Funds Availability Reg Cc

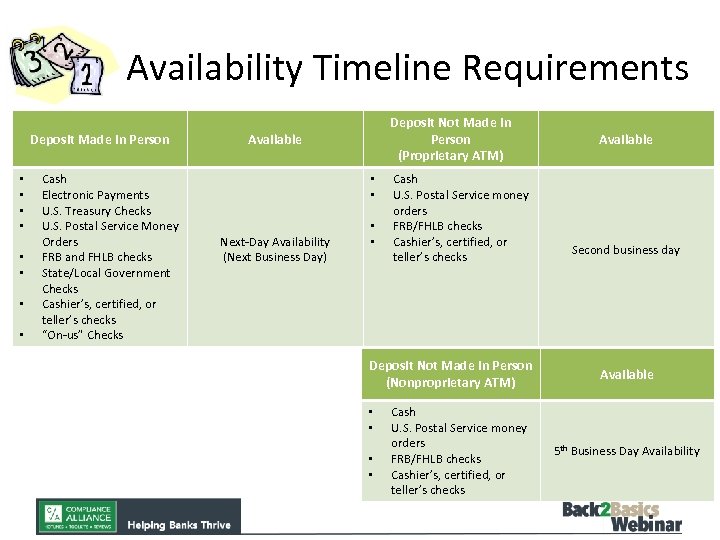

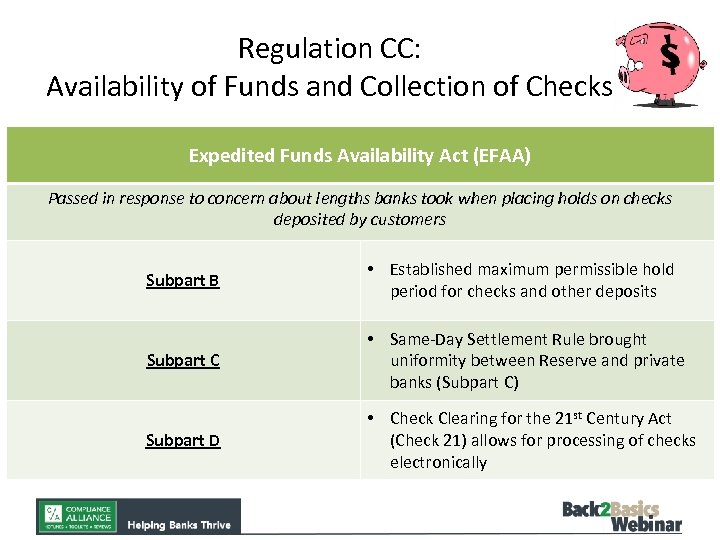

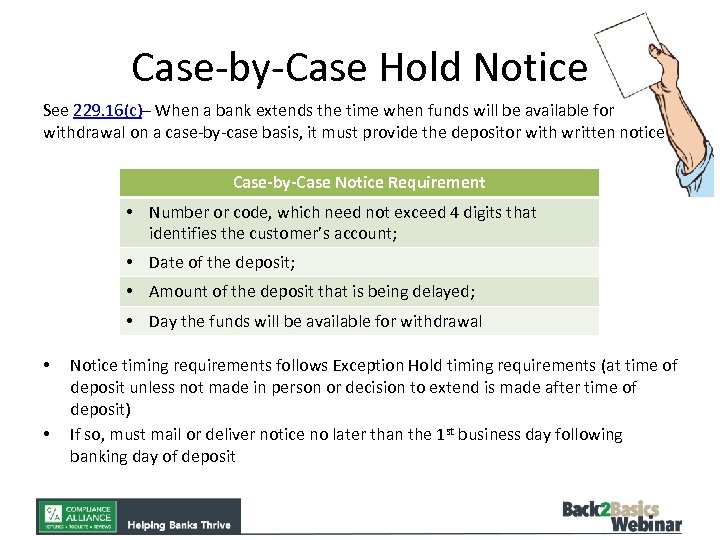

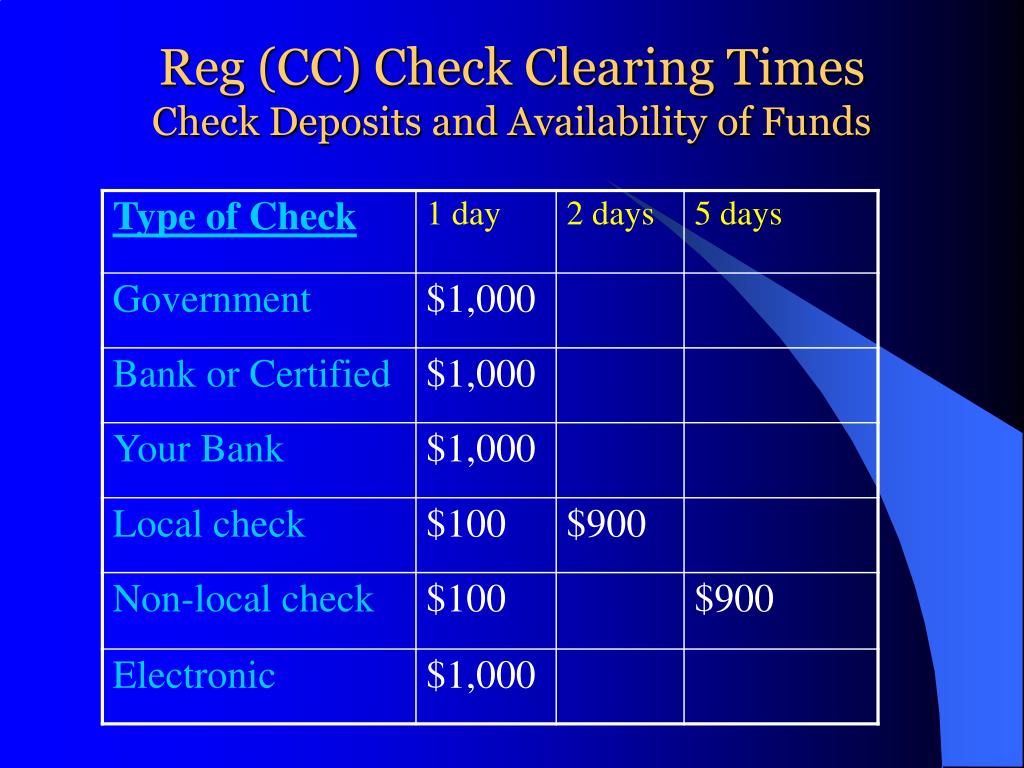

Funds Availability Reg Cc - Regulation cc establishes the rules and procedures for the availability of funds and the collection of checks by banks and other. Learn how regulation cc implements the efa act and check 21, which affect the availability and collection of funds for transaction accounts. A bank shall send a notice to holders of consumer accounts at least 30 days before implementing a change to the bank's availability policy. Regulation cc implements the expedited funds availability act and the check clearing for the 21st century act, which. Learn how to hold funds from different types of checks and items according to regulation cc. Find the maximum time you can hold per check and.

Learn how regulation cc implements the efa act and check 21, which affect the availability and collection of funds for transaction accounts. Find the maximum time you can hold per check and. Learn how to hold funds from different types of checks and items according to regulation cc. Regulation cc implements the expedited funds availability act and the check clearing for the 21st century act, which. A bank shall send a notice to holders of consumer accounts at least 30 days before implementing a change to the bank's availability policy. Regulation cc establishes the rules and procedures for the availability of funds and the collection of checks by banks and other.

Regulation cc establishes the rules and procedures for the availability of funds and the collection of checks by banks and other. Find the maximum time you can hold per check and. Learn how to hold funds from different types of checks and items according to regulation cc. A bank shall send a notice to holders of consumer accounts at least 30 days before implementing a change to the bank's availability policy. Regulation cc implements the expedited funds availability act and the check clearing for the 21st century act, which. Learn how regulation cc implements the efa act and check 21, which affect the availability and collection of funds for transaction accounts.

Reg Cc Funds Availability Chart 2025 Scott J. Allen

A bank shall send a notice to holders of consumer accounts at least 30 days before implementing a change to the bank's availability policy. Find the maximum time you can hold per check and. Learn how to hold funds from different types of checks and items according to regulation cc. Regulation cc establishes the rules and procedures for the availability.

Reg Cc Funds Availability Chart 2025 L. Hutton

Regulation cc establishes the rules and procedures for the availability of funds and the collection of checks by banks and other. Find the maximum time you can hold per check and. Regulation cc implements the expedited funds availability act and the check clearing for the 21st century act, which. Learn how regulation cc implements the efa act and check 21,.

Regulation Cc Funds Availability Chart 2024 Daune Eolande

Learn how regulation cc implements the efa act and check 21, which affect the availability and collection of funds for transaction accounts. Regulation cc implements the expedited funds availability act and the check clearing for the 21st century act, which. Find the maximum time you can hold per check and. Regulation cc establishes the rules and procedures for the availability.

Reg Cc Funds Availability Chart 2025 L. Hutton

Regulation cc implements the expedited funds availability act and the check clearing for the 21st century act, which. A bank shall send a notice to holders of consumer accounts at least 30 days before implementing a change to the bank's availability policy. Find the maximum time you can hold per check and. Regulation cc establishes the rules and procedures for.

PPT Financial Fitness Program PowerPoint Presentation, free download

Find the maximum time you can hold per check and. A bank shall send a notice to holders of consumer accounts at least 30 days before implementing a change to the bank's availability policy. Regulation cc establishes the rules and procedures for the availability of funds and the collection of checks by banks and other. Regulation cc implements the expedited.

Reg Cc Hold Calculator 2024 Loren Lorene

Regulation cc implements the expedited funds availability act and the check clearing for the 21st century act, which. A bank shall send a notice to holders of consumer accounts at least 30 days before implementing a change to the bank's availability policy. Learn how to hold funds from different types of checks and items according to regulation cc. Learn how.

Regulation CC Explained How Funds Availability & Check Holds Work

Learn how regulation cc implements the efa act and check 21, which affect the availability and collection of funds for transaction accounts. Regulation cc implements the expedited funds availability act and the check clearing for the 21st century act, which. Learn how to hold funds from different types of checks and items according to regulation cc. A bank shall send.

PPT Credit Union Website Compliance Presented By PowerPoint

Regulation cc implements the expedited funds availability act and the check clearing for the 21st century act, which. Regulation cc establishes the rules and procedures for the availability of funds and the collection of checks by banks and other. Find the maximum time you can hold per check and. Learn how regulation cc implements the efa act and check 21,.

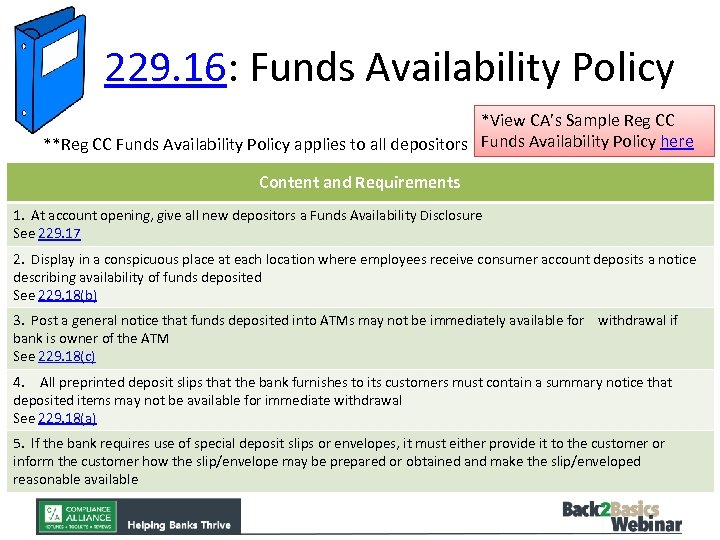

Regulation CC Funds Availability BY ELIZABETH MADLEM ASSOCIATE

A bank shall send a notice to holders of consumer accounts at least 30 days before implementing a change to the bank's availability policy. Learn how regulation cc implements the efa act and check 21, which affect the availability and collection of funds for transaction accounts. Regulation cc implements the expedited funds availability act and the check clearing for the.

Reg Cc Funds Availability Chart 2025 L. Hutton

Regulation cc establishes the rules and procedures for the availability of funds and the collection of checks by banks and other. Regulation cc implements the expedited funds availability act and the check clearing for the 21st century act, which. Find the maximum time you can hold per check and. Learn how regulation cc implements the efa act and check 21,.

Learn How Regulation Cc Implements The Efa Act And Check 21, Which Affect The Availability And Collection Of Funds For Transaction Accounts.

Regulation cc implements the expedited funds availability act and the check clearing for the 21st century act, which. A bank shall send a notice to holders of consumer accounts at least 30 days before implementing a change to the bank's availability policy. Regulation cc establishes the rules and procedures for the availability of funds and the collection of checks by banks and other. Learn how to hold funds from different types of checks and items according to regulation cc.