Tax Warrant Kansas

Tax Warrant Kansas - The kansas department of revenue (kdor) can issue a tax warrant when a taxpayer fails to pay assessed taxes, penalties, or. Find out if you or your business have unresolved tax debts in kansas. (a) whenever a taxpayer liable to pay any tax, penalty or interest assessed pursuant to k.s.a. Learn how to resolve a tax warrant issued by the kansas department of revenue and recorded with the court. If any tax due to the state of. Tax warrants are filed by the kansas department of revenue for recovery of delinquent tax obligations. Learn how to pay, remove your name, or bid on seized items from the tax. Find out the criteria, fees, options and. Learn how to request a payment plan for your tax debt and avoid a tax warrant in kansas. New section 1 of the bill, now k.s.a.

Learn how to request a payment plan for your tax debt and avoid a tax warrant in kansas. If any tax due to the state of. Find out the criteria, fees, options and. Learn how to resolve a tax warrant issued by the kansas department of revenue and recorded with the court. New section 1 of the bill, now k.s.a. Find out if you or your business have unresolved tax debts in kansas. (a) whenever a taxpayer liable to pay any tax, penalty or interest assessed pursuant to k.s.a. Tax warrants are filed by the kansas department of revenue for recovery of delinquent tax obligations. The kansas department of revenue (kdor) can issue a tax warrant when a taxpayer fails to pay assessed taxes, penalties, or. Learn how to pay, remove your name, or bid on seized items from the tax.

Learn how to pay, remove your name, or bid on seized items from the tax. (a) whenever a taxpayer liable to pay any tax, penalty or interest assessed pursuant to k.s.a. New section 1 of the bill, now k.s.a. Learn how to request a payment plan for your tax debt and avoid a tax warrant in kansas. Learn how to resolve a tax warrant issued by the kansas department of revenue and recorded with the court. Tax warrants are filed by the kansas department of revenue for recovery of delinquent tax obligations. If any tax due to the state of. Find out if you or your business have unresolved tax debts in kansas. The kansas department of revenue (kdor) can issue a tax warrant when a taxpayer fails to pay assessed taxes, penalties, or. Find out the criteria, fees, options and.

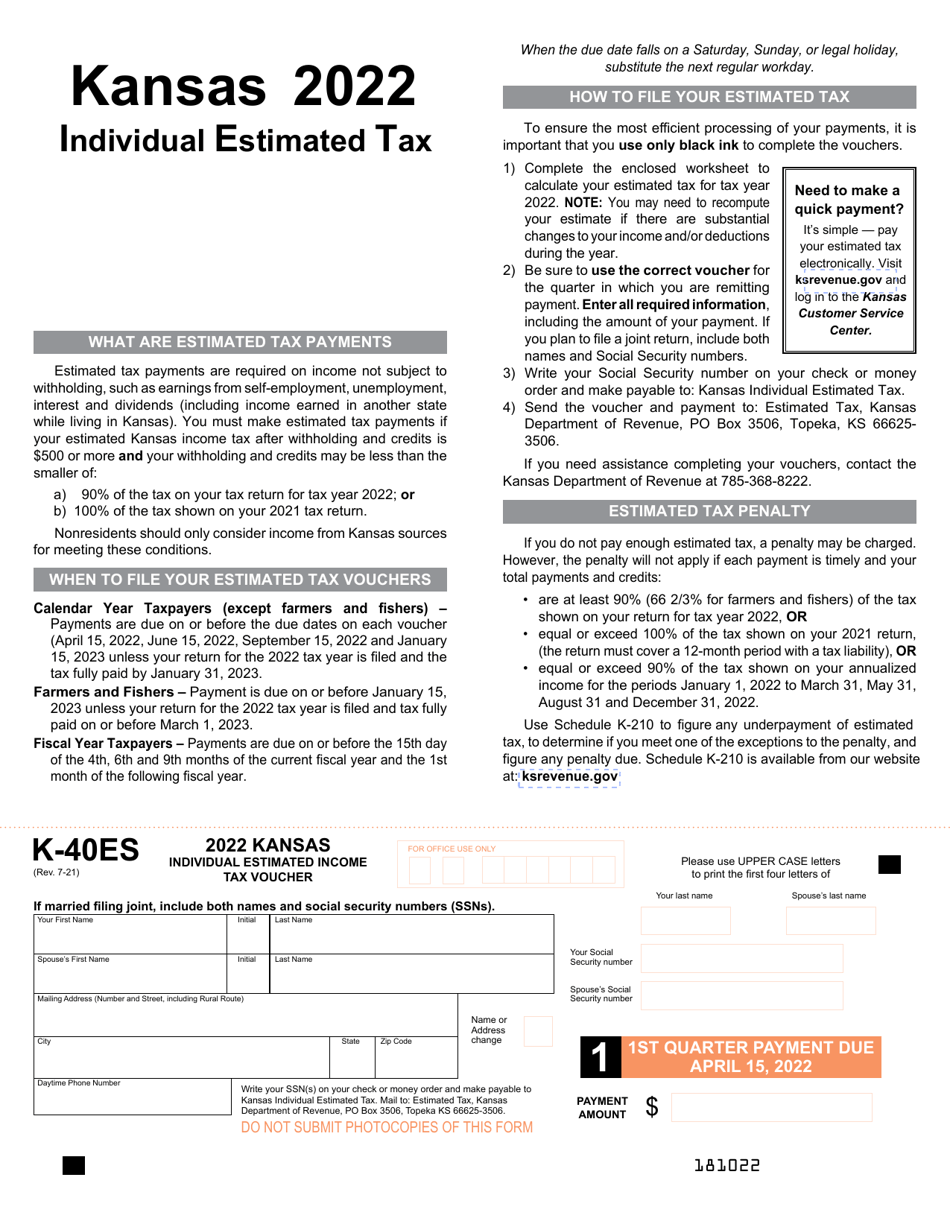

Form K40ES Download Fillable PDF or Fill Online Kansas Individual

If any tax due to the state of. Learn how to pay, remove your name, or bid on seized items from the tax. Tax warrants are filed by the kansas department of revenue for recovery of delinquent tax obligations. The kansas department of revenue (kdor) can issue a tax warrant when a taxpayer fails to pay assessed taxes, penalties, or..

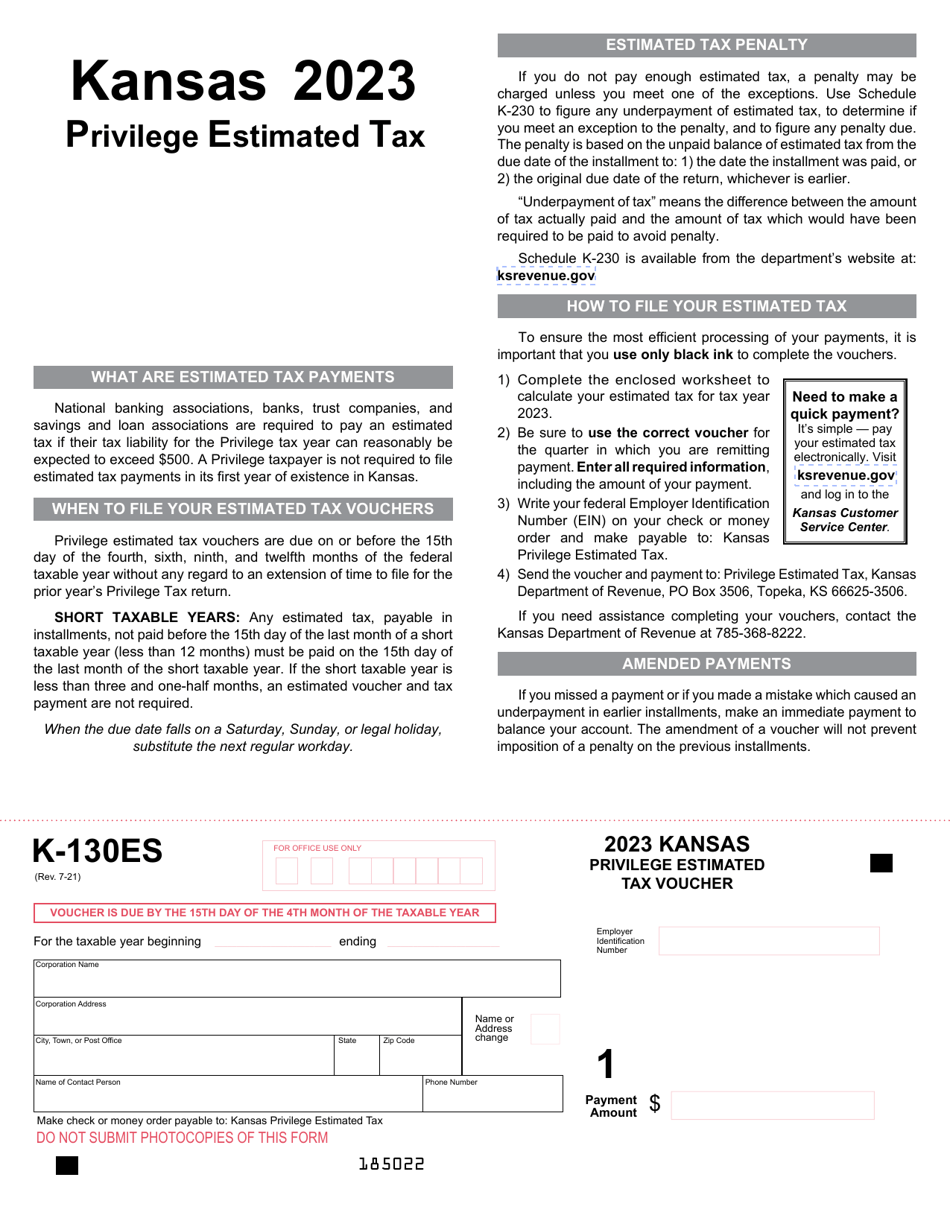

Form K130ES 2023 Fill Out, Sign Online and Download Fillable PDF

Learn how to resolve a tax warrant issued by the kansas department of revenue and recorded with the court. Find out if you or your business have unresolved tax debts in kansas. Learn how to request a payment plan for your tax debt and avoid a tax warrant in kansas. New section 1 of the bill, now k.s.a. (a) whenever.

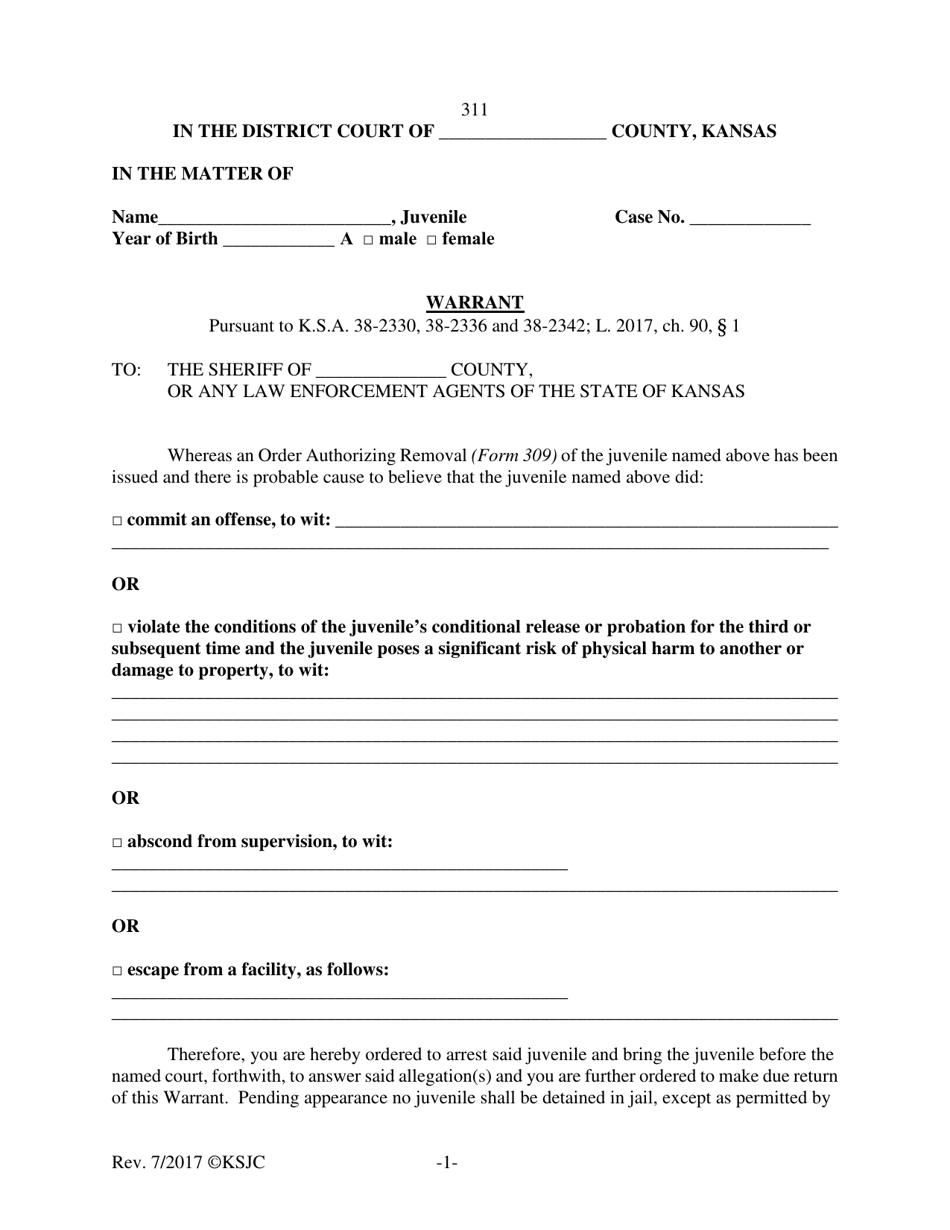

Form 311 Fill Out, Sign Online and Download Printable PDF, Kansas

Learn how to resolve a tax warrant issued by the kansas department of revenue and recorded with the court. Find out if you or your business have unresolved tax debts in kansas. Find out the criteria, fees, options and. (a) whenever a taxpayer liable to pay any tax, penalty or interest assessed pursuant to k.s.a. Learn how to request a.

Sharice Davids Campaign Served with Tax Warrant The Sentinel

Learn how to pay, remove your name, or bid on seized items from the tax. Learn how to resolve a tax warrant issued by the kansas department of revenue and recorded with the court. The kansas department of revenue (kdor) can issue a tax warrant when a taxpayer fails to pay assessed taxes, penalties, or. If any tax due to.

Tax Warrants — DeKalb County Sheriff's Office

Learn how to pay, remove your name, or bid on seized items from the tax. Learn how to request a payment plan for your tax debt and avoid a tax warrant in kansas. (a) whenever a taxpayer liable to pay any tax, penalty or interest assessed pursuant to k.s.a. Tax warrants are filed by the kansas department of revenue for.

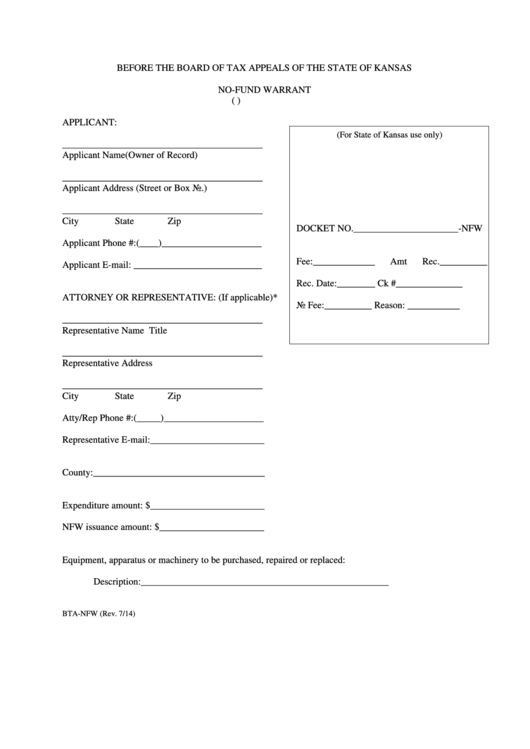

Form CTANFW Download Fillable PDF or Fill Online NoFund Warrant

Find out the criteria, fees, options and. Find out if you or your business have unresolved tax debts in kansas. New section 1 of the bill, now k.s.a. Learn how to pay, remove your name, or bid on seized items from the tax. The kansas department of revenue (kdor) can issue a tax warrant when a taxpayer fails to pay.

Fillable Form Ksa 12110a Before The Board Of Tax Appeals Of The State

Learn how to request a payment plan for your tax debt and avoid a tax warrant in kansas. If any tax due to the state of. Tax warrants are filed by the kansas department of revenue for recovery of delinquent tax obligations. New section 1 of the bill, now k.s.a. (a) whenever a taxpayer liable to pay any tax, penalty.

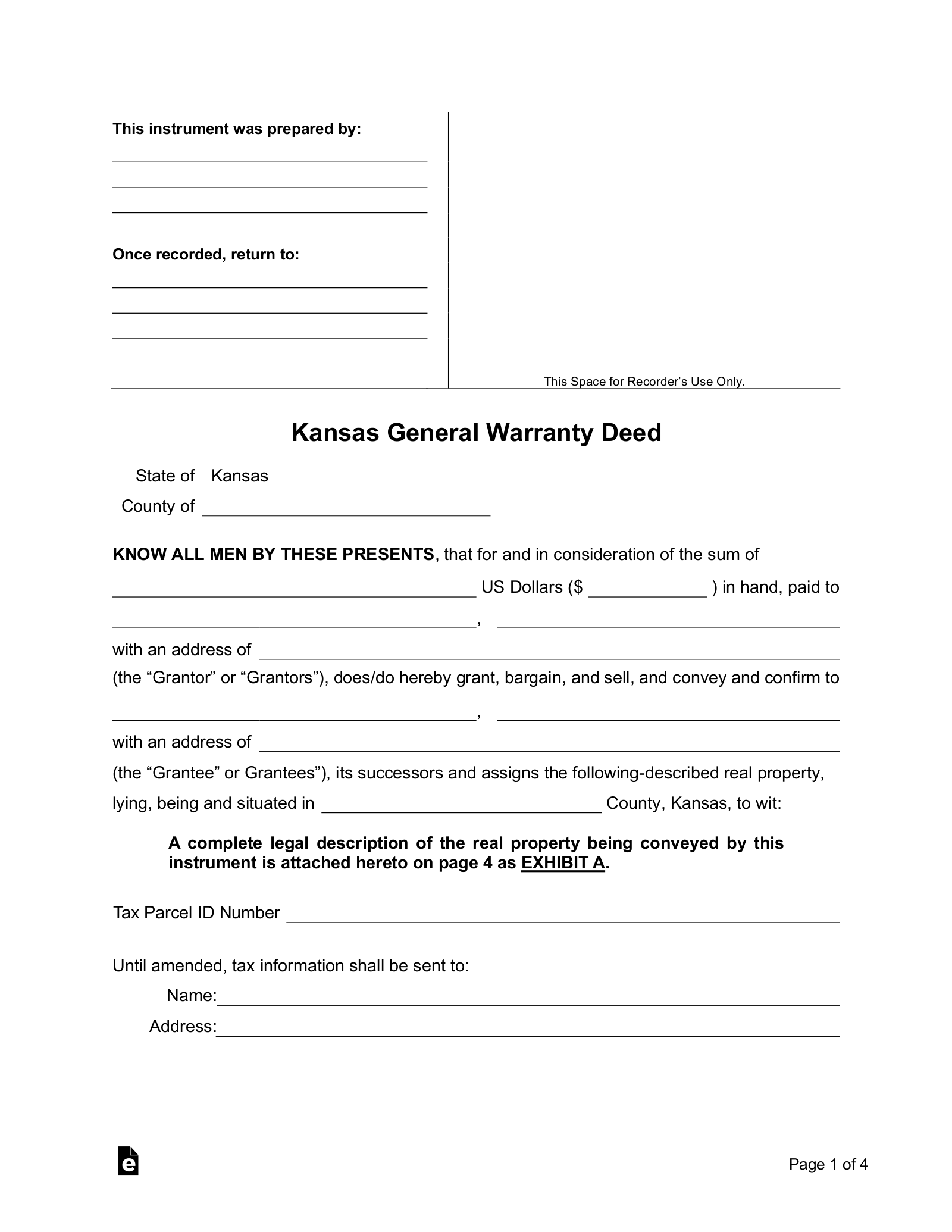

Sample Kansas Warranty Deed Template » Forms 2025

Learn how to pay, remove your name, or bid on seized items from the tax. Find out the criteria, fees, options and. Learn how to request a payment plan for your tax debt and avoid a tax warrant in kansas. If any tax due to the state of. New section 1 of the bill, now k.s.a.

Free Kansas General Warranty Deed Form PDF Word eForms

Find out the criteria, fees, options and. If any tax due to the state of. New section 1 of the bill, now k.s.a. (a) whenever a taxpayer liable to pay any tax, penalty or interest assessed pursuant to k.s.a. Find out if you or your business have unresolved tax debts in kansas.

How To Check For Warrants In Wichita, Kansas? YouTube

Find out the criteria, fees, options and. Learn how to pay, remove your name, or bid on seized items from the tax. Tax warrants are filed by the kansas department of revenue for recovery of delinquent tax obligations. If any tax due to the state of. The kansas department of revenue (kdor) can issue a tax warrant when a taxpayer.

Find Out The Criteria, Fees, Options And.

If any tax due to the state of. The kansas department of revenue (kdor) can issue a tax warrant when a taxpayer fails to pay assessed taxes, penalties, or. Tax warrants are filed by the kansas department of revenue for recovery of delinquent tax obligations. (a) whenever a taxpayer liable to pay any tax, penalty or interest assessed pursuant to k.s.a.

Find Out If You Or Your Business Have Unresolved Tax Debts In Kansas.

New section 1 of the bill, now k.s.a. Learn how to pay, remove your name, or bid on seized items from the tax. Learn how to resolve a tax warrant issued by the kansas department of revenue and recorded with the court. Learn how to request a payment plan for your tax debt and avoid a tax warrant in kansas.