Prepaid Insurance In Balance Sheet

Prepaid Insurance In Balance Sheet - Prepaid insurance is the insurance premium paid by a company in an accounting period that didn’t expire in the same accounting period. Therefore, the unexpired portion of this. Insurance companies carry prepaid insurance as current assets on their balance. When the company makes an advance payment for insurance, it can make prepaid insurance journal entry by debiting prepaid insurance account and crediting cash account. Prepaid insurance is an asset account on the balance sheet, in which its normal balance is on the debit side. The amount of the insurance premiums that remain prepaid at the end of each accounting period. The company should not record the advance payment as the insurance expense. Prepaid insurance is payments made to insurers in advance for insurance coverage. When the insurance premiums are paid in advance, they are referred to as prepaid.

The company should not record the advance payment as the insurance expense. When the company makes an advance payment for insurance, it can make prepaid insurance journal entry by debiting prepaid insurance account and crediting cash account. Prepaid insurance is the insurance premium paid by a company in an accounting period that didn’t expire in the same accounting period. Therefore, the unexpired portion of this. Prepaid insurance is payments made to insurers in advance for insurance coverage. Prepaid insurance is an asset account on the balance sheet, in which its normal balance is on the debit side. The amount of the insurance premiums that remain prepaid at the end of each accounting period. Insurance companies carry prepaid insurance as current assets on their balance. When the insurance premiums are paid in advance, they are referred to as prepaid.

Prepaid insurance is an asset account on the balance sheet, in which its normal balance is on the debit side. Prepaid insurance is the insurance premium paid by a company in an accounting period that didn’t expire in the same accounting period. When the insurance premiums are paid in advance, they are referred to as prepaid. Therefore, the unexpired portion of this. Insurance companies carry prepaid insurance as current assets on their balance. The company should not record the advance payment as the insurance expense. Prepaid insurance is payments made to insurers in advance for insurance coverage. When the company makes an advance payment for insurance, it can make prepaid insurance journal entry by debiting prepaid insurance account and crediting cash account. The amount of the insurance premiums that remain prepaid at the end of each accounting period.

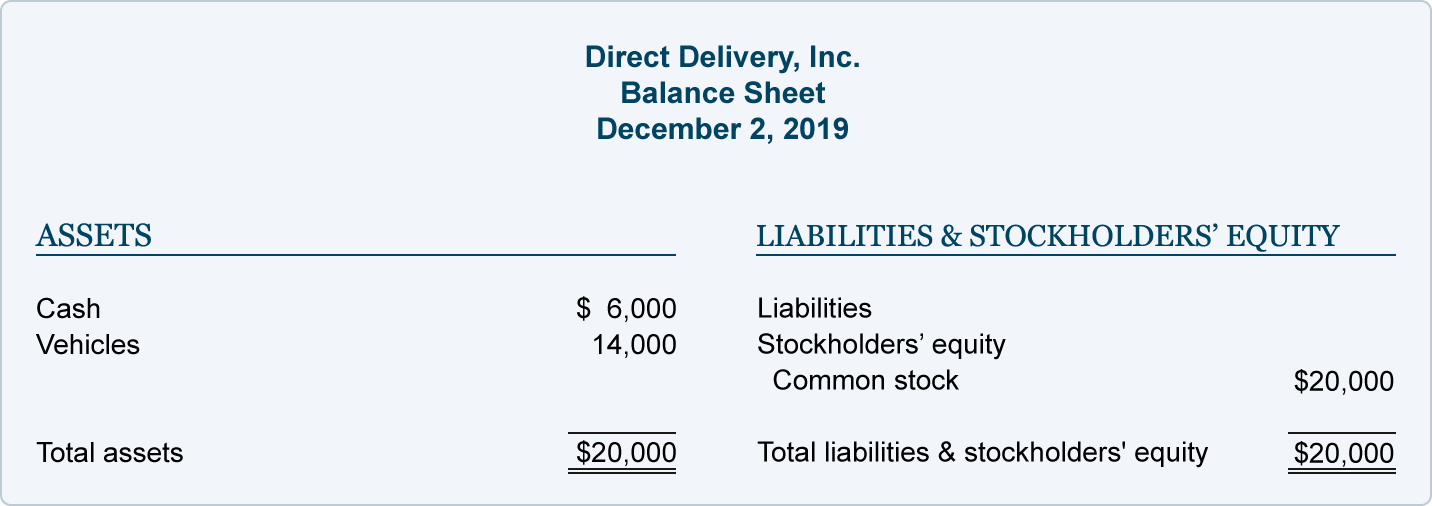

Prepaid Assets on Balance Sheet Quant RL

Prepaid insurance is an asset account on the balance sheet, in which its normal balance is on the debit side. Therefore, the unexpired portion of this. Prepaid insurance is the insurance premium paid by a company in an accounting period that didn’t expire in the same accounting period. When the company makes an advance payment for insurance, it can make.

Understanding Prepaid Insurance In Statements Cuztomize

When the company makes an advance payment for insurance, it can make prepaid insurance journal entry by debiting prepaid insurance account and crediting cash account. When the insurance premiums are paid in advance, they are referred to as prepaid. Prepaid insurance is payments made to insurers in advance for insurance coverage. Prepaid insurance is an asset account on the balance.

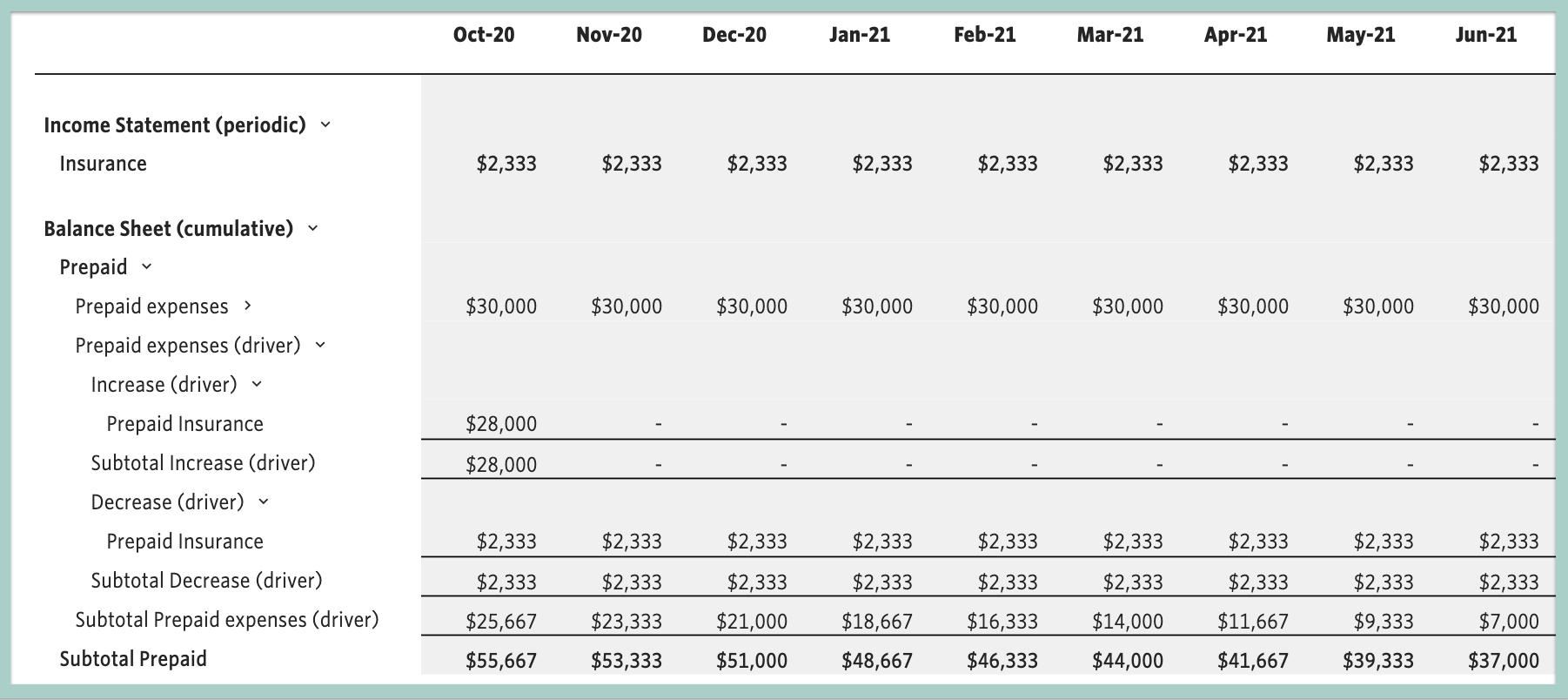

Step 20 Plan for Prepaid Insurance

The company should not record the advance payment as the insurance expense. When the insurance premiums are paid in advance, they are referred to as prepaid. Prepaid insurance is an asset account on the balance sheet, in which its normal balance is on the debit side. Therefore, the unexpired portion of this. When the company makes an advance payment for.

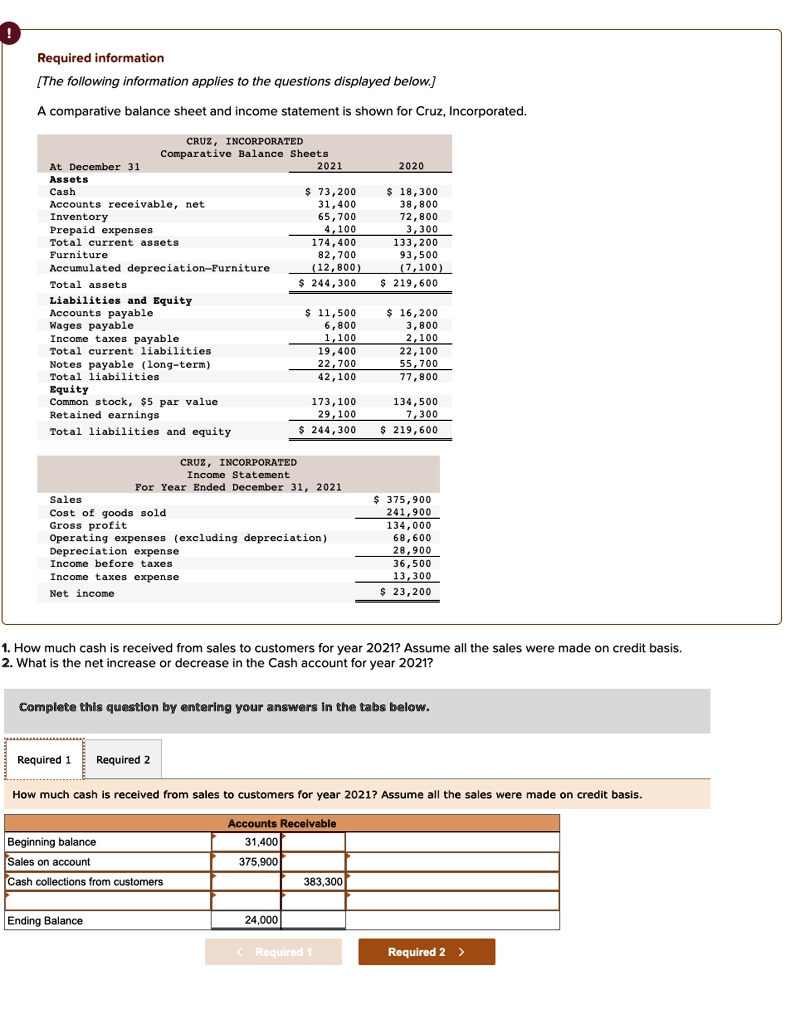

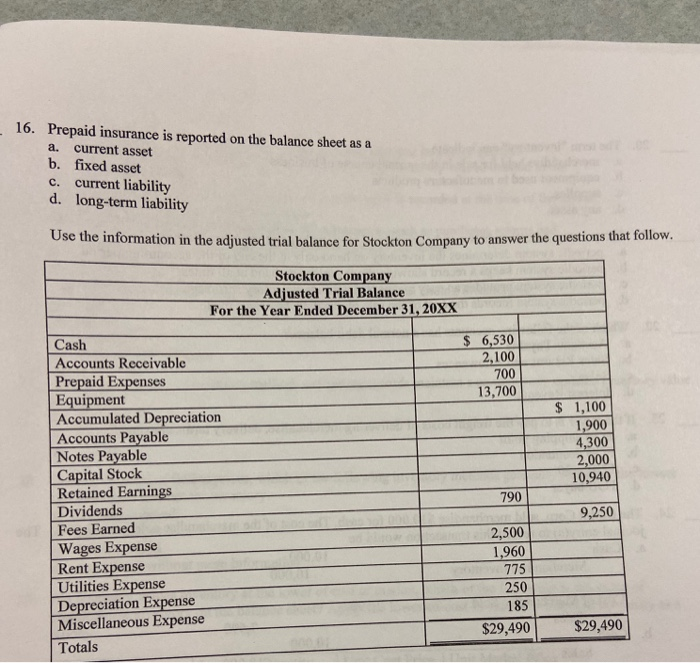

Help, cant balance sheet, see prepaid insurance and accumulated

Prepaid insurance is an asset account on the balance sheet, in which its normal balance is on the debit side. Prepaid insurance is payments made to insurers in advance for insurance coverage. Prepaid insurance is the insurance premium paid by a company in an accounting period that didn’t expire in the same accounting period. Therefore, the unexpired portion of this..

Balance sheet prepaid insurance veryrb

Therefore, the unexpired portion of this. When the insurance premiums are paid in advance, they are referred to as prepaid. The amount of the insurance premiums that remain prepaid at the end of each accounting period. The company should not record the advance payment as the insurance expense. When the company makes an advance payment for insurance, it can make.

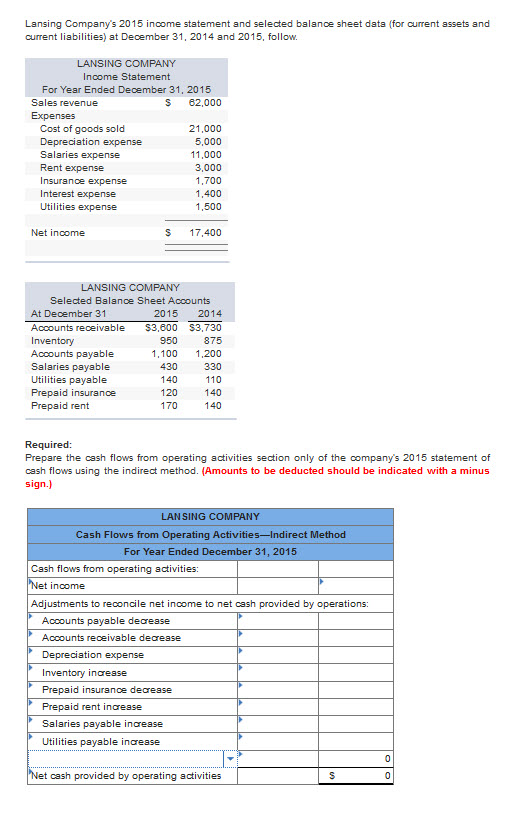

Solved Please help complete balance sheet. Prepaid insurance

Prepaid insurance is the insurance premium paid by a company in an accounting period that didn’t expire in the same accounting period. When the company makes an advance payment for insurance, it can make prepaid insurance journal entry by debiting prepaid insurance account and crediting cash account. The company should not record the advance payment as the insurance expense. The.

What Type of Account Is Prepaid Insurance on the Balance Sheet

The amount of the insurance premiums that remain prepaid at the end of each accounting period. Prepaid insurance is an asset account on the balance sheet, in which its normal balance is on the debit side. Prepaid insurance is the insurance premium paid by a company in an accounting period that didn’t expire in the same accounting period. Insurance companies.

What Is Prepaid Insurance On A Balance Sheet? Cuztomize

Insurance companies carry prepaid insurance as current assets on their balance. When the company makes an advance payment for insurance, it can make prepaid insurance journal entry by debiting prepaid insurance account and crediting cash account. Prepaid insurance is an asset account on the balance sheet, in which its normal balance is on the debit side. Prepaid insurance is payments.

What is prepaid insurance on a balance sheet? Leia aqui Is prepaid

Prepaid insurance is the insurance premium paid by a company in an accounting period that didn’t expire in the same accounting period. Therefore, the unexpired portion of this. The amount of the insurance premiums that remain prepaid at the end of each accounting period. When the insurance premiums are paid in advance, they are referred to as prepaid. Prepaid insurance.

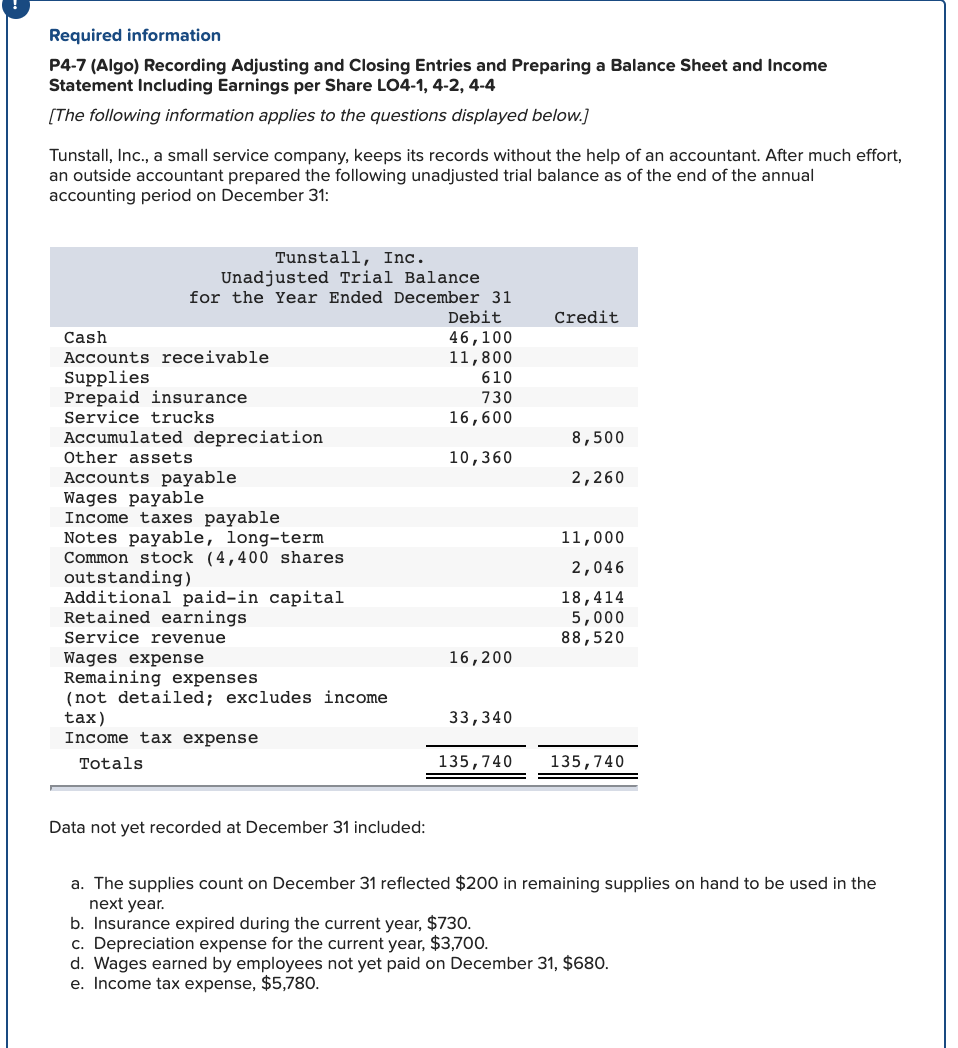

Prepaid Expenses In Balance Sheet Analysis Template Ipsas 20 Financial

Prepaid insurance is the insurance premium paid by a company in an accounting period that didn’t expire in the same accounting period. Prepaid insurance is payments made to insurers in advance for insurance coverage. Prepaid insurance is an asset account on the balance sheet, in which its normal balance is on the debit side. The company should not record the.

Insurance Companies Carry Prepaid Insurance As Current Assets On Their Balance.

Prepaid insurance is the insurance premium paid by a company in an accounting period that didn’t expire in the same accounting period. Therefore, the unexpired portion of this. When the insurance premiums are paid in advance, they are referred to as prepaid. Prepaid insurance is an asset account on the balance sheet, in which its normal balance is on the debit side.

When The Company Makes An Advance Payment For Insurance, It Can Make Prepaid Insurance Journal Entry By Debiting Prepaid Insurance Account And Crediting Cash Account.

The company should not record the advance payment as the insurance expense. The amount of the insurance premiums that remain prepaid at the end of each accounting period. Prepaid insurance is payments made to insurers in advance for insurance coverage.