Prepaid Expense On Balance Sheet

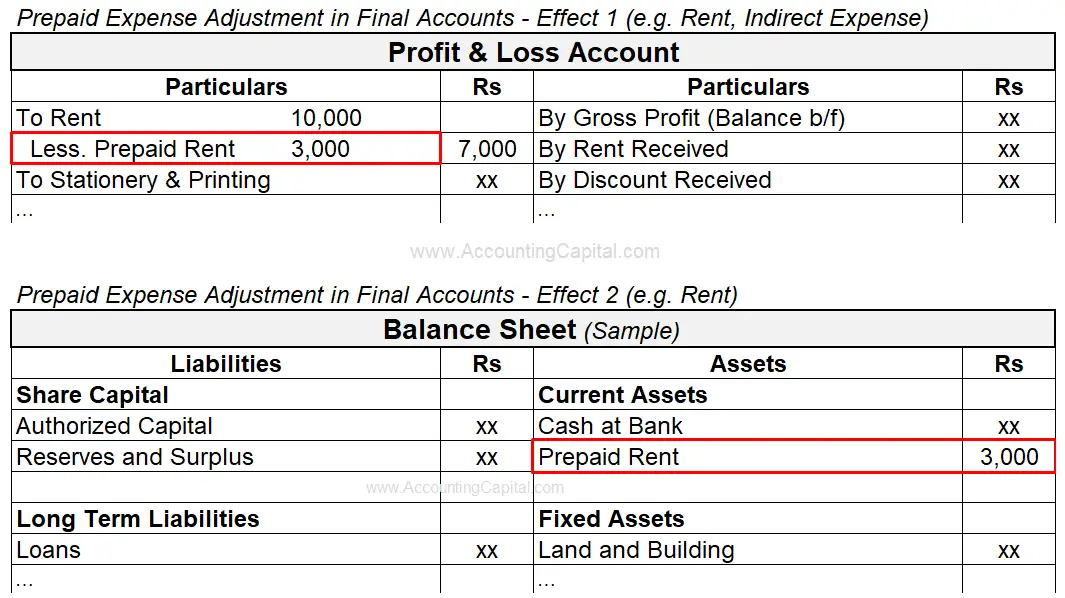

Prepaid Expense On Balance Sheet - As the benefits of the expenses are. The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. Learn what prepaid expenses are, how they differ from other current assets, and how they are treated in the balance sheet and income. Prepaid expenses are an essential aspect of financial accounting, enabling businesses to manage cash flow and. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset.

The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. Learn what prepaid expenses are, how they differ from other current assets, and how they are treated in the balance sheet and income. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. Prepaid expenses are an essential aspect of financial accounting, enabling businesses to manage cash flow and. As the benefits of the expenses are.

Prepaid expenses are an essential aspect of financial accounting, enabling businesses to manage cash flow and. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. As the benefits of the expenses are. Learn what prepaid expenses are, how they differ from other current assets, and how they are treated in the balance sheet and income.

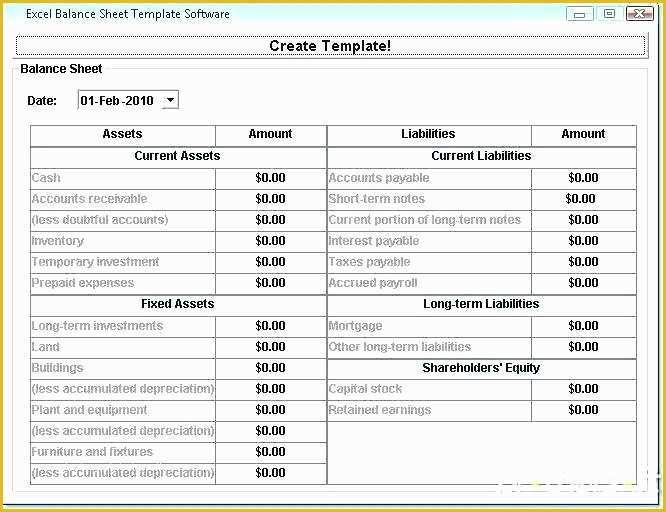

Prepaid Expenses on Balance Sheet Quant RL

As the benefits of the expenses are. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. Learn what prepaid expenses are, how they differ from other current assets, and how they are treated in the balance sheet and income. The “prepaid expenses” line item is recorded in the current assets section of.

Where are prepaid expenses on balance sheet? Leia aqui Are prepaid

Prepaid expenses are an essential aspect of financial accounting, enabling businesses to manage cash flow and. The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. As the benefits of the expenses are. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. Learn what prepaid expenses.

Prepaid Expense Reconciliation Template Excel

Prepaid expenses are an essential aspect of financial accounting, enabling businesses to manage cash flow and. Learn what prepaid expenses are, how they differ from other current assets, and how they are treated in the balance sheet and income. As the benefits of the expenses are. Prepaid expenses are future expenses that are paid in advance and hence recognized initially.

Prepaid Expense Template

Learn what prepaid expenses are, how they differ from other current assets, and how they are treated in the balance sheet and income. As the benefits of the expenses are. Prepaid expenses are an essential aspect of financial accounting, enabling businesses to manage cash flow and. The “prepaid expenses” line item is recorded in the current assets section of the.

Prepaid Expense Definition and Example

As the benefits of the expenses are. The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. Prepaid expenses are an essential aspect of financial accounting, enabling businesses to manage cash flow and. Learn what prepaid expenses are, how they differ from other current assets, and how they are treated in the balance sheet.

Free Prepaid Expense Schedule Excel Template Web Prepayments And

Learn what prepaid expenses are, how they differ from other current assets, and how they are treated in the balance sheet and income. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. Prepaid expenses are an essential aspect of financial accounting, enabling businesses to manage cash flow and. As the benefits of.

Prepaid Expenses In Balance Sheet Analysis Template Ipsas 20 Financial

As the benefits of the expenses are. Prepaid expenses are an essential aspect of financial accounting, enabling businesses to manage cash flow and. The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. Learn what prepaid expenses are, how they differ from other current assets, and how they are treated in the balance sheet.

Free Prepaid Expense Schedule Excel Template Of Balance Sheet Template

Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. Learn what prepaid expenses are, how they differ from other current assets, and how they are treated in the balance sheet and income. Prepaid expenses are an essential aspect of financial accounting, enabling businesses to manage cash flow and. As the benefits of.

Prepaid Expenses Meaning Example Entry Quiz & More..

The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. Prepaid expenses are an essential aspect of financial accounting, enabling businesses to manage cash flow and. As the benefits of the expenses are. Learn what prepaid expenses are, how they differ from other current assets, and how they are treated in the balance sheet.

Prepaid Expenses on the Balance Sheet Quant RL

Prepaid expenses are an essential aspect of financial accounting, enabling businesses to manage cash flow and. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. As the benefits of the expenses are. Learn what prepaid expenses.

Prepaid Expenses Are Future Expenses That Are Paid In Advance And Hence Recognized Initially As An Asset.

The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. As the benefits of the expenses are. Prepaid expenses are an essential aspect of financial accounting, enabling businesses to manage cash flow and. Learn what prepaid expenses are, how they differ from other current assets, and how they are treated in the balance sheet and income.

:max_bytes(150000):strip_icc()/prepaid-expense-4191042-recirc-blue-1d8d154bf0c94ba6858fe12907d2b694.jpg)