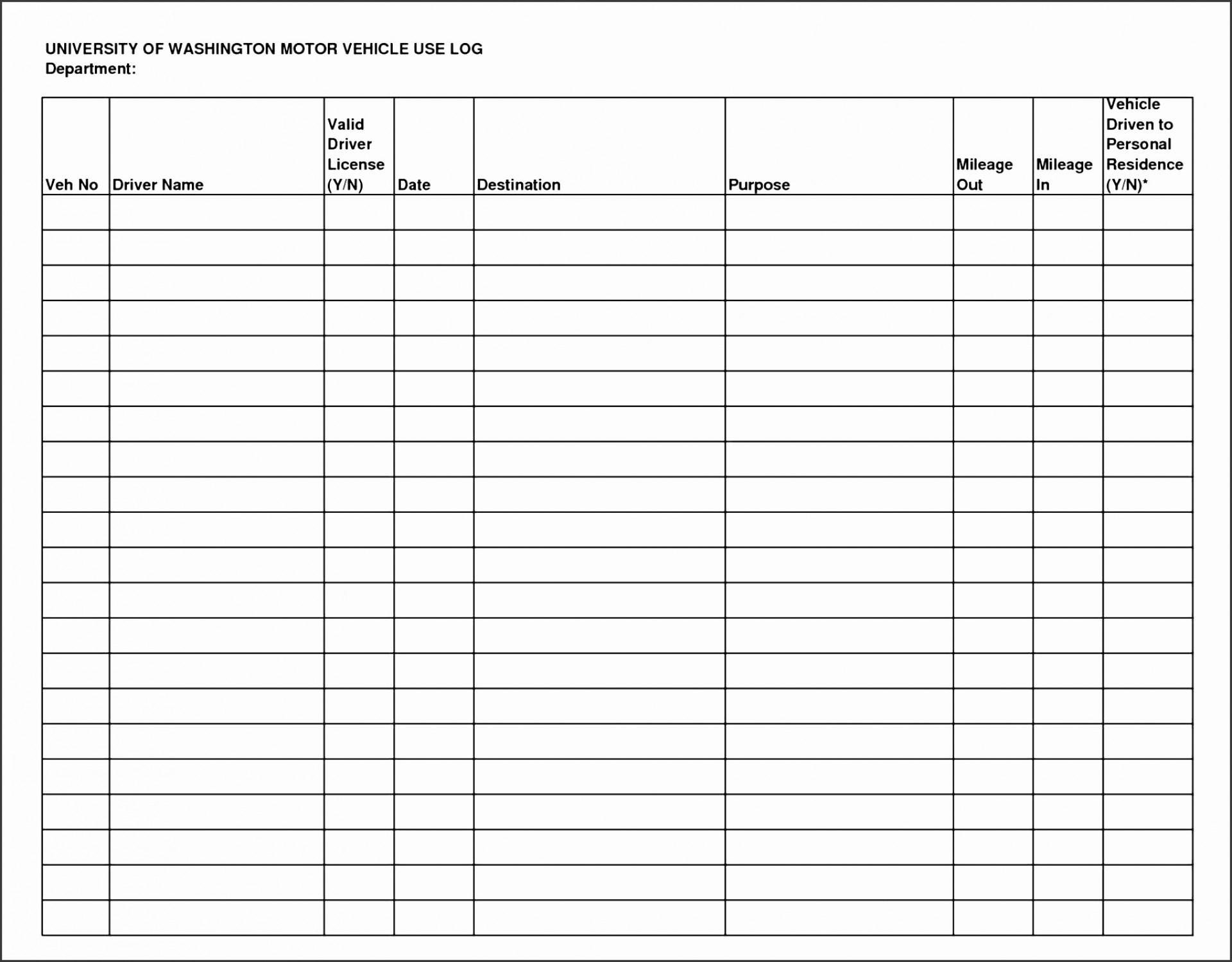

Workers Compensation Excel Spreadsheet —

Enter your name and email in the form below and download the free template now! Determine the metrics and multiples you want to use. It involves identifying similar companies, selecting appropriate valuation methods, and creating a. To value a company with cca, follow these steps: Select an appropriate set of comparable public companies.

Compensation Spreadsheet Template inside Salary Increase Template Excel

It involves identifying similar companies, selecting appropriate valuation methods, and creating a. Comparable company analysis is a relative valuation method in which a company’s value is derived from comparisons to the current stock prices of similar companies in the market. When used to gauge the performance of retail operations, comps is used in the context. Determine the metrics and multiples.

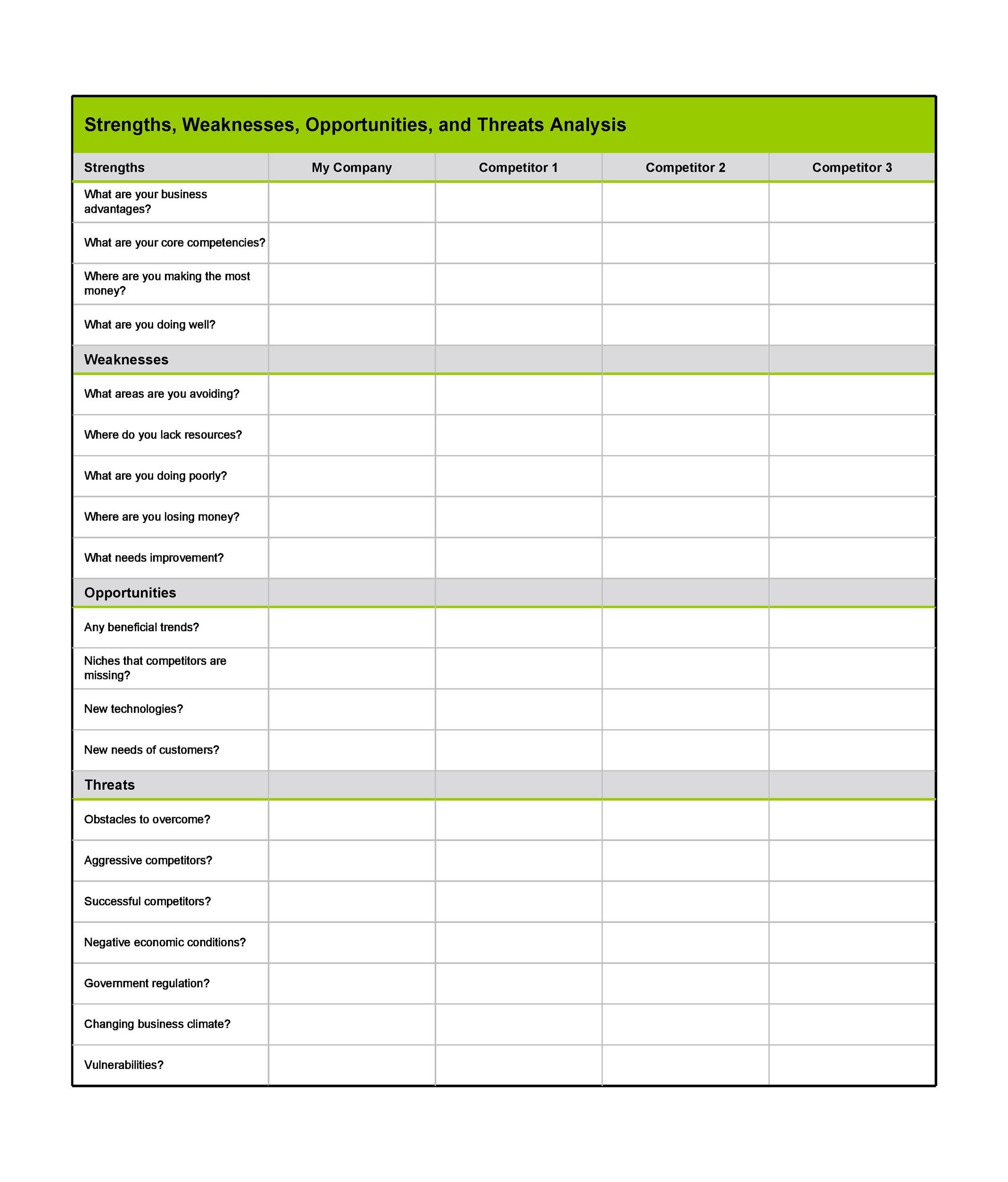

Competitive Analysis Template Word Microsoft Template Free Word Template

Comparable company analysis (or “comps” for short) is a valuation methodology that looks at ratios of. Comps are valuable metrics used by retailers to identify the profitability of a current store. Determine the metrics and multiples you want to use. To value a company with cca, follow these steps: Enter your name and email in the form below and download.

Blues comp Sheet music for Piano, Violin, Drum Set

Comparable company analysis is valuable for determining a company's fair value. Comps are valuable metrics used by retailers to identify the profitability of a current store. Comparable company analysis (or “comps” for short) is a valuation methodology that looks at ratios of. To value a company with cca, follow these steps: Comparable company analysis is a relative valuation method in.

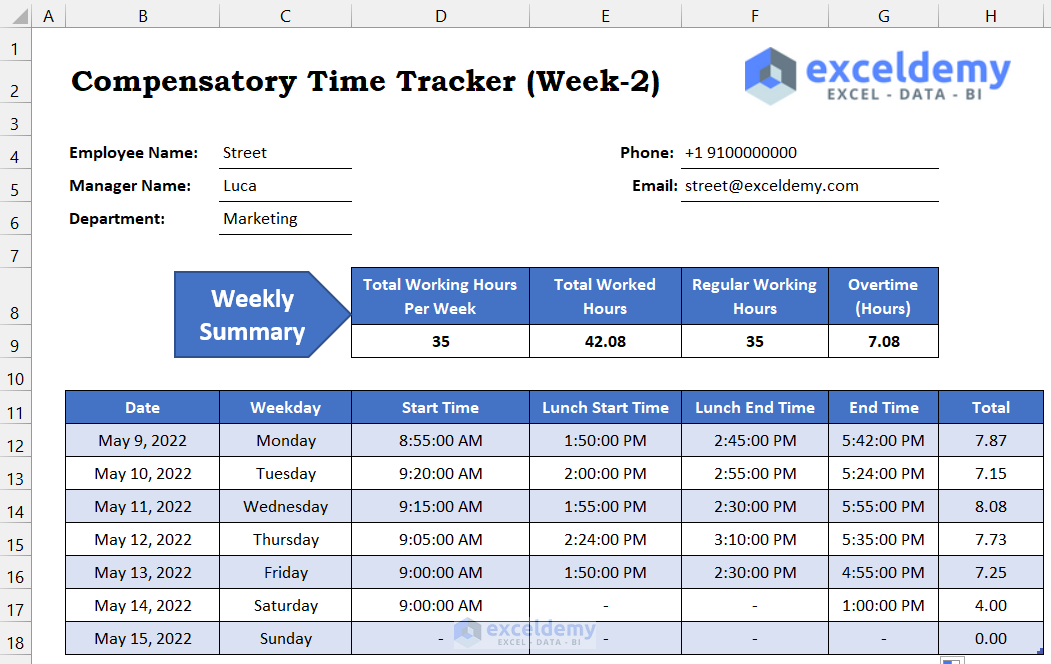

How to Track Comp Time in Excel (with Quick Steps) ExcelDemy

Comparable company analysis is valuable for determining a company's fair value. When used to gauge the performance of retail operations, comps is used in the context. Determine the metrics and multiples you want to use. Comparable company analysis is a relative valuation method in which a company’s value is derived from comparisons to the current stock prices of similar companies.

Comps Are Valuable Metrics Used By Retailers To Identify The Profitability Of A Current Store.

Determine the metrics and multiples you want to use. To value a company with cca, follow these steps: Comparable company analysis is a relative valuation method in which a company’s value is derived from comparisons to the current stock prices of similar companies in the market. Comparable company analysis is valuable for determining a company's fair value.

Select An Appropriate Set Of Comparable Public Companies.

Enter your name and email in the form below and download the free template now! Comparable company analysis (or “comps” for short) is a valuation methodology that looks at ratios of. It involves identifying similar companies, selecting appropriate valuation methods, and creating a. When used to gauge the performance of retail operations, comps is used in the context.