Payroll Liabilities Balance Sheet

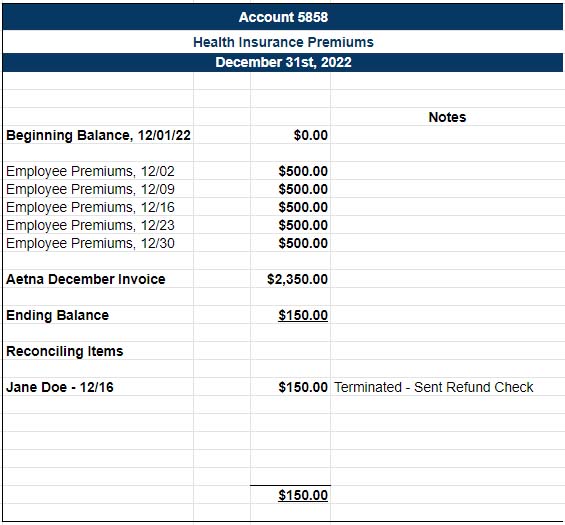

Payroll Liabilities Balance Sheet - Why is the reconciliation of payroll liabilities so important? What do auditors want to see to provide assurance that payroll liability account. If you prepare a balance sheet for your business, you’ll record payroll liabilities as wages payable and taxes payable under current liabilities. Learn what the different types of payroll liabilities there are and how to record them.

Learn what the different types of payroll liabilities there are and how to record them. Why is the reconciliation of payroll liabilities so important? What do auditors want to see to provide assurance that payroll liability account. If you prepare a balance sheet for your business, you’ll record payroll liabilities as wages payable and taxes payable under current liabilities.

If you prepare a balance sheet for your business, you’ll record payroll liabilities as wages payable and taxes payable under current liabilities. Why is the reconciliation of payroll liabilities so important? What do auditors want to see to provide assurance that payroll liability account. Learn what the different types of payroll liabilities there are and how to record them.

How to Do Payroll Reconciliation for Small Businesses

Learn what the different types of payroll liabilities there are and how to record them. Why is the reconciliation of payroll liabilities so important? What do auditors want to see to provide assurance that payroll liability account. If you prepare a balance sheet for your business, you’ll record payroll liabilities as wages payable and taxes payable under current liabilities.

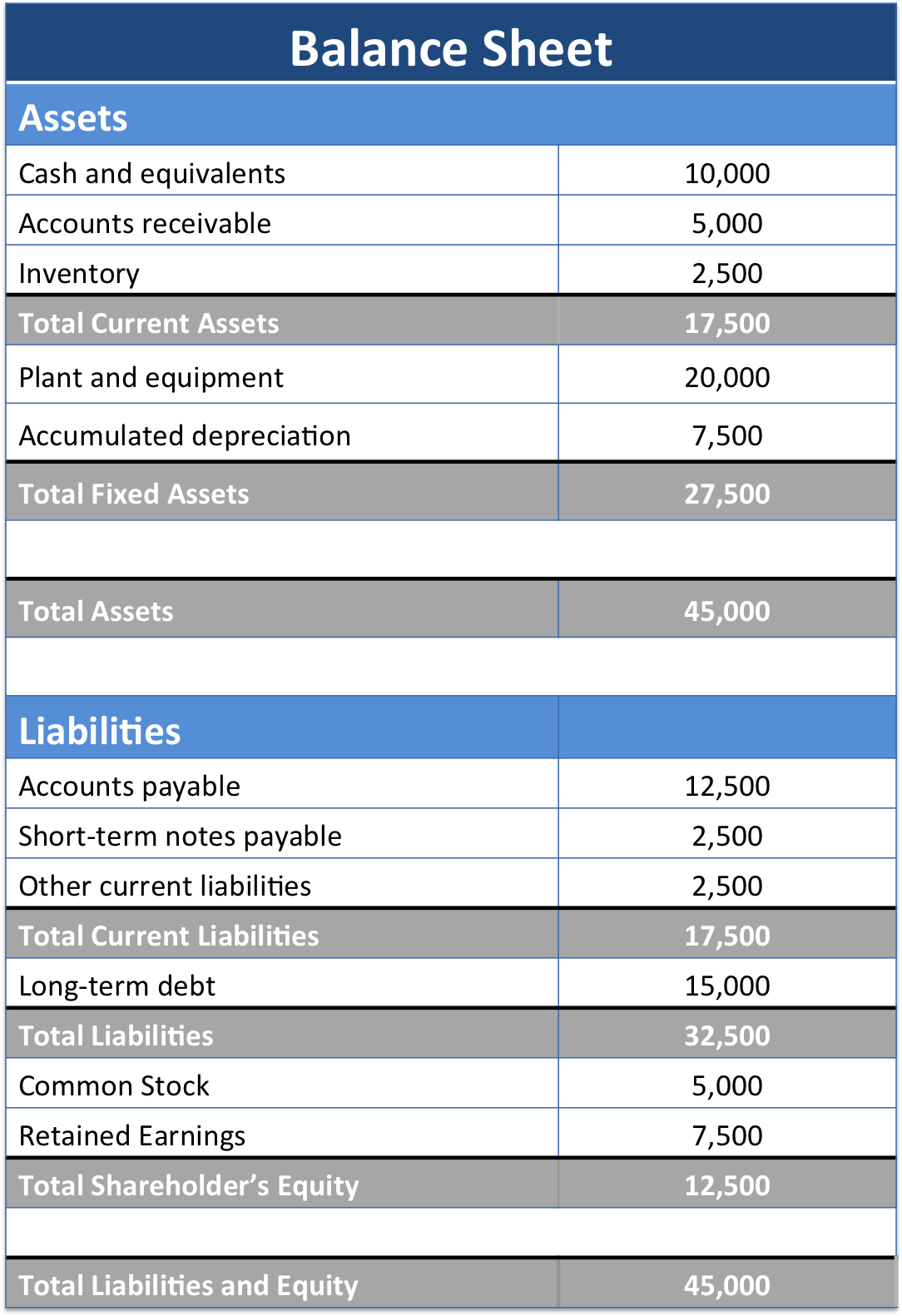

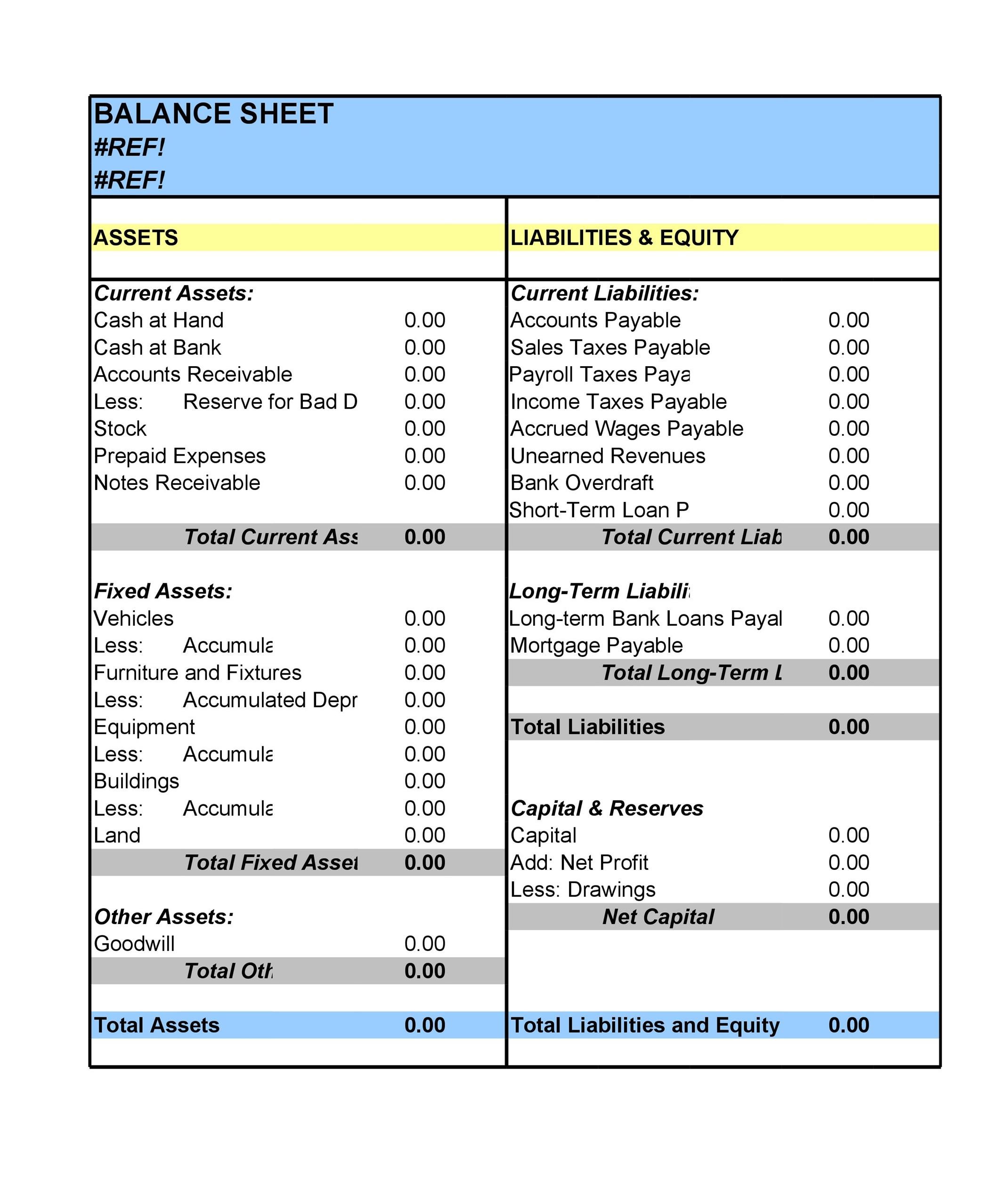

Balance sheet example track assets and liabilities

If you prepare a balance sheet for your business, you’ll record payroll liabilities as wages payable and taxes payable under current liabilities. What do auditors want to see to provide assurance that payroll liability account. Why is the reconciliation of payroll liabilities so important? Learn what the different types of payroll liabilities there are and how to record them.

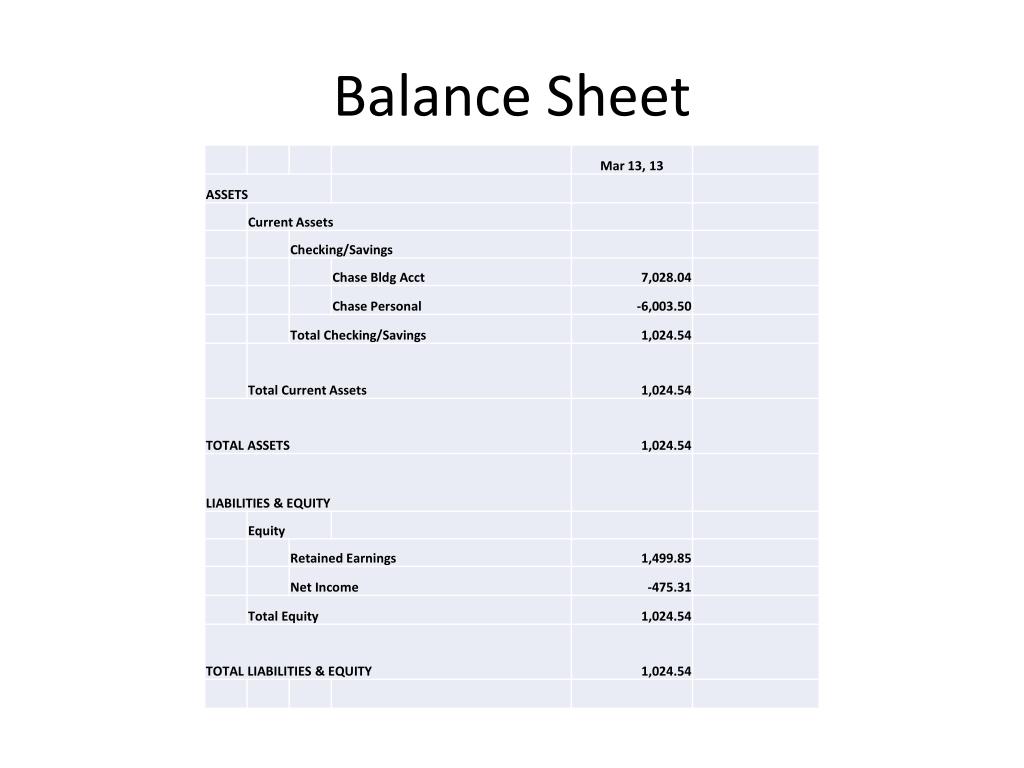

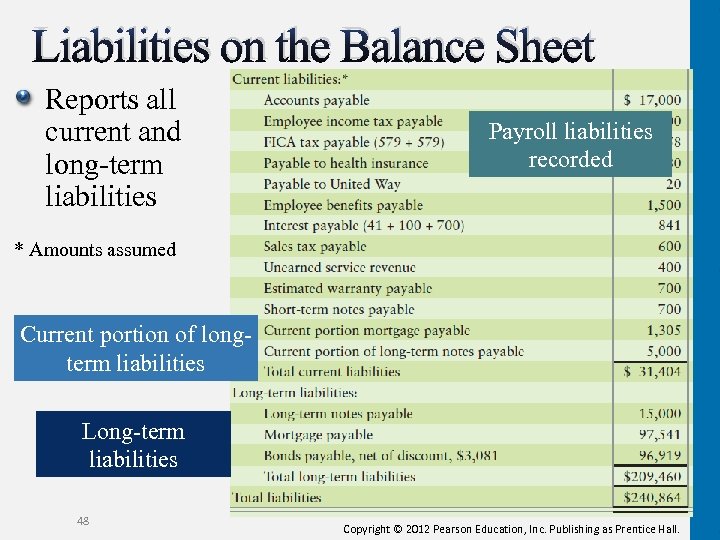

PPT PAYROLL ACCOUNTING Chapter 11 2013 CPP REVIEW CLASS CHAPTER 11

If you prepare a balance sheet for your business, you’ll record payroll liabilities as wages payable and taxes payable under current liabilities. What do auditors want to see to provide assurance that payroll liability account. Why is the reconciliation of payroll liabilities so important? Learn what the different types of payroll liabilities there are and how to record them.

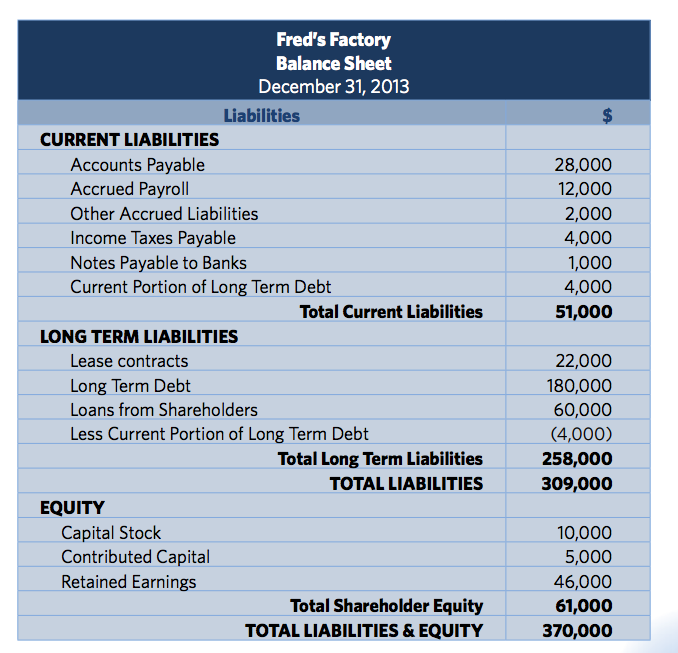

Understanding Liabilities Reading a Balance Sheet

What do auditors want to see to provide assurance that payroll liability account. Learn what the different types of payroll liabilities there are and how to record them. If you prepare a balance sheet for your business, you’ll record payroll liabilities as wages payable and taxes payable under current liabilities. Why is the reconciliation of payroll liabilities so important?

What is the Difference Between Payroll Expenses and Payroll Liabilities

Learn what the different types of payroll liabilities there are and how to record them. If you prepare a balance sheet for your business, you’ll record payroll liabilities as wages payable and taxes payable under current liabilities. What do auditors want to see to provide assurance that payroll liability account. Why is the reconciliation of payroll liabilities so important?

Payroll With Balance Sheet

If you prepare a balance sheet for your business, you’ll record payroll liabilities as wages payable and taxes payable under current liabilities. Learn what the different types of payroll liabilities there are and how to record them. Why is the reconciliation of payroll liabilities so important? What do auditors want to see to provide assurance that payroll liability account.

How to Read a Balance Sheet (Free Download) Poindexter Blog

Why is the reconciliation of payroll liabilities so important? What do auditors want to see to provide assurance that payroll liability account. Learn what the different types of payroll liabilities there are and how to record them. If you prepare a balance sheet for your business, you’ll record payroll liabilities as wages payable and taxes payable under current liabilities.

38 Free Balance Sheet Templates & Examples ᐅ TemplateLab

Learn what the different types of payroll liabilities there are and how to record them. If you prepare a balance sheet for your business, you’ll record payroll liabilities as wages payable and taxes payable under current liabilities. Why is the reconciliation of payroll liabilities so important? What do auditors want to see to provide assurance that payroll liability account.

LongTerm Liabilities Bonds Payable and Classification of Liabilities

What do auditors want to see to provide assurance that payroll liability account. Learn what the different types of payroll liabilities there are and how to record them. If you prepare a balance sheet for your business, you’ll record payroll liabilities as wages payable and taxes payable under current liabilities. Why is the reconciliation of payroll liabilities so important?

Liabilities Side of Balance Sheet

If you prepare a balance sheet for your business, you’ll record payroll liabilities as wages payable and taxes payable under current liabilities. Why is the reconciliation of payroll liabilities so important? What do auditors want to see to provide assurance that payroll liability account. Learn what the different types of payroll liabilities there are and how to record them.

If You Prepare A Balance Sheet For Your Business, You’ll Record Payroll Liabilities As Wages Payable And Taxes Payable Under Current Liabilities.

Why is the reconciliation of payroll liabilities so important? Learn what the different types of payroll liabilities there are and how to record them. What do auditors want to see to provide assurance that payroll liability account.