Funds Availability Regulation

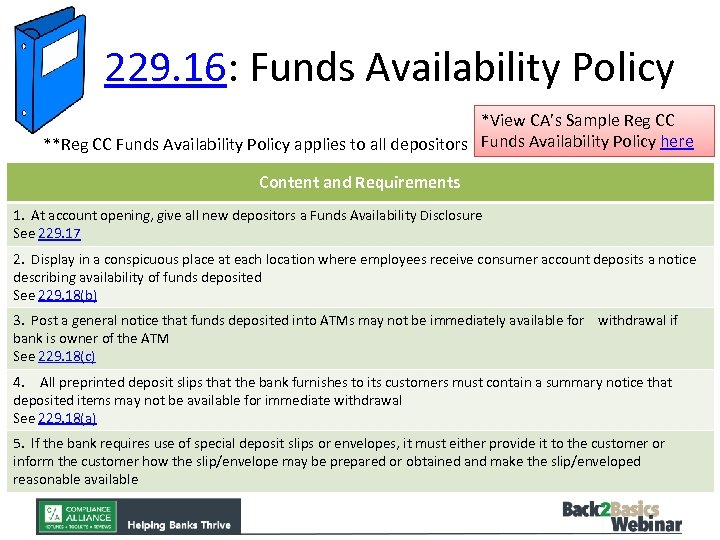

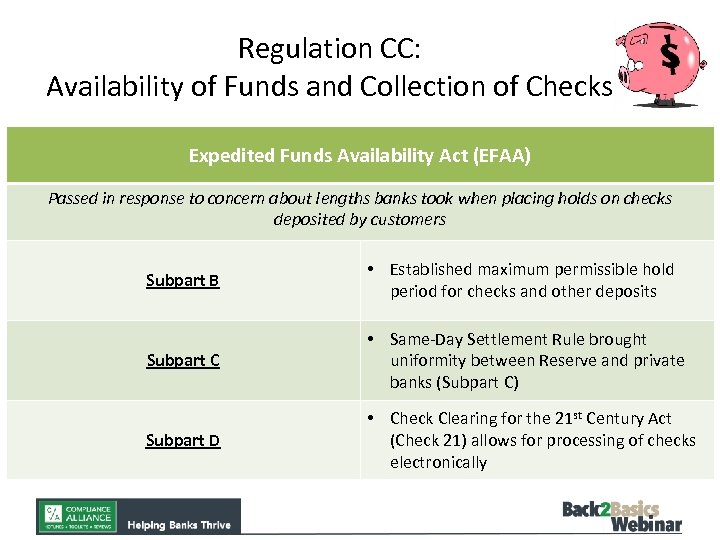

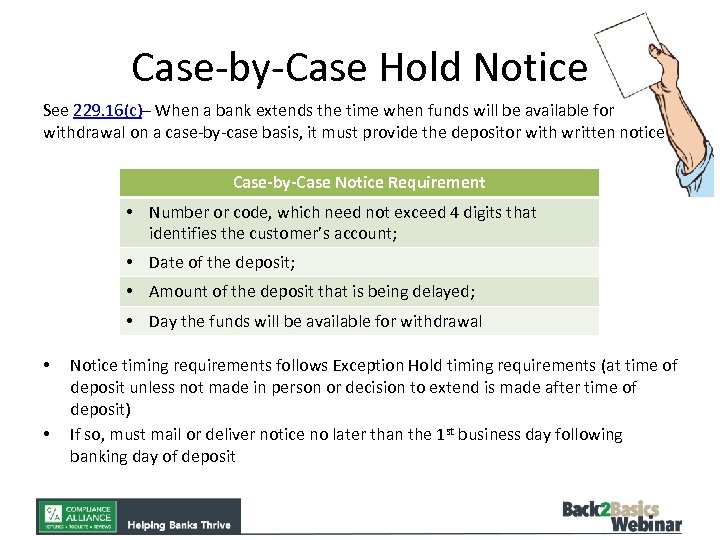

Funds Availability Regulation - These rules reduce the risk to. The regulation sets forth the requirements that depositary institutions (“banks”) make funds deposited into transaction accounts available. (2) subpart b of this part contains rules regarding the duty of banks to make funds deposited into accounts available for withdrawal, including. Pursuant to this authority, the board adopted rules to speed the return of unpaid checks. To ensure continued compliance with federal banking regulations, we want to inform our members of upcoming changes to regulation.

To ensure continued compliance with federal banking regulations, we want to inform our members of upcoming changes to regulation. (2) subpart b of this part contains rules regarding the duty of banks to make funds deposited into accounts available for withdrawal, including. Pursuant to this authority, the board adopted rules to speed the return of unpaid checks. The regulation sets forth the requirements that depositary institutions (“banks”) make funds deposited into transaction accounts available. These rules reduce the risk to.

The regulation sets forth the requirements that depositary institutions (“banks”) make funds deposited into transaction accounts available. To ensure continued compliance with federal banking regulations, we want to inform our members of upcoming changes to regulation. These rules reduce the risk to. Pursuant to this authority, the board adopted rules to speed the return of unpaid checks. (2) subpart b of this part contains rules regarding the duty of banks to make funds deposited into accounts available for withdrawal, including.

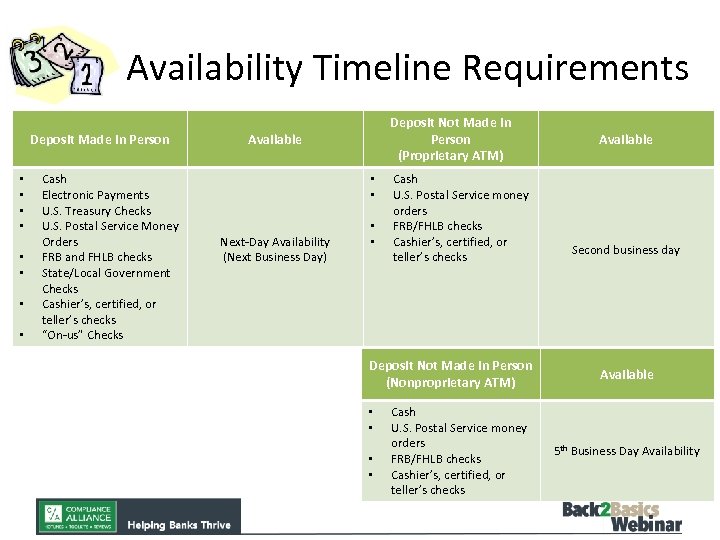

Deposit Holds and Funds Availability Rules

(2) subpart b of this part contains rules regarding the duty of banks to make funds deposited into accounts available for withdrawal, including. These rules reduce the risk to. Pursuant to this authority, the board adopted rules to speed the return of unpaid checks. The regulation sets forth the requirements that depositary institutions (“banks”) make funds deposited into transaction accounts.

Funds Availability Policy Mandatory Sign second day text U.S. Bank

(2) subpart b of this part contains rules regarding the duty of banks to make funds deposited into accounts available for withdrawal, including. Pursuant to this authority, the board adopted rules to speed the return of unpaid checks. To ensure continued compliance with federal banking regulations, we want to inform our members of upcoming changes to regulation. The regulation sets.

Reg Cc Hold Calculator 2024 Loren Lorene

The regulation sets forth the requirements that depositary institutions (“banks”) make funds deposited into transaction accounts available. These rules reduce the risk to. To ensure continued compliance with federal banking regulations, we want to inform our members of upcoming changes to regulation. Pursuant to this authority, the board adopted rules to speed the return of unpaid checks. (2) subpart b.

Regulation CC Funds Availability BY ELIZABETH MADLEM ASSOCIATE

To ensure continued compliance with federal banking regulations, we want to inform our members of upcoming changes to regulation. Pursuant to this authority, the board adopted rules to speed the return of unpaid checks. (2) subpart b of this part contains rules regarding the duty of banks to make funds deposited into accounts available for withdrawal, including. These rules reduce.

Reg Cc Funds Availability Chart 2025 L. Hutton

These rules reduce the risk to. The regulation sets forth the requirements that depositary institutions (“banks”) make funds deposited into transaction accounts available. To ensure continued compliance with federal banking regulations, we want to inform our members of upcoming changes to regulation. Pursuant to this authority, the board adopted rules to speed the return of unpaid checks. (2) subpart b.

Reg Cc Funds Availability Chart 2025 Scott J. Allen

These rules reduce the risk to. The regulation sets forth the requirements that depositary institutions (“banks”) make funds deposited into transaction accounts available. Pursuant to this authority, the board adopted rules to speed the return of unpaid checks. (2) subpart b of this part contains rules regarding the duty of banks to make funds deposited into accounts available for withdrawal,.

Bank Policy Guru Bank Regulatory Compliance Policy Templates

The regulation sets forth the requirements that depositary institutions (“banks”) make funds deposited into transaction accounts available. (2) subpart b of this part contains rules regarding the duty of banks to make funds deposited into accounts available for withdrawal, including. Pursuant to this authority, the board adopted rules to speed the return of unpaid checks. These rules reduce the risk.

PPT Credit Union Website Compliance Presented By PowerPoint

(2) subpart b of this part contains rules regarding the duty of banks to make funds deposited into accounts available for withdrawal, including. To ensure continued compliance with federal banking regulations, we want to inform our members of upcoming changes to regulation. The regulation sets forth the requirements that depositary institutions (“banks”) make funds deposited into transaction accounts available. These.

Reg Cc Funds Availability Chart 2025 Scott J. Allen

Pursuant to this authority, the board adopted rules to speed the return of unpaid checks. These rules reduce the risk to. To ensure continued compliance with federal banking regulations, we want to inform our members of upcoming changes to regulation. The regulation sets forth the requirements that depositary institutions (“banks”) make funds deposited into transaction accounts available. (2) subpart b.

Reg Cc Funds Availability Chart 2025 L. Hutton

Pursuant to this authority, the board adopted rules to speed the return of unpaid checks. These rules reduce the risk to. (2) subpart b of this part contains rules regarding the duty of banks to make funds deposited into accounts available for withdrawal, including. To ensure continued compliance with federal banking regulations, we want to inform our members of upcoming.

To Ensure Continued Compliance With Federal Banking Regulations, We Want To Inform Our Members Of Upcoming Changes To Regulation.

Pursuant to this authority, the board adopted rules to speed the return of unpaid checks. The regulation sets forth the requirements that depositary institutions (“banks”) make funds deposited into transaction accounts available. (2) subpart b of this part contains rules regarding the duty of banks to make funds deposited into accounts available for withdrawal, including. These rules reduce the risk to.

:max_bytes(150000):strip_icc()/funds-availability-315448-Final-5c58582d46e0fb0001c08aee.png)