Tax Warrant Wisconsin

Tax Warrant Wisconsin - (1) taxes due and unpaid on june 15 shall be deemed delinquent as of that date, and when delinquent shall be subject to a penalty of 4. Unpaid taxes in wisconsin can lead to serious consequences, including a delinquent tax warrant. The releases, withdrawals, and satisfactions of. What is a tax warrant and when does the wisconsin department of revenue file a tax warrant? This legal action allows the state. Stats., the wisconsin department of revenue, division of income, sales, and excise taxes hereby seeks. Most tax warrants filed since 1997 can be found electronically at wisconsin circuit court access. A tax warrant acts as a lien against real and personal property you own in the county in which it is filed. You may enter search terms in any combination of fields. The warrant is filed with the clerk of.

Stats., the wisconsin department of revenue, division of income, sales, and excise taxes hereby seeks. Unpaid taxes in wisconsin can lead to serious consequences, including a delinquent tax warrant. This legal action allows the state. (1) taxes due and unpaid on june 15 shall be deemed delinquent as of that date, and when delinquent shall be subject to a penalty of 4. A tax warrant acts as a lien against real and personal property you own in the county in which it is filed. All delinquent debt is subject to having. The warrant is filed with the clerk of. You may enter search terms in any combination of fields. What is a tax warrant and when does the wisconsin department of revenue file a tax warrant? Most tax warrants filed since 1997 can be found electronically at wisconsin circuit court access.

Unpaid taxes in wisconsin can lead to serious consequences, including a delinquent tax warrant. What is a tax warrant and when does the wisconsin department of revenue file a tax warrant? You may enter search terms in any combination of fields. A tax warrant acts as a lien against real and personal property you own in the county in which it is filed. The releases, withdrawals, and satisfactions of. Most tax warrants filed since 1997 can be found electronically at wisconsin circuit court access. Stats., the wisconsin department of revenue, division of income, sales, and excise taxes hereby seeks. This legal action allows the state. All delinquent debt is subject to having. The warrant is filed with the clerk of.

How to Identify a Valid Judicial Warrant ACLU of Wisconsin

(1) taxes due and unpaid on june 15 shall be deemed delinquent as of that date, and when delinquent shall be subject to a penalty of 4. Unpaid taxes in wisconsin can lead to serious consequences, including a delinquent tax warrant. Stats., the wisconsin department of revenue, division of income, sales, and excise taxes hereby seeks. This legal action allows.

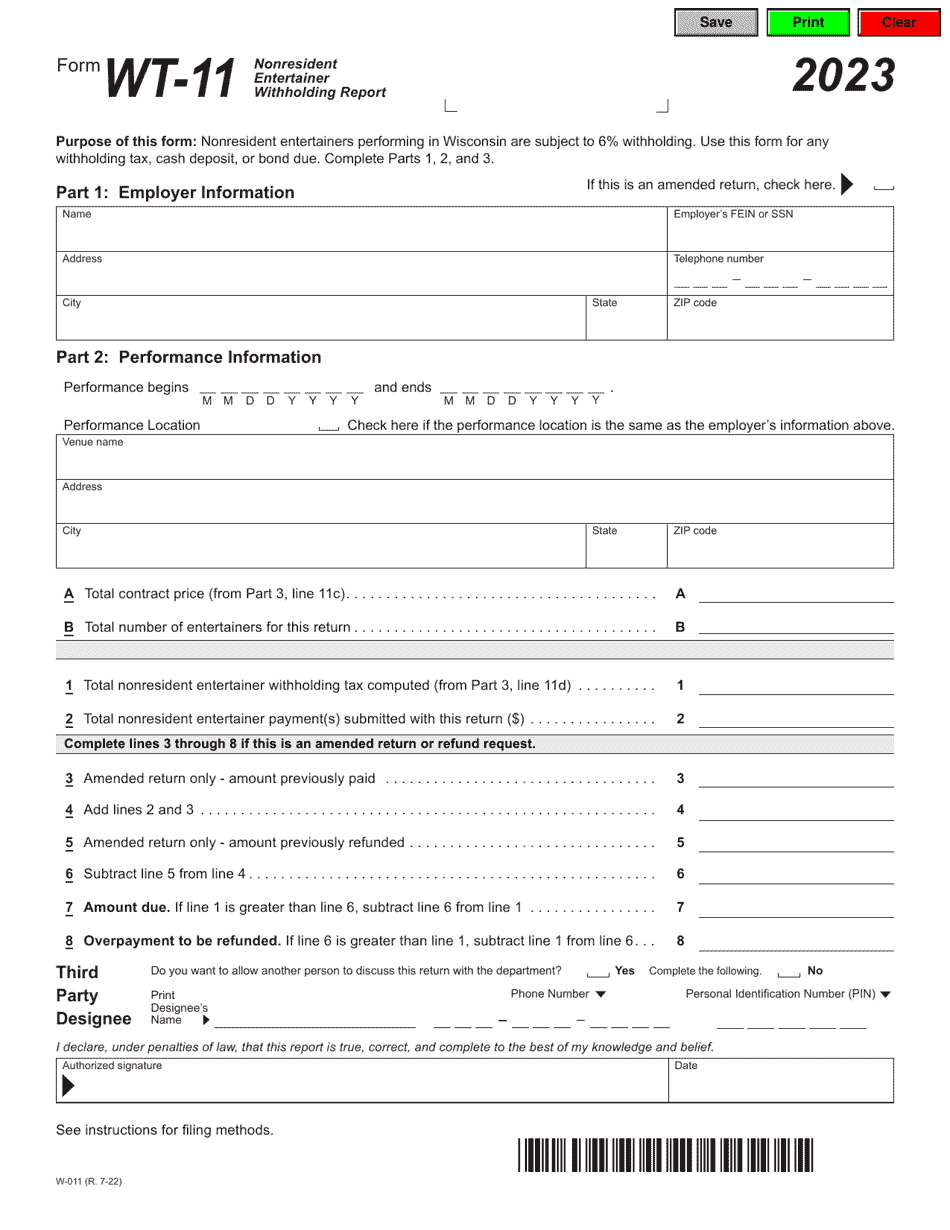

Form WT11 (W011) Download Fillable PDF or Fill Online Nonresident

The warrant is filed with the clerk of. (1) taxes due and unpaid on june 15 shall be deemed delinquent as of that date, and when delinquent shall be subject to a penalty of 4. Stats., the wisconsin department of revenue, division of income, sales, and excise taxes hereby seeks. A tax warrant acts as a lien against real and.

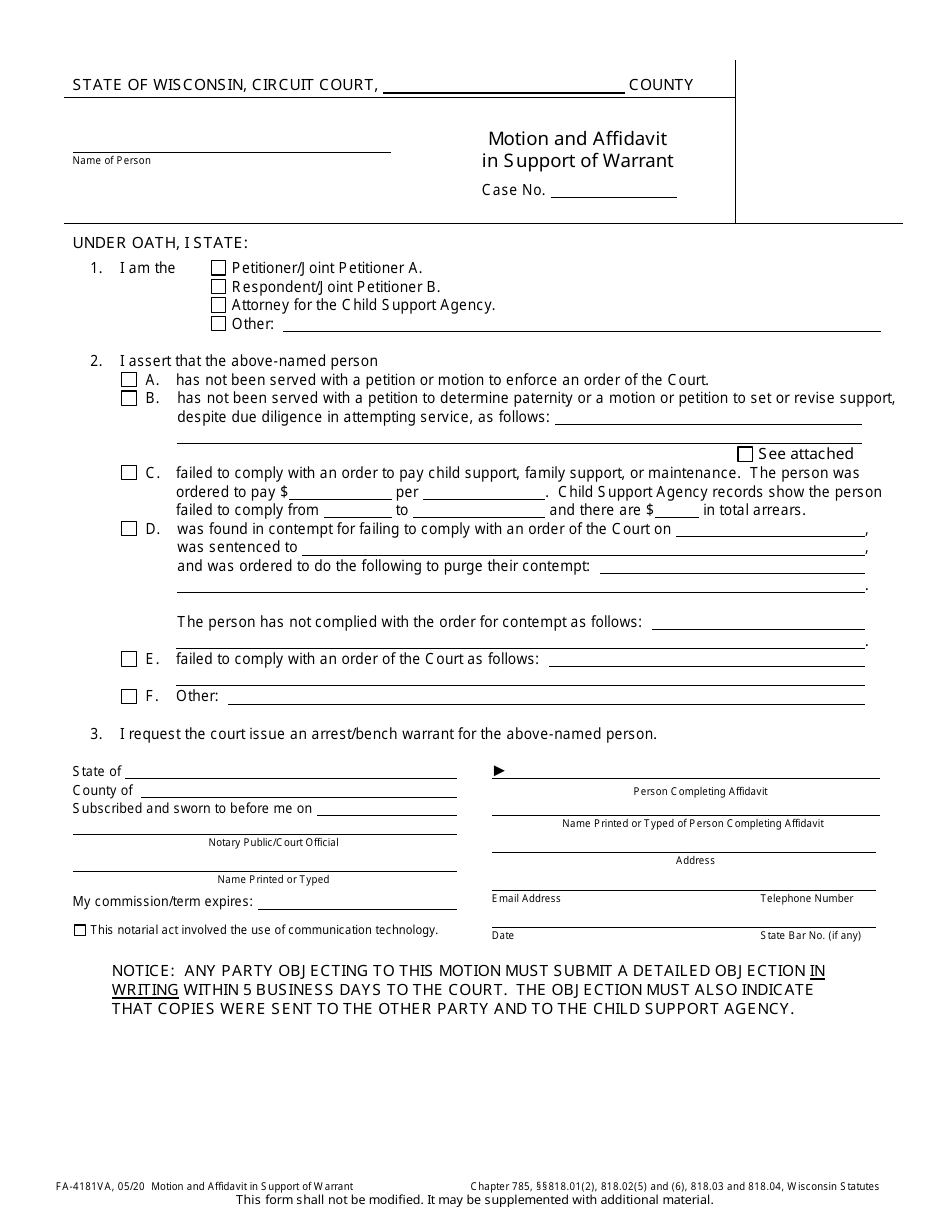

Form FA4181VA Fill Out, Sign Online and Download Printable PDF

Stats., the wisconsin department of revenue, division of income, sales, and excise taxes hereby seeks. What is a tax warrant and when does the wisconsin department of revenue file a tax warrant? The releases, withdrawals, and satisfactions of. (1) taxes due and unpaid on june 15 shall be deemed delinquent as of that date, and when delinquent shall be subject.

Fake tax letter sent to Winnebago County residents, officials warn

Unpaid taxes in wisconsin can lead to serious consequences, including a delinquent tax warrant. Most tax warrants filed since 1997 can be found electronically at wisconsin circuit court access. What is a tax warrant and when does the wisconsin department of revenue file a tax warrant? (1) taxes due and unpaid on june 15 shall be deemed delinquent as of.

Wisconsin Tax Warrants Guide for Taxpayers

The warrant is filed with the clerk of. A tax warrant acts as a lien against real and personal property you own in the county in which it is filed. All delinquent debt is subject to having. Most tax warrants filed since 1997 can be found electronically at wisconsin circuit court access. The releases, withdrawals, and satisfactions of.

Former Hooters in Wichita Falls served tax warrant

This legal action allows the state. (1) taxes due and unpaid on june 15 shall be deemed delinquent as of that date, and when delinquent shall be subject to a penalty of 4. You may enter search terms in any combination of fields. Most tax warrants filed since 1997 can be found electronically at wisconsin circuit court access. The warrant.

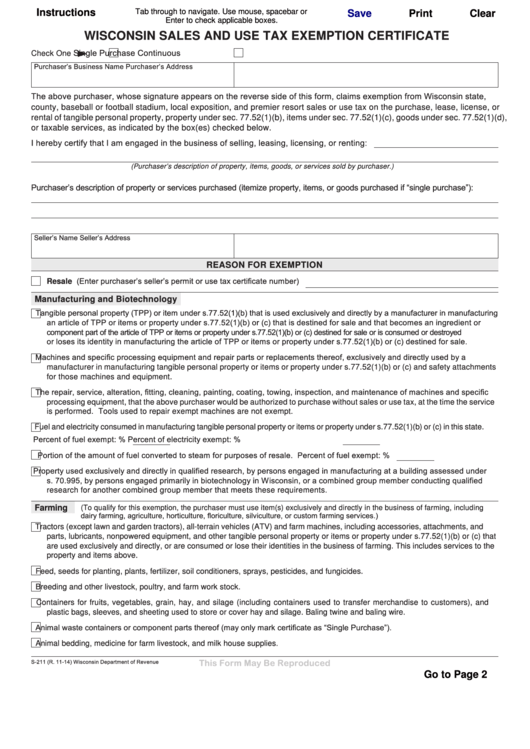

Fillable Wisconsin Sales And Use Tax Exemption Printable Pdf Download

What is a tax warrant and when does the wisconsin department of revenue file a tax warrant? The releases, withdrawals, and satisfactions of. Stats., the wisconsin department of revenue, division of income, sales, and excise taxes hereby seeks. All delinquent debt is subject to having. Most tax warrants filed since 1997 can be found electronically at wisconsin circuit court access.

A Guide to Understanding Property Taxes in Wisconsin Families, New

The releases, withdrawals, and satisfactions of. Most tax warrants filed since 1997 can be found electronically at wisconsin circuit court access. All delinquent debt is subject to having. (1) taxes due and unpaid on june 15 shall be deemed delinquent as of that date, and when delinquent shall be subject to a penalty of 4. A tax warrant acts as.

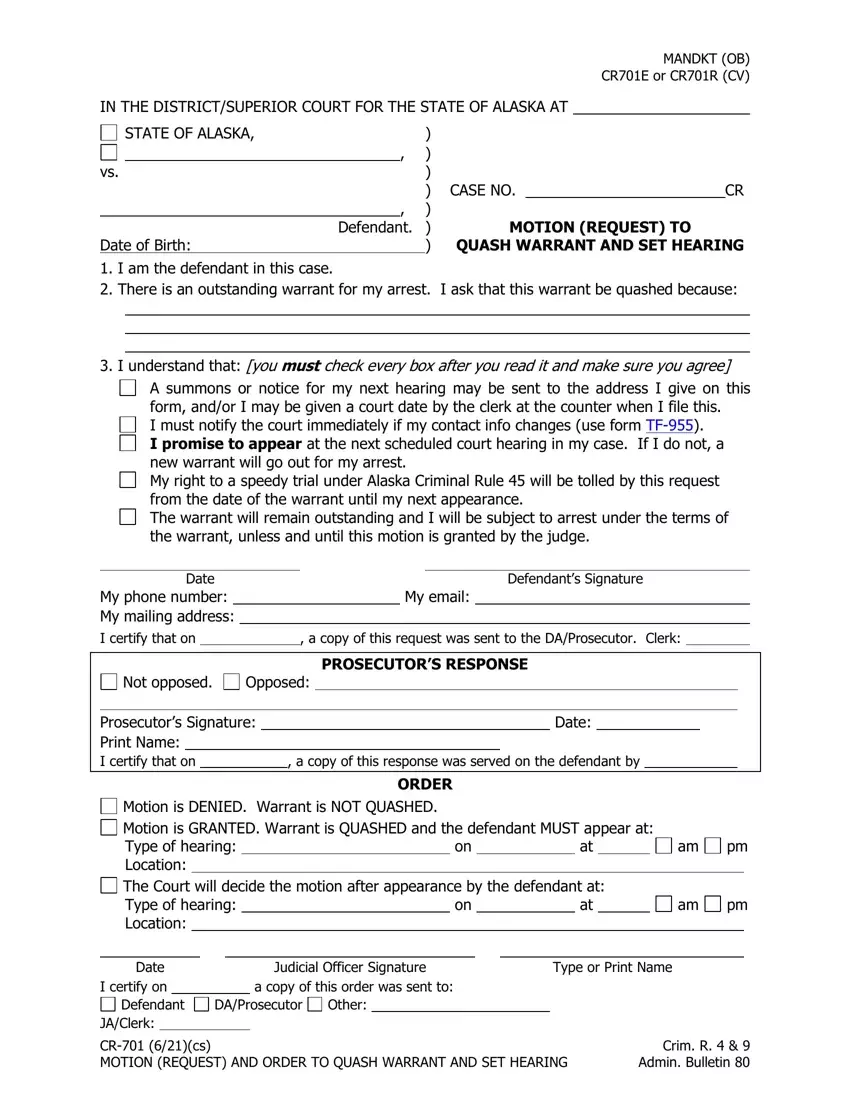

Wisconsin Warrant Template Fill Out And Sign Printabl vrogue.co

(1) taxes due and unpaid on june 15 shall be deemed delinquent as of that date, and when delinquent shall be subject to a penalty of 4. Most tax warrants filed since 1997 can be found electronically at wisconsin circuit court access. What is a tax warrant and when does the wisconsin department of revenue file a tax warrant? All.

Tax Warrants — DeKalb County Sheriff's Office

All delinquent debt is subject to having. The warrant is filed with the clerk of. This legal action allows the state. A tax warrant acts as a lien against real and personal property you own in the county in which it is filed. Stats., the wisconsin department of revenue, division of income, sales, and excise taxes hereby seeks.

The Warrant Is Filed With The Clerk Of.

A tax warrant acts as a lien against real and personal property you own in the county in which it is filed. Most tax warrants filed since 1997 can be found electronically at wisconsin circuit court access. This legal action allows the state. The releases, withdrawals, and satisfactions of.

(1) Taxes Due And Unpaid On June 15 Shall Be Deemed Delinquent As Of That Date, And When Delinquent Shall Be Subject To A Penalty Of 4.

You may enter search terms in any combination of fields. Unpaid taxes in wisconsin can lead to serious consequences, including a delinquent tax warrant. What is a tax warrant and when does the wisconsin department of revenue file a tax warrant? All delinquent debt is subject to having.