Recent Tax Proposals

Recent Tax Proposals - Key proposals in the house bill would make permanent many provisions of the tcja, restore favorable tax treatment of various business. The “one big, beautiful bill” promises permanent tax cuts —. Here's who would benefit from the change. Since he took office, trump has proposed the largest tax cut in american history. This new limitation is effective for taxable years beginning after december 31, 2025. House republicans passed a bill to raise the 'salt' deduction cap to $40,000. But democrats warn that millions of americans will lose coverage. Republicans are looking to generate savings with new work requirements.

The “one big, beautiful bill” promises permanent tax cuts —. Since he took office, trump has proposed the largest tax cut in american history. House republicans passed a bill to raise the 'salt' deduction cap to $40,000. But democrats warn that millions of americans will lose coverage. Key proposals in the house bill would make permanent many provisions of the tcja, restore favorable tax treatment of various business. Republicans are looking to generate savings with new work requirements. Here's who would benefit from the change. This new limitation is effective for taxable years beginning after december 31, 2025.

Here's who would benefit from the change. Republicans are looking to generate savings with new work requirements. House republicans passed a bill to raise the 'salt' deduction cap to $40,000. But democrats warn that millions of americans will lose coverage. Key proposals in the house bill would make permanent many provisions of the tcja, restore favorable tax treatment of various business. This new limitation is effective for taxable years beginning after december 31, 2025. The “one big, beautiful bill” promises permanent tax cuts —. Since he took office, trump has proposed the largest tax cut in american history.

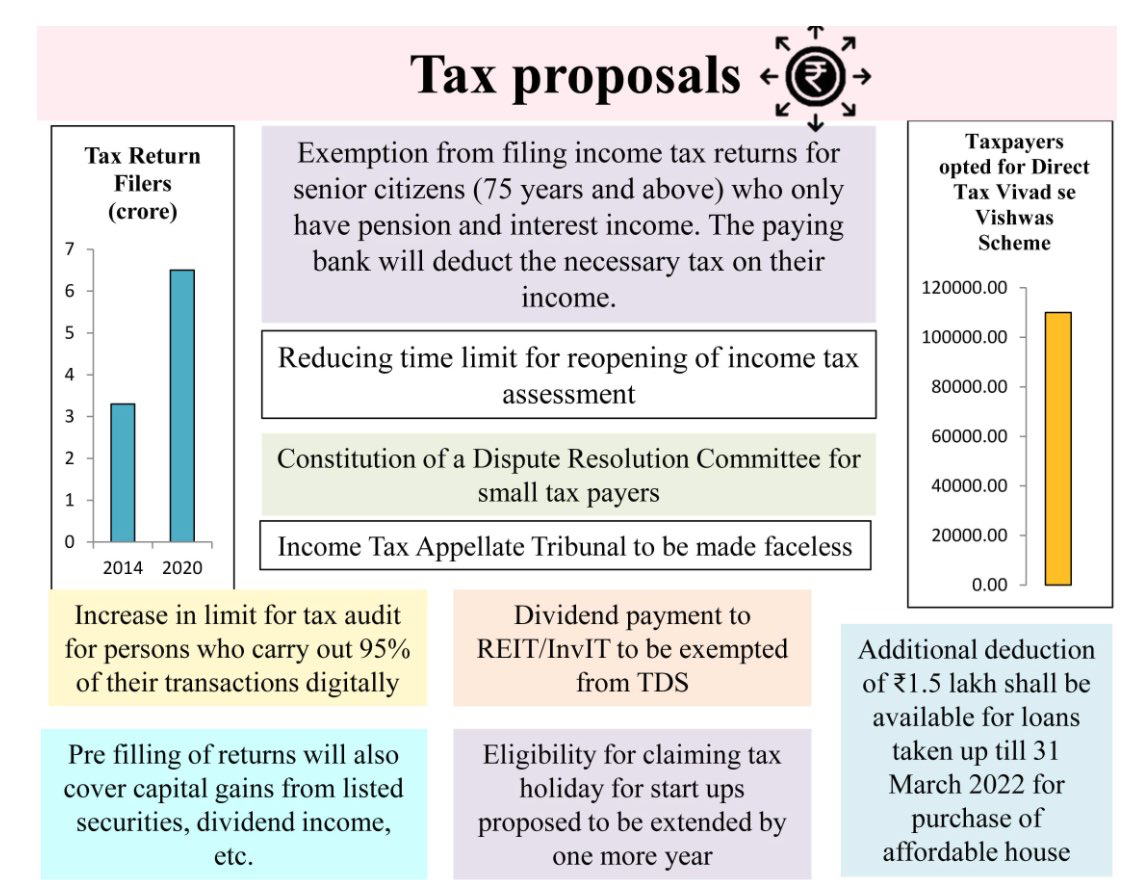

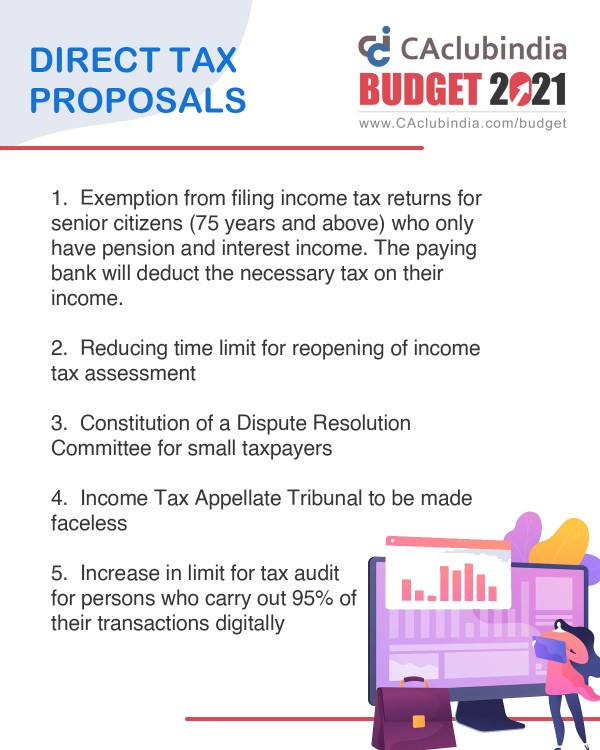

Budget 2021 Direct Tax Proposals

Key proposals in the house bill would make permanent many provisions of the tcja, restore favorable tax treatment of various business. The “one big, beautiful bill” promises permanent tax cuts —. Republicans are looking to generate savings with new work requirements. Here's who would benefit from the change. House republicans passed a bill to raise the 'salt' deduction cap to.

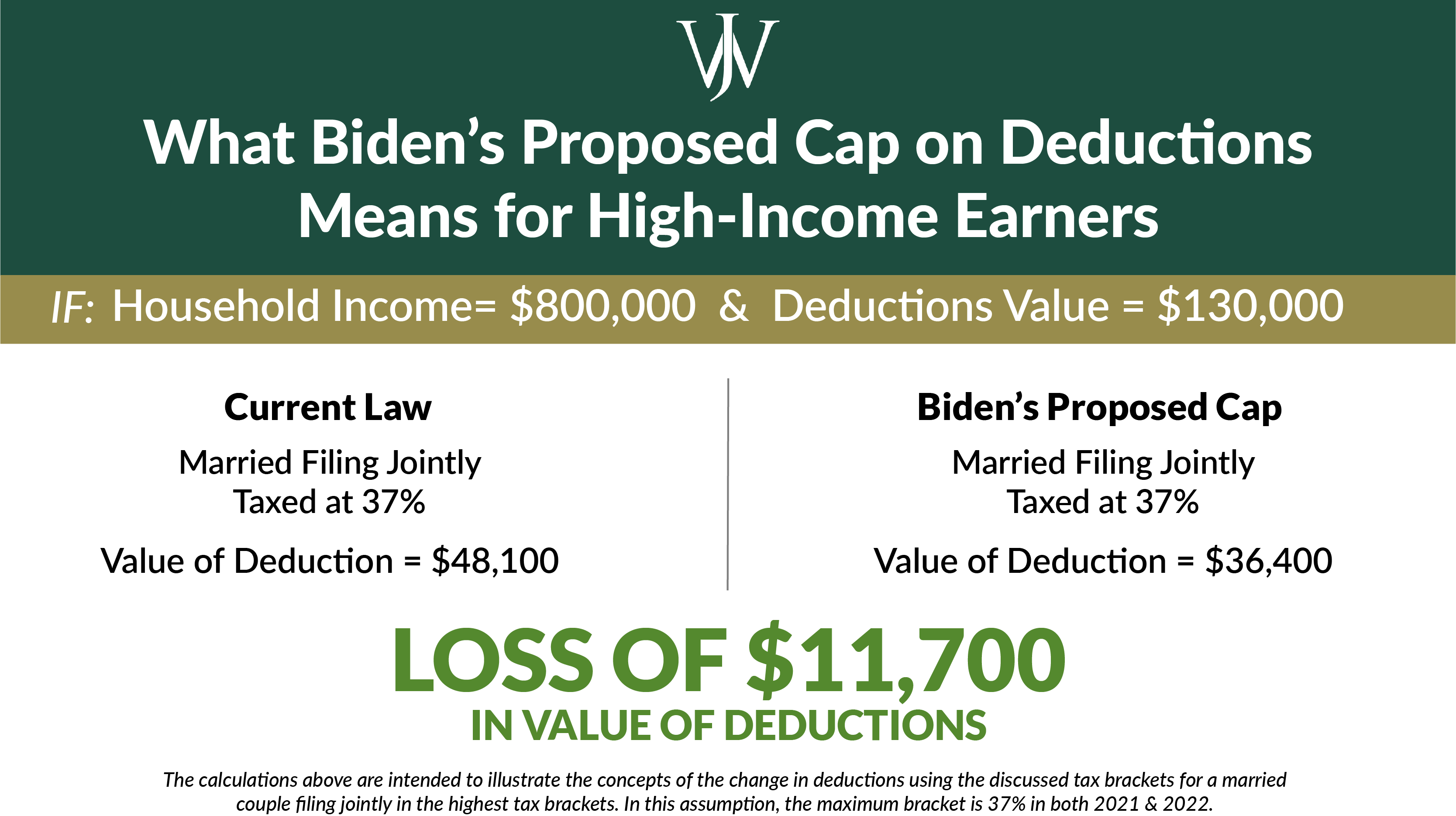

Biden's New Tax Proposals and What They Mean For You — Human Investing

Here's who would benefit from the change. Republicans are looking to generate savings with new work requirements. Since he took office, trump has proposed the largest tax cut in american history. Key proposals in the house bill would make permanent many provisions of the tcja, restore favorable tax treatment of various business. But democrats warn that millions of americans will.

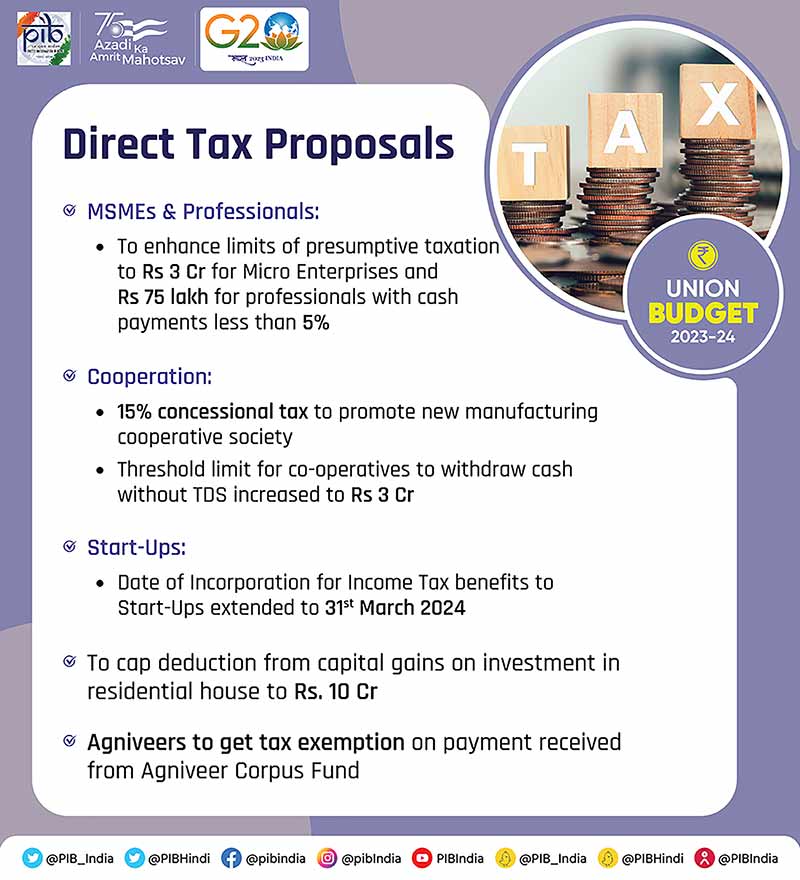

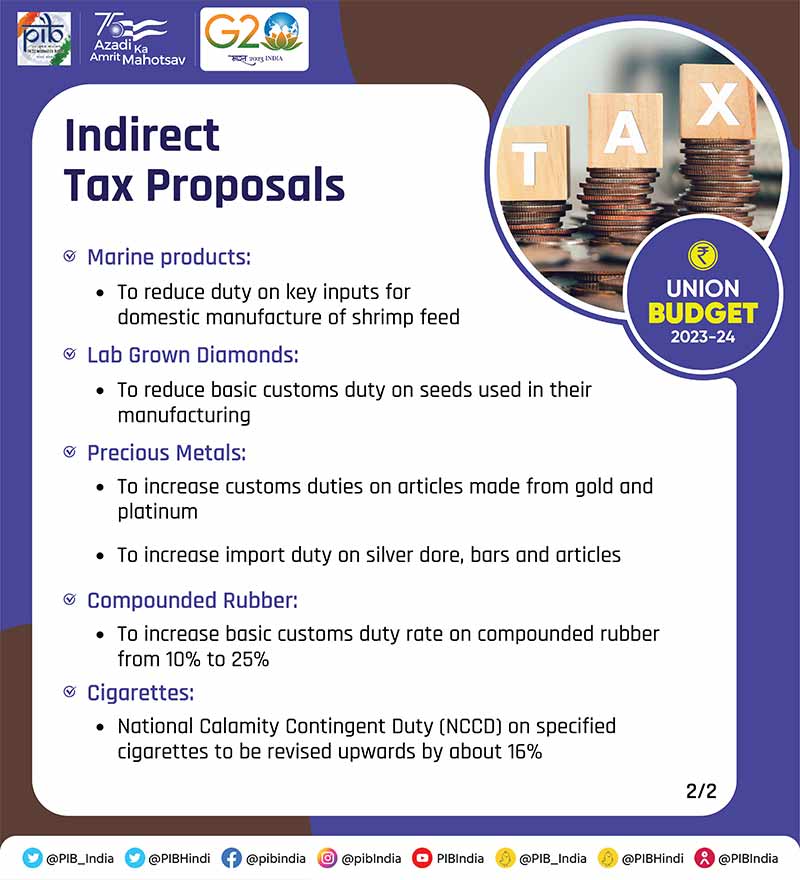

Budget 2023 in Pictures Important Facts and Numbers Explained in

Republicans are looking to generate savings with new work requirements. But democrats warn that millions of americans will lose coverage. Key proposals in the house bill would make permanent many provisions of the tcja, restore favorable tax treatment of various business. Here's who would benefit from the change. Since he took office, trump has proposed the largest tax cut in.

Budget 2023 in Pictures Important Facts and Numbers Explained in

Republicans are looking to generate savings with new work requirements. Key proposals in the house bill would make permanent many provisions of the tcja, restore favorable tax treatment of various business. Here's who would benefit from the change. But democrats warn that millions of americans will lose coverage. Since he took office, trump has proposed the largest tax cut in.

Breaking Down the New 2021 Federal Tax Proposals Strohmeyer Law PLLC

Key proposals in the house bill would make permanent many provisions of the tcja, restore favorable tax treatment of various business. Republicans are looking to generate savings with new work requirements. Here's who would benefit from the change. Since he took office, trump has proposed the largest tax cut in american history. This new limitation is effective for taxable years.

Direct Tax Proposals Budget 2021

House republicans passed a bill to raise the 'salt' deduction cap to $40,000. The “one big, beautiful bill” promises permanent tax cuts —. Here's who would benefit from the change. Key proposals in the house bill would make permanent many provisions of the tcja, restore favorable tax treatment of various business. Republicans are looking to generate savings with new work.

An Overview of Recent Tax Reform Proposals

Key proposals in the house bill would make permanent many provisions of the tcja, restore favorable tax treatment of various business. Since he took office, trump has proposed the largest tax cut in american history. This new limitation is effective for taxable years beginning after december 31, 2025. But democrats warn that millions of americans will lose coverage. House republicans.

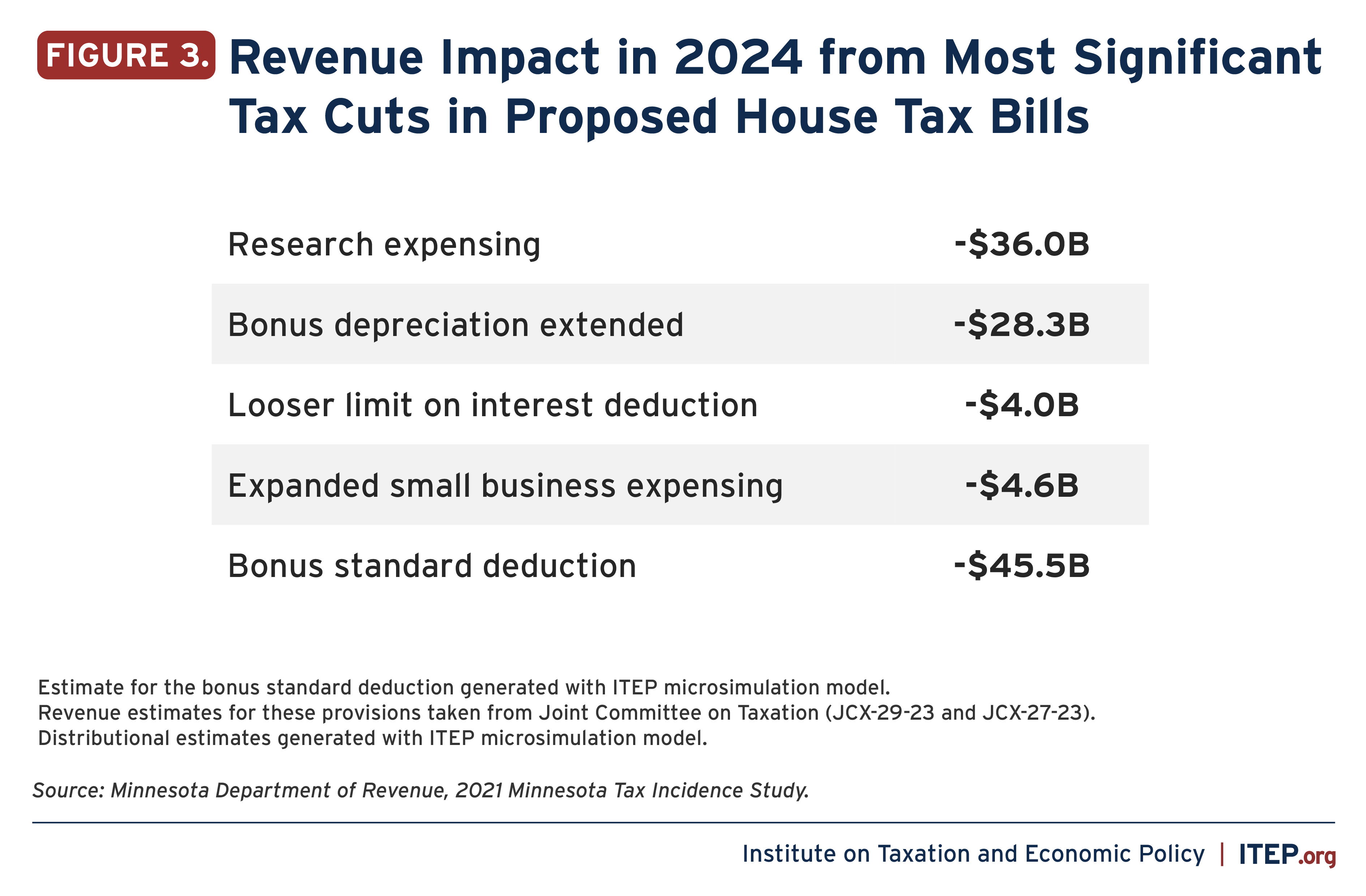

Trio of GOP Tax Bills Would Expand Corporate Tax Breaks While Doing

House republicans passed a bill to raise the 'salt' deduction cap to $40,000. But democrats warn that millions of americans will lose coverage. Here's who would benefit from the change. Since he took office, trump has proposed the largest tax cut in american history. Republicans are looking to generate savings with new work requirements.

Analyzing the New Tax Proposal Plan to Rise Above®

House republicans passed a bill to raise the 'salt' deduction cap to $40,000. This new limitation is effective for taxable years beginning after december 31, 2025. Here's who would benefit from the change. Since he took office, trump has proposed the largest tax cut in american history. But democrats warn that millions of americans will lose coverage.

2021 Tax Changes Biden's Families' & Capital Gains

Key proposals in the house bill would make permanent many provisions of the tcja, restore favorable tax treatment of various business. House republicans passed a bill to raise the 'salt' deduction cap to $40,000. This new limitation is effective for taxable years beginning after december 31, 2025. Republicans are looking to generate savings with new work requirements. But democrats warn.

Key Proposals In The House Bill Would Make Permanent Many Provisions Of The Tcja, Restore Favorable Tax Treatment Of Various Business.

The “one big, beautiful bill” promises permanent tax cuts —. Republicans are looking to generate savings with new work requirements. Here's who would benefit from the change. Since he took office, trump has proposed the largest tax cut in american history.

This New Limitation Is Effective For Taxable Years Beginning After December 31, 2025.

But democrats warn that millions of americans will lose coverage. House republicans passed a bill to raise the 'salt' deduction cap to $40,000.