Does Retained Earnings Go On The Balance Sheet

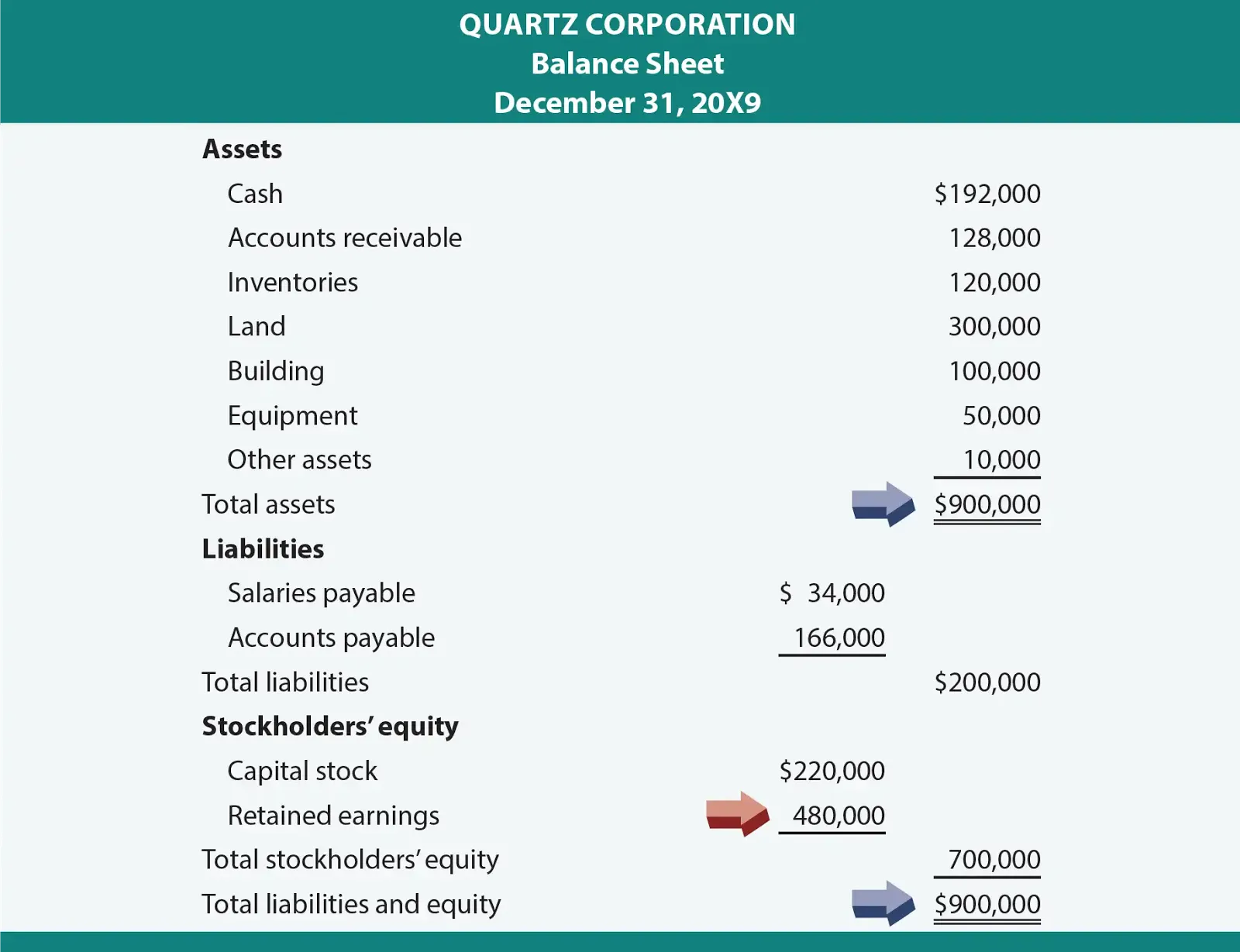

Does Retained Earnings Go On The Balance Sheet - A statement of retained earnings may appear as a separate document, or it can be included on a company’s balance sheet or income statement. The retained earnings metric measures a company's total. Retained earnings are reported on the balance sheet under the shareholder’s equity section at the end of each accounting period. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds issued as dividends to shareholders. To calculate re, the beginning re balance is added to the net income or reduced by a net loss and then. Shareholders, analysts and potential investors use the statement to assess a. Retained earnings can typically be found on a company’s balance sheet in the shareholders’ equity section. Retained earnings are found in the equity section of a company’s balance sheet, highlighting their role as a component of shareholders’ equity.

Shareholders, analysts and potential investors use the statement to assess a. A statement of retained earnings may appear as a separate document, or it can be included on a company’s balance sheet or income statement. The retained earnings metric measures a company's total. Retained earnings are found in the equity section of a company’s balance sheet, highlighting their role as a component of shareholders’ equity. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds issued as dividends to shareholders. Retained earnings can typically be found on a company’s balance sheet in the shareholders’ equity section. Retained earnings are reported on the balance sheet under the shareholder’s equity section at the end of each accounting period. To calculate re, the beginning re balance is added to the net income or reduced by a net loss and then.

Shareholders, analysts and potential investors use the statement to assess a. Retained earnings are found in the equity section of a company’s balance sheet, highlighting their role as a component of shareholders’ equity. Retained earnings can typically be found on a company’s balance sheet in the shareholders’ equity section. Retained earnings are reported on the balance sheet under the shareholder’s equity section at the end of each accounting period. The retained earnings metric measures a company's total. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds issued as dividends to shareholders. To calculate re, the beginning re balance is added to the net income or reduced by a net loss and then. A statement of retained earnings may appear as a separate document, or it can be included on a company’s balance sheet or income statement.

Retained Earnings Explained Definition, Formula, & Examples

The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds issued as dividends to shareholders. To calculate re, the beginning re balance is added to the net income or reduced by a net loss and then. The retained earnings metric measures a company's total. Shareholders, analysts and potential investors.

Retained Earnings What Are They, and How Do You Calculate Them?

The retained earnings metric measures a company's total. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds issued as dividends to shareholders. To calculate re, the beginning re balance is added to the net income or reduced by a net loss and then. Retained earnings are reported on.

Statement Of Retained Earnings Common Stock

Retained earnings can typically be found on a company’s balance sheet in the shareholders’ equity section. The retained earnings metric measures a company's total. Retained earnings are found in the equity section of a company’s balance sheet, highlighting their role as a component of shareholders’ equity. The retained earnings on the balance sheet refer to the cumulative profits kept by.

Looking Good Retained Earnings Formula In Balance Sheet Difference

Retained earnings can typically be found on a company’s balance sheet in the shareholders’ equity section. Retained earnings are reported on the balance sheet under the shareholder’s equity section at the end of each accounting period. Retained earnings are found in the equity section of a company’s balance sheet, highlighting their role as a component of shareholders’ equity. A statement.

What Is Meant By Retained Earnings in Balance sheet Financial

Retained earnings can typically be found on a company’s balance sheet in the shareholders’ equity section. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds issued as dividends to shareholders. Retained earnings are found in the equity section of a company’s balance sheet, highlighting their role as a.

Balance Sheet and Statement of Retained Earnings YouTube

To calculate re, the beginning re balance is added to the net income or reduced by a net loss and then. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds issued as dividends to shareholders. Retained earnings are reported on the balance sheet under the shareholder’s equity section.

What Is the Normal Balance of Retained Earnings

Retained earnings are found in the equity section of a company’s balance sheet, highlighting their role as a component of shareholders’ equity. A statement of retained earnings may appear as a separate document, or it can be included on a company’s balance sheet or income statement. Retained earnings are reported on the balance sheet under the shareholder’s equity section at.

Retained Earnings Definition, Formula, and Example

To calculate re, the beginning re balance is added to the net income or reduced by a net loss and then. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds issued as dividends to shareholders. Retained earnings are reported on the balance sheet under the shareholder’s equity section.

Looking Good Retained Earnings Formula In Balance Sheet Difference

The retained earnings metric measures a company's total. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds issued as dividends to shareholders. To calculate re, the beginning re balance is added to the net income or reduced by a net loss and then. Retained earnings can typically be.

What are Retained Earnings? Guide, Formula, and Examples

Retained earnings can typically be found on a company’s balance sheet in the shareholders’ equity section. Shareholders, analysts and potential investors use the statement to assess a. To calculate re, the beginning re balance is added to the net income or reduced by a net loss and then. A statement of retained earnings may appear as a separate document, or.

Retained Earnings Can Typically Be Found On A Company’s Balance Sheet In The Shareholders’ Equity Section.

To calculate re, the beginning re balance is added to the net income or reduced by a net loss and then. Retained earnings are found in the equity section of a company’s balance sheet, highlighting their role as a component of shareholders’ equity. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds issued as dividends to shareholders. A statement of retained earnings may appear as a separate document, or it can be included on a company’s balance sheet or income statement.

Shareholders, Analysts And Potential Investors Use The Statement To Assess A.

Retained earnings are reported on the balance sheet under the shareholder’s equity section at the end of each accounting period. The retained earnings metric measures a company's total.