Distraint Warrant Colorado

Distraint Warrant Colorado - A distraint warrant is a document served by the sheriff that indicates the amount of overdue taxes. Distraint warrant a warrant for distraint is a legal document giving the department and its agents the power to collect delinquent taxes or seize. Whenever a distraint warrant is issued, it shall be served by the sheriff or a commissioned deputy or, at the discretion of the sheriff, by a private. If any person, firm, or corporation liable for the payment of any tax covered by this article has repeatedly failed, neglected, or refused to pay. When necessary, business property may be seized under a distraint warrant issued by the manager of finance and sold at auction to. At any time after the first day of october, the treasurer shall enforce collection of delinquent taxes on. A colorado distraint warrant is part of the property tax collection mechanism in colorado. Distraint warrants are a legally. The removal or destruction of any property. Taxpayers facing a distraint warrant in colorado have several avenues to challenge or mitigate its effects.

When necessary, business property may be seized under a distraint warrant issued by the manager of finance and sold at auction to. A distraint warrant is a document served by the sheriff that indicates the amount of overdue taxes. A colorado distraint warrant is part of the property tax collection mechanism in colorado. If any person, firm, or corporation liable for the payment of any tax covered by this article has repeatedly failed, neglected, or refused to pay. The removal or destruction of any property. Taxpayers facing a distraint warrant in colorado have several avenues to challenge or mitigate its effects. At any time after the first day of october, the treasurer shall enforce collection of delinquent taxes on. Distraint warrant a warrant for distraint is a legal document giving the department and its agents the power to collect delinquent taxes or seize. Whenever a distraint warrant is issued, it shall be served by the sheriff or a commissioned deputy or, at the discretion of the sheriff, by a private. Distraint warrants are a legally.

A distraint warrant is a document served by the sheriff that indicates the amount of overdue taxes. Taxpayers facing a distraint warrant in colorado have several avenues to challenge or mitigate its effects. A colorado distraint warrant is part of the property tax collection mechanism in colorado. The removal or destruction of any property. When necessary, business property may be seized under a distraint warrant issued by the manager of finance and sold at auction to. If any person, firm, or corporation liable for the payment of any tax covered by this article has repeatedly failed, neglected, or refused to pay. Distraint warrant a warrant for distraint is a legal document giving the department and its agents the power to collect delinquent taxes or seize. At any time after the first day of october, the treasurer shall enforce collection of delinquent taxes on. Distraint warrants are a legally. Whenever a distraint warrant is issued, it shall be served by the sheriff or a commissioned deputy or, at the discretion of the sheriff, by a private.

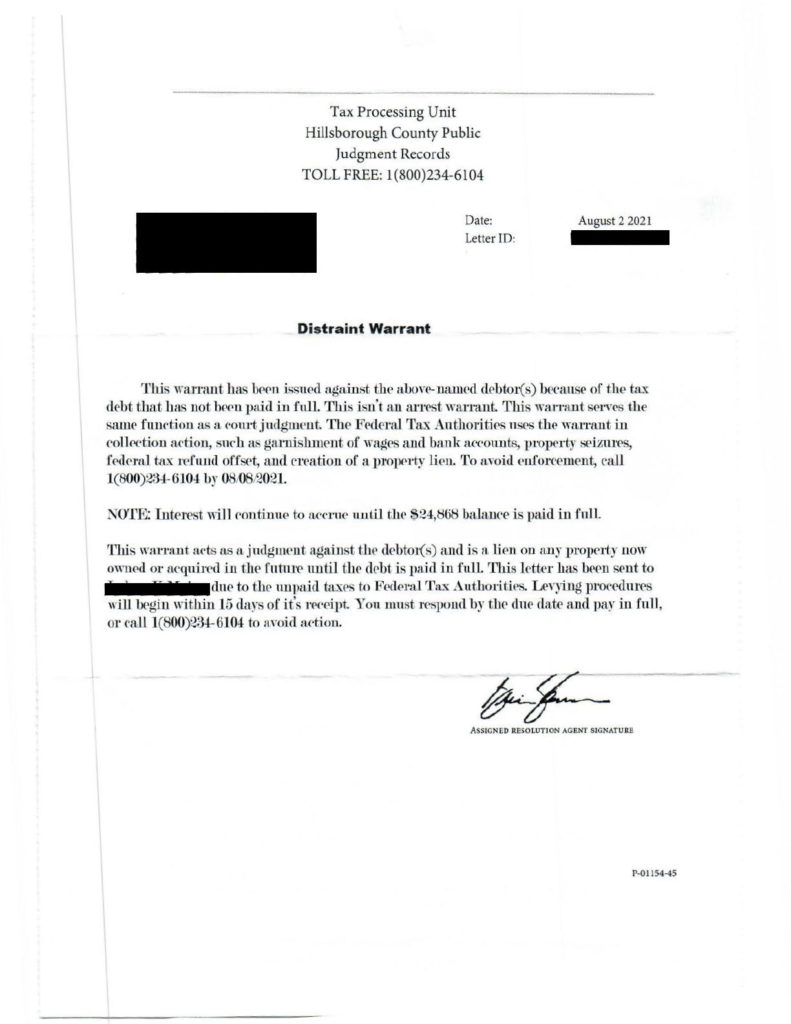

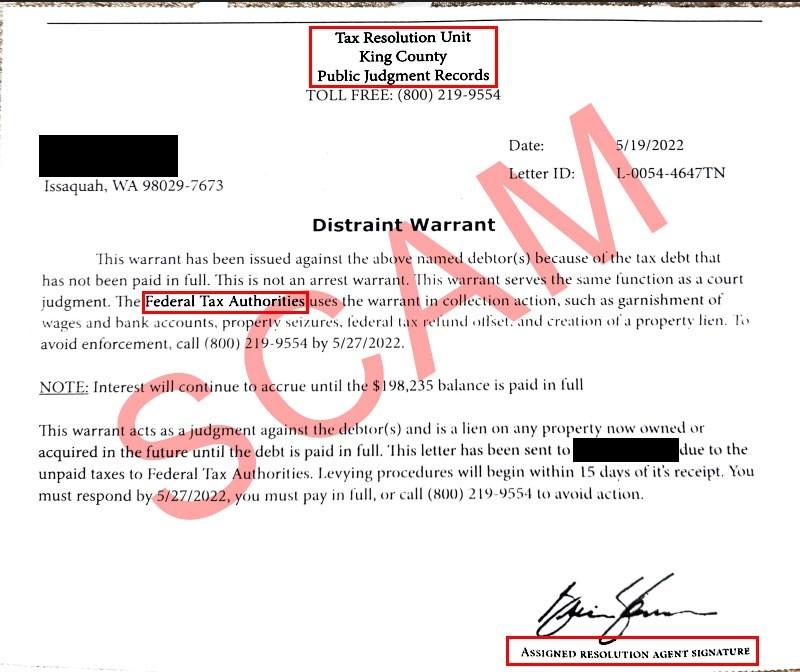

Anatomy of a Mail Fraud Scam The Distraint Warrant Letter

A distraint warrant is a document served by the sheriff that indicates the amount of overdue taxes. Distraint warrant a warrant for distraint is a legal document giving the department and its agents the power to collect delinquent taxes or seize. When necessary, business property may be seized under a distraint warrant issued by the manager of finance and sold.

to Jefferson County, New York Scam Alerts

If any person, firm, or corporation liable for the payment of any tax covered by this article has repeatedly failed, neglected, or refused to pay. Taxpayers facing a distraint warrant in colorado have several avenues to challenge or mitigate its effects. Distraint warrant a warrant for distraint is a legal document giving the department and its agents the power to.

SSS Guideline On The Warrants of Distraint Levy and or Garnishment PDF

The removal or destruction of any property. At any time after the first day of october, the treasurer shall enforce collection of delinquent taxes on. Distraint warrant a warrant for distraint is a legal document giving the department and its agents the power to collect delinquent taxes or seize. Taxpayers facing a distraint warrant in colorado have several avenues to.

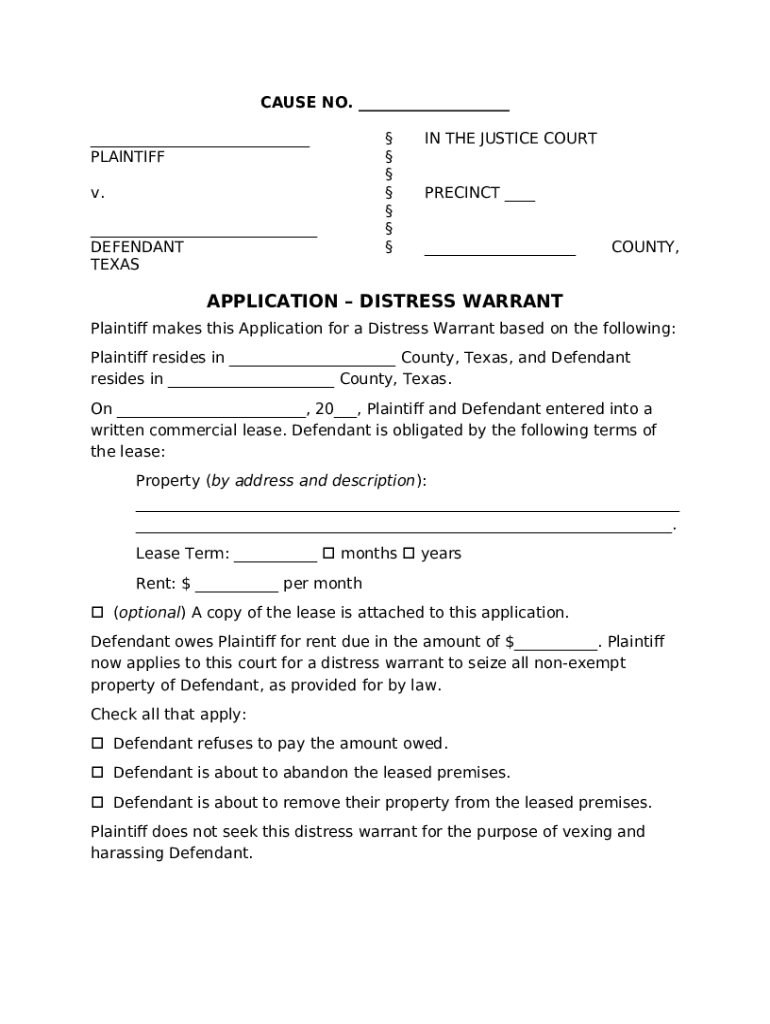

citation (distress warrant) Texas State University Doc Template

At any time after the first day of october, the treasurer shall enforce collection of delinquent taxes on. A distraint warrant is a document served by the sheriff that indicates the amount of overdue taxes. If any person, firm, or corporation liable for the payment of any tax covered by this article has repeatedly failed, neglected, or refused to pay..

Judgement Records Search

Distraint warrant a warrant for distraint is a legal document giving the department and its agents the power to collect delinquent taxes or seize. If any person, firm, or corporation liable for the payment of any tax covered by this article has repeatedly failed, neglected, or refused to pay. Whenever a distraint warrant is issued, it shall be served by.

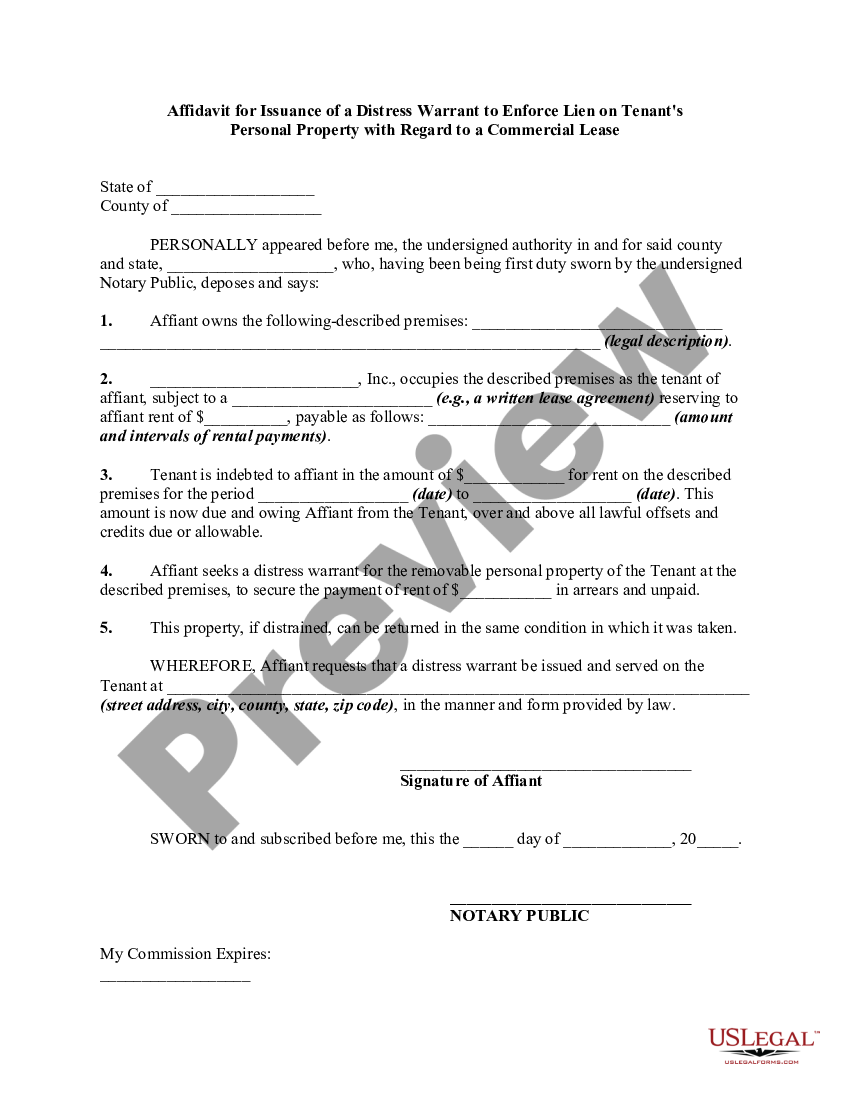

Affidavit for Issuance of a Distress Warrant to Enforce Lien on Tenant

The removal or destruction of any property. Distraint warrants are a legally. Distraint warrant a warrant for distraint is a legal document giving the department and its agents the power to collect delinquent taxes or seize. A distraint warrant is a document served by the sheriff that indicates the amount of overdue taxes. A colorado distraint warrant is part of.

Distress warrant Fill out & sign online DocHub

The removal or destruction of any property. Whenever a distraint warrant is issued, it shall be served by the sheriff or a commissioned deputy or, at the discretion of the sheriff, by a private. A distraint warrant is a document served by the sheriff that indicates the amount of overdue taxes. A colorado distraint warrant is part of the property.

What is a Distress Warrant? YouTube

The removal or destruction of any property. At any time after the first day of october, the treasurer shall enforce collection of delinquent taxes on. A colorado distraint warrant is part of the property tax collection mechanism in colorado. Whenever a distraint warrant is issued, it shall be served by the sheriff or a commissioned deputy or, at the discretion.

Scam Alert Fraudulent Tax Letters Claiming "Distraint Warrant

Whenever a distraint warrant is issued, it shall be served by the sheriff or a commissioned deputy or, at the discretion of the sheriff, by a private. If any person, firm, or corporation liable for the payment of any tax covered by this article has repeatedly failed, neglected, or refused to pay. At any time after the first day of.

What to Do if You Receive a BIR Warrant of Distraint and Levy A Stepby

When necessary, business property may be seized under a distraint warrant issued by the manager of finance and sold at auction to. At any time after the first day of october, the treasurer shall enforce collection of delinquent taxes on. Whenever a distraint warrant is issued, it shall be served by the sheriff or a commissioned deputy or, at the.

A Distraint Warrant Is A Document Served By The Sheriff That Indicates The Amount Of Overdue Taxes.

The removal or destruction of any property. Distraint warrant a warrant for distraint is a legal document giving the department and its agents the power to collect delinquent taxes or seize. Distraint warrants are a legally. Taxpayers facing a distraint warrant in colorado have several avenues to challenge or mitigate its effects.

Whenever A Distraint Warrant Is Issued, It Shall Be Served By The Sheriff Or A Commissioned Deputy Or, At The Discretion Of The Sheriff, By A Private.

A colorado distraint warrant is part of the property tax collection mechanism in colorado. If any person, firm, or corporation liable for the payment of any tax covered by this article has repeatedly failed, neglected, or refused to pay. At any time after the first day of october, the treasurer shall enforce collection of delinquent taxes on. When necessary, business property may be seized under a distraint warrant issued by the manager of finance and sold at auction to.