Cost Of Good Available For Sale Formula

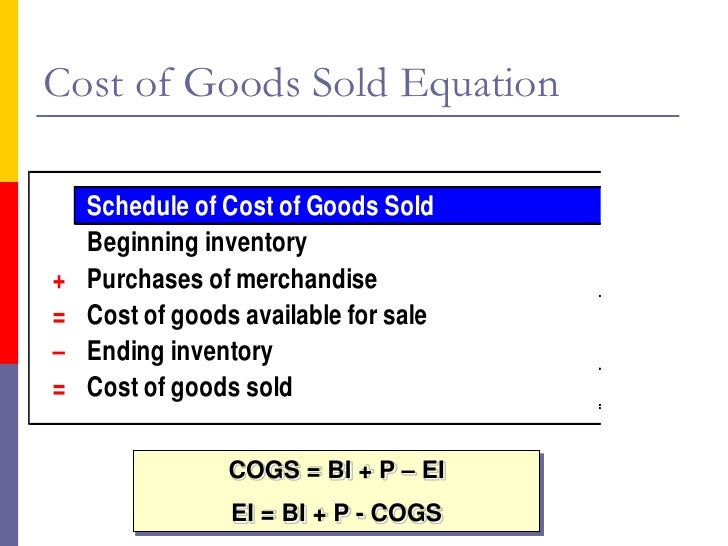

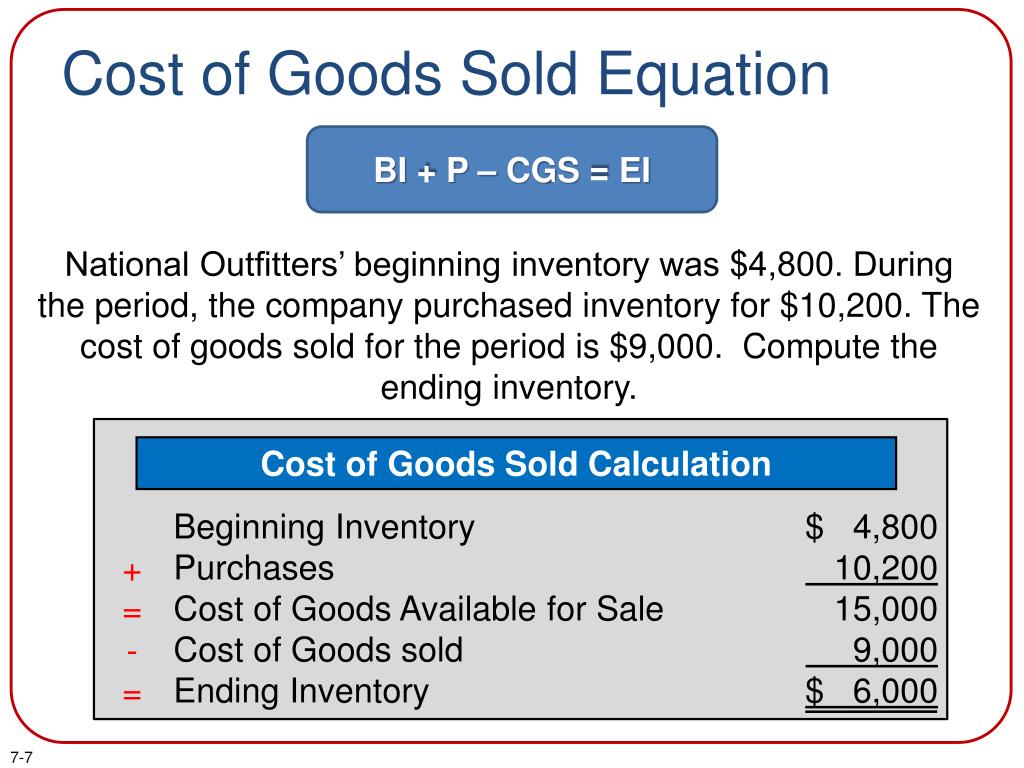

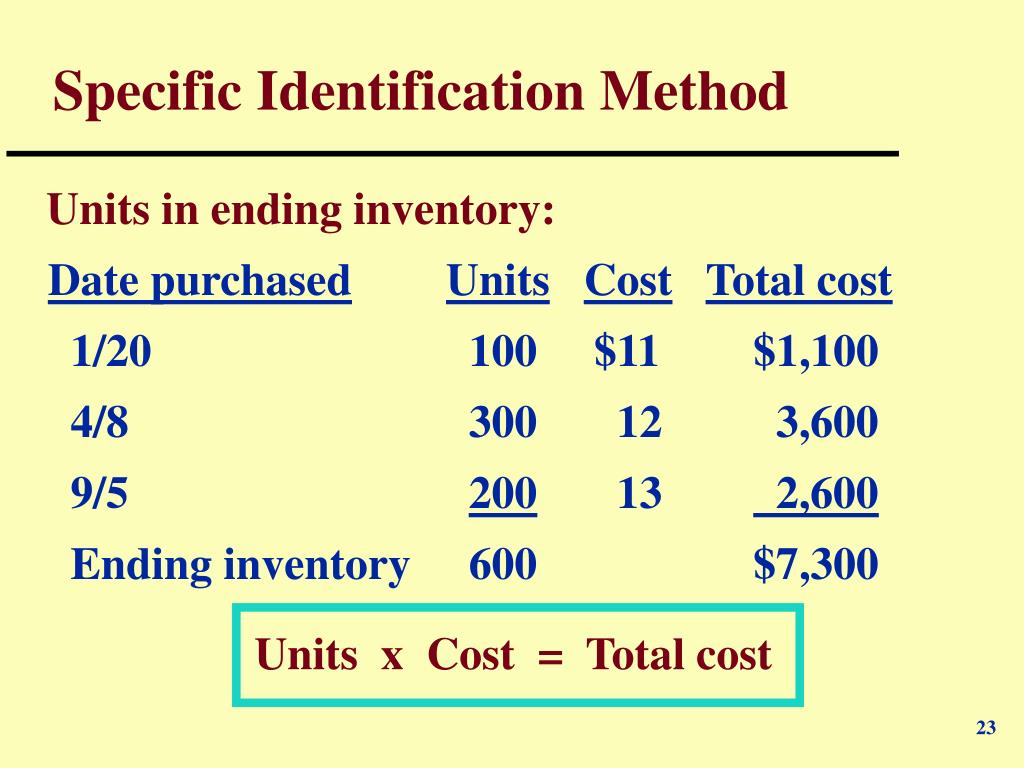

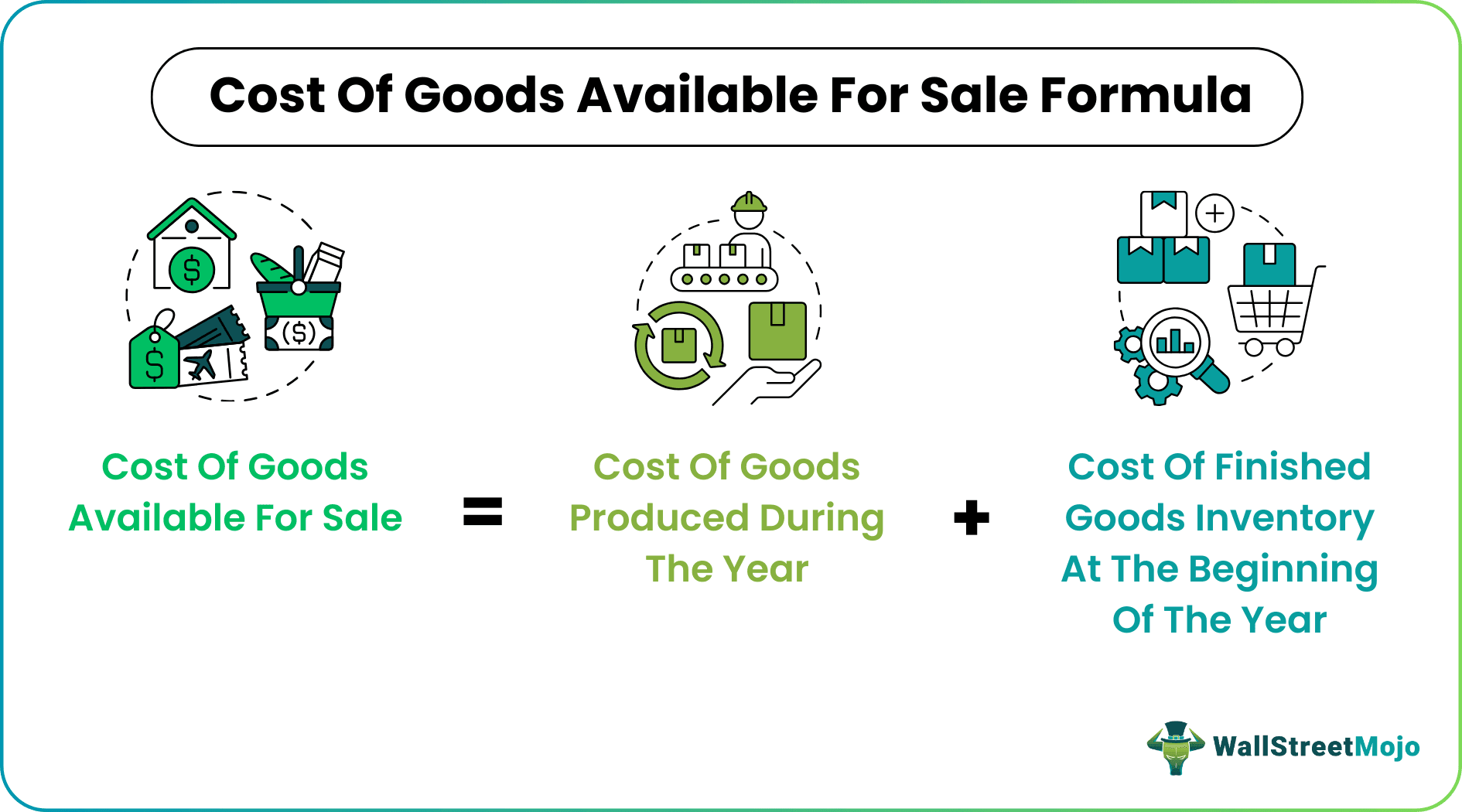

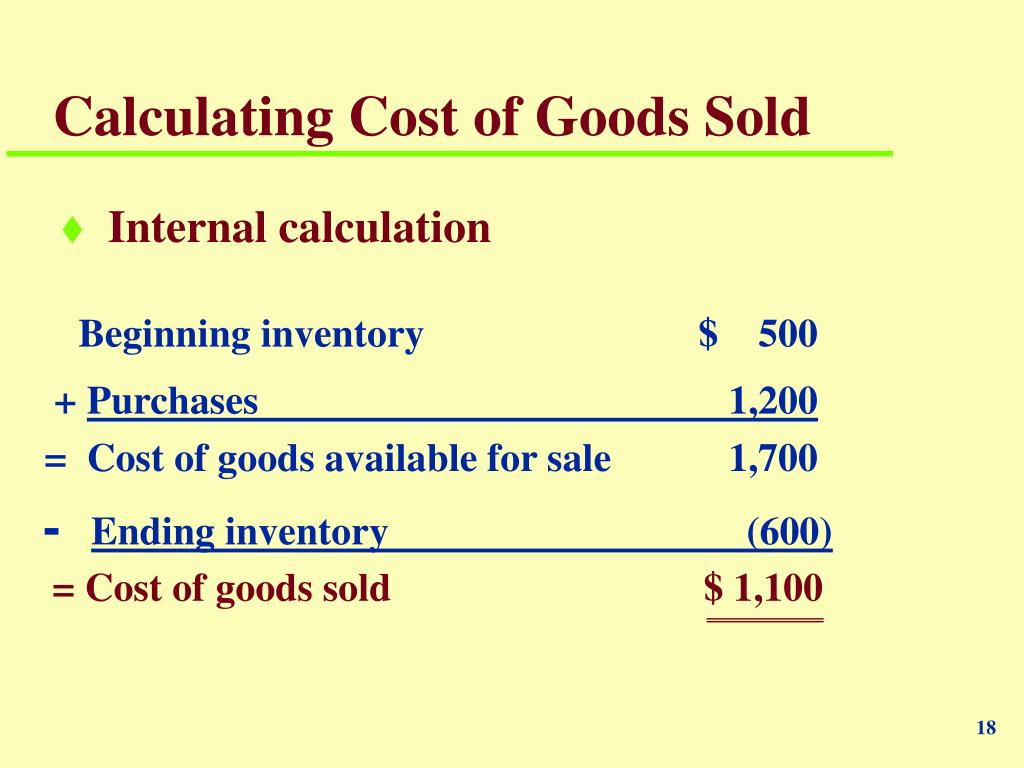

Cost Of Good Available For Sale Formula - To find out how much was available for sale during the year, we follow a simple formula: [1] beginning inventory (at the start of accounting period) + purchases (within the accounting period) + production (within the. Starting inventory plus purchases minus ending. The cost of goods available for sale is divided by the total number of units available for sale, resulting in a weighted average unit. If you’re a manufacturer, the cost of goods available includes all the money spent from production to final packaging. The calculation of the cost of goods available for sale is to add together the total of beginning sellable inventory, finished goods.

The calculation of the cost of goods available for sale is to add together the total of beginning sellable inventory, finished goods. [1] beginning inventory (at the start of accounting period) + purchases (within the accounting period) + production (within the. The cost of goods available for sale is divided by the total number of units available for sale, resulting in a weighted average unit. To find out how much was available for sale during the year, we follow a simple formula: Starting inventory plus purchases minus ending. If you’re a manufacturer, the cost of goods available includes all the money spent from production to final packaging.

If you’re a manufacturer, the cost of goods available includes all the money spent from production to final packaging. The cost of goods available for sale is divided by the total number of units available for sale, resulting in a weighted average unit. The calculation of the cost of goods available for sale is to add together the total of beginning sellable inventory, finished goods. To find out how much was available for sale during the year, we follow a simple formula: [1] beginning inventory (at the start of accounting period) + purchases (within the accounting period) + production (within the. Starting inventory plus purchases minus ending.

Chapter 7

The cost of goods available for sale is divided by the total number of units available for sale, resulting in a weighted average unit. [1] beginning inventory (at the start of accounting period) + purchases (within the accounting period) + production (within the. Starting inventory plus purchases minus ending. If you’re a manufacturer, the cost of goods available includes all.

Calculating Cost of Goods Sold for Glew

[1] beginning inventory (at the start of accounting period) + purchases (within the accounting period) + production (within the. The cost of goods available for sale is divided by the total number of units available for sale, resulting in a weighted average unit. Starting inventory plus purchases minus ending. The calculation of the cost of goods available for sale is.

PPT Chapter 7 PowerPoint Presentation, free download ID1661229

Starting inventory plus purchases minus ending. To find out how much was available for sale during the year, we follow a simple formula: [1] beginning inventory (at the start of accounting period) + purchases (within the accounting period) + production (within the. If you’re a manufacturer, the cost of goods available includes all the money spent from production to final.

PPT Chapter 7 PowerPoint Presentation, free download ID6421395

If you’re a manufacturer, the cost of goods available includes all the money spent from production to final packaging. The cost of goods available for sale is divided by the total number of units available for sale, resulting in a weighted average unit. To find out how much was available for sale during the year, we follow a simple formula:.

Cost of Goods Available for Sale (Formula, Calculation)

If you’re a manufacturer, the cost of goods available includes all the money spent from production to final packaging. To find out how much was available for sale during the year, we follow a simple formula: Starting inventory plus purchases minus ending. The cost of goods available for sale is divided by the total number of units available for sale,.

Cost of Goods Available For Sale Calculator Finance Calculator iCa

If you’re a manufacturer, the cost of goods available includes all the money spent from production to final packaging. Starting inventory plus purchases minus ending. To find out how much was available for sale during the year, we follow a simple formula: [1] beginning inventory (at the start of accounting period) + purchases (within the accounting period) + production (within.

How To Calculate Ending Inventory Without Cost Of Goods Sold If you

To find out how much was available for sale during the year, we follow a simple formula: If you’re a manufacturer, the cost of goods available includes all the money spent from production to final packaging. [1] beginning inventory (at the start of accounting period) + purchases (within the accounting period) + production (within the. Starting inventory plus purchases minus.

Cost of Goods Available for Sale in a Perpetual Inventory System YouTube

If you’re a manufacturer, the cost of goods available includes all the money spent from production to final packaging. The cost of goods available for sale is divided by the total number of units available for sale, resulting in a weighted average unit. The calculation of the cost of goods available for sale is to add together the total of.

Solved M76 Calculating Cost of Goods Available for Sale,

[1] beginning inventory (at the start of accounting period) + purchases (within the accounting period) + production (within the. The calculation of the cost of goods available for sale is to add together the total of beginning sellable inventory, finished goods. To find out how much was available for sale during the year, we follow a simple formula: The cost.

PPT Chapter 7 PowerPoint Presentation, free download ID6421395

To find out how much was available for sale during the year, we follow a simple formula: Starting inventory plus purchases minus ending. If you’re a manufacturer, the cost of goods available includes all the money spent from production to final packaging. The calculation of the cost of goods available for sale is to add together the total of beginning.

[1] Beginning Inventory (At The Start Of Accounting Period) + Purchases (Within The Accounting Period) + Production (Within The.

The calculation of the cost of goods available for sale is to add together the total of beginning sellable inventory, finished goods. To find out how much was available for sale during the year, we follow a simple formula: If you’re a manufacturer, the cost of goods available includes all the money spent from production to final packaging. Starting inventory plus purchases minus ending.