Trade Receivables Balance Sheet

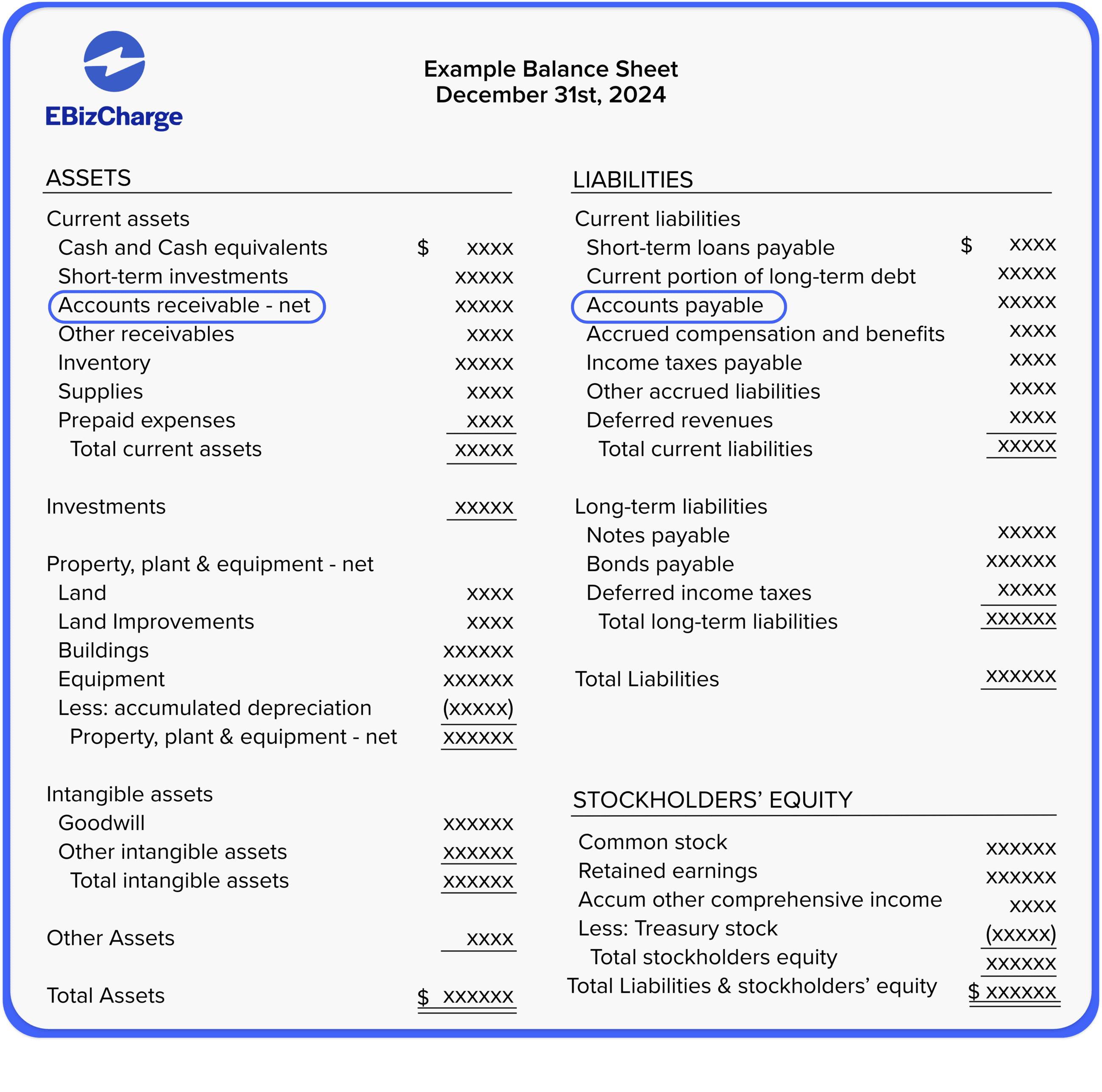

Trade Receivables Balance Sheet - Trade receivables arise due to credit sales. Trade receivables consist of debtors and bills receivables. These amounts are expected to be settled in. Trade receivable is the amount the company has billed to its customer for selling its goods or supplying the services for which the amount has not been paid yet by the customers and is. Trade receivables can be found on a company’s balance sheet under. They are treated as an asset to the company and can be found on the balance. Trade and other receivables are categorized or classified as current assets on the company’s balance sheet at the specific reporting period. Yes, it is an asset because the trade receivables’ amount is expected to be fully paid off within one year. In the general ledger, trade receivables are recorded in a separate accounts receivable account, and are classified as current assets on the balance sheet if you expect to.

Trade receivables arise due to credit sales. Yes, it is an asset because the trade receivables’ amount is expected to be fully paid off within one year. Trade receivable is the amount the company has billed to its customer for selling its goods or supplying the services for which the amount has not been paid yet by the customers and is. They are treated as an asset to the company and can be found on the balance. These amounts are expected to be settled in. Trade and other receivables are categorized or classified as current assets on the company’s balance sheet at the specific reporting period. In the general ledger, trade receivables are recorded in a separate accounts receivable account, and are classified as current assets on the balance sheet if you expect to. Trade receivables consist of debtors and bills receivables. Trade receivables can be found on a company’s balance sheet under.

Trade receivable is the amount the company has billed to its customer for selling its goods or supplying the services for which the amount has not been paid yet by the customers and is. Trade and other receivables are categorized or classified as current assets on the company’s balance sheet at the specific reporting period. Trade receivables can be found on a company’s balance sheet under. Trade receivables consist of debtors and bills receivables. In the general ledger, trade receivables are recorded in a separate accounts receivable account, and are classified as current assets on the balance sheet if you expect to. Yes, it is an asset because the trade receivables’ amount is expected to be fully paid off within one year. They are treated as an asset to the company and can be found on the balance. These amounts are expected to be settled in. Trade receivables arise due to credit sales.

What is Accounts Receivables Examples, Process & Importance Tally

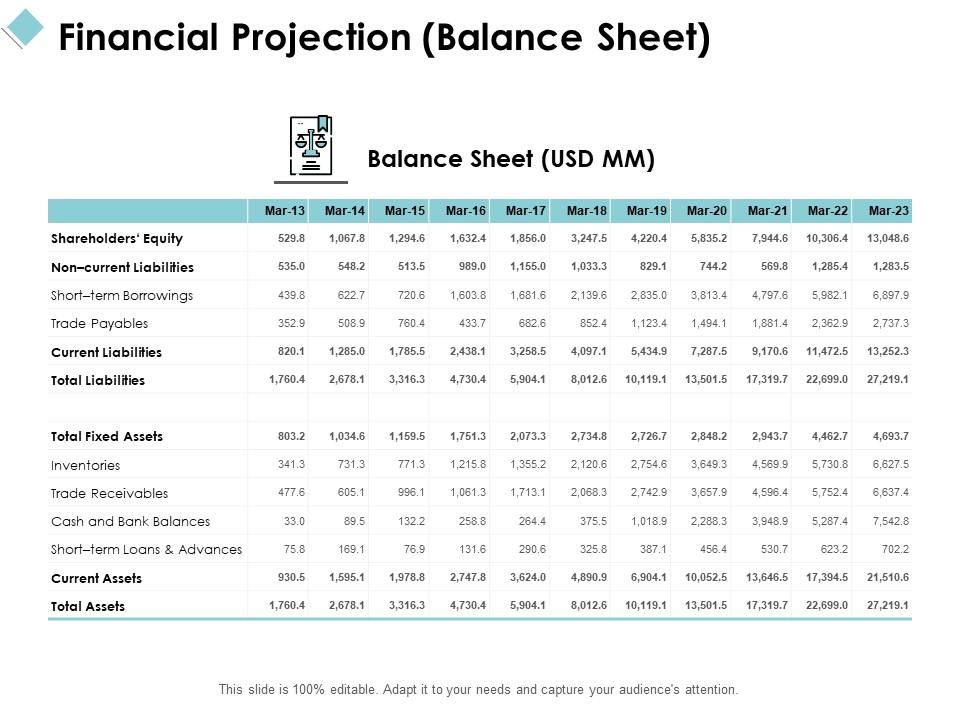

Trade and other receivables are categorized or classified as current assets on the company’s balance sheet at the specific reporting period. Trade receivable is the amount the company has billed to its customer for selling its goods or supplying the services for which the amount has not been paid yet by the customers and is. They are treated as an.

What is accounts receivable? Definition and examples

They are treated as an asset to the company and can be found on the balance. Trade receivables arise due to credit sales. Trade and other receivables are categorized or classified as current assets on the company’s balance sheet at the specific reporting period. Trade receivable is the amount the company has billed to its customer for selling its goods.

What are Accounts Receivable and Accounts Payable?

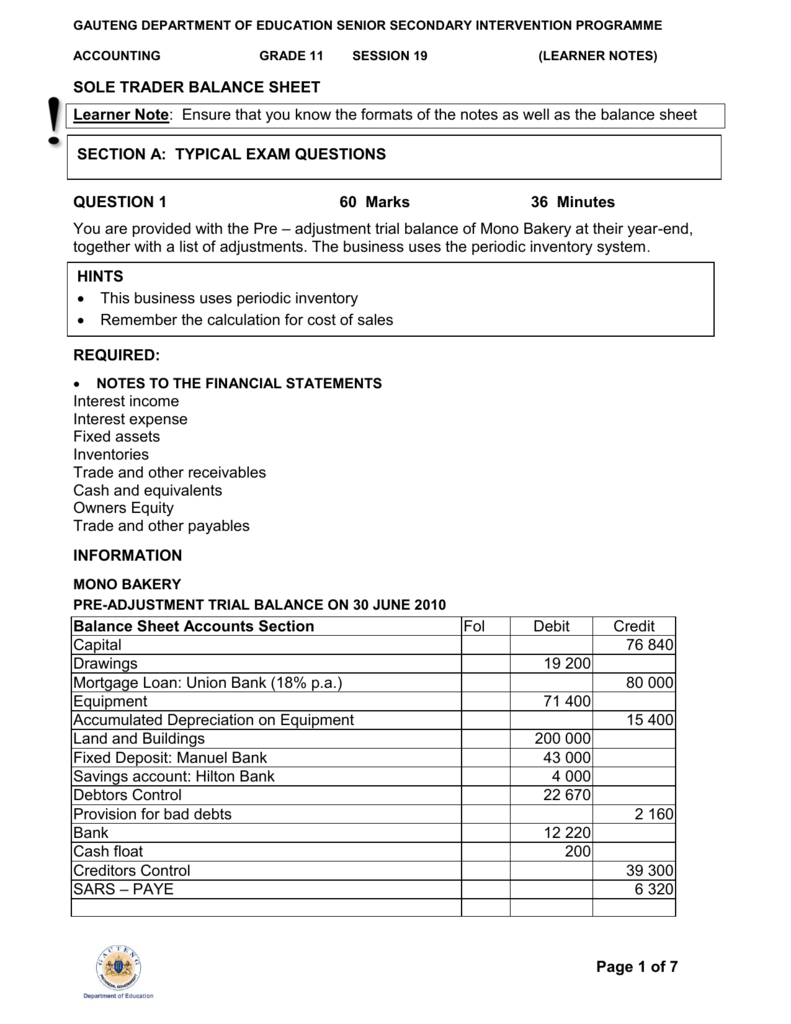

Trade receivables consist of debtors and bills receivables. Trade receivables arise due to credit sales. These amounts are expected to be settled in. In the general ledger, trade receivables are recorded in a separate accounts receivable account, and are classified as current assets on the balance sheet if you expect to. Trade receivables can be found on a company’s balance.

Financial Projection Balance Sheet Trade Receivables Ppt Powerpoint

They are treated as an asset to the company and can be found on the balance. Trade and other receivables are categorized or classified as current assets on the company’s balance sheet at the specific reporting period. In the general ledger, trade receivables are recorded in a separate accounts receivable account, and are classified as current assets on the balance.

Create a Balance Sheet Format for Trading Company in Excel

Trade receivable is the amount the company has billed to its customer for selling its goods or supplying the services for which the amount has not been paid yet by the customers and is. Trade receivables consist of debtors and bills receivables. Trade and other receivables are categorized or classified as current assets on the company’s balance sheet at the.

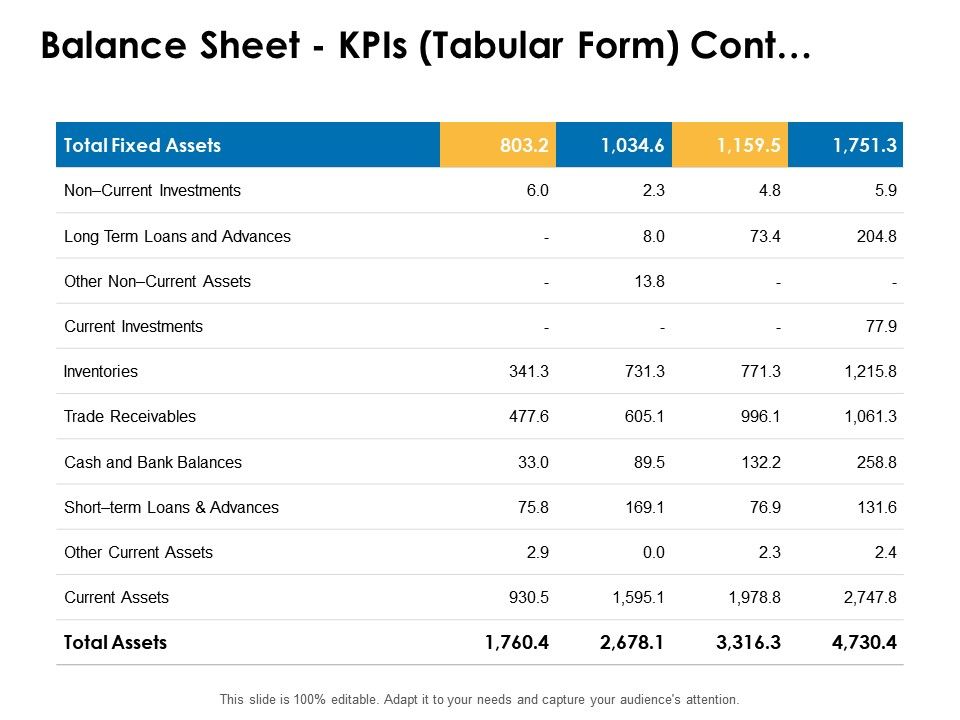

Best Practices Trade Receivables Company Comparative Balance Sheets

Yes, it is an asset because the trade receivables’ amount is expected to be fully paid off within one year. Trade receivable is the amount the company has billed to its customer for selling its goods or supplying the services for which the amount has not been paid yet by the customers and is. Trade receivables arise due to credit.

Page 1 of 7 SOLE TRADER BALANCE SHEET Learner Note

Trade receivables arise due to credit sales. Yes, it is an asset because the trade receivables’ amount is expected to be fully paid off within one year. They are treated as an asset to the company and can be found on the balance. Trade receivables consist of debtors and bills receivables. Trade receivables can be found on a company’s balance.

38 Free Balance Sheet Templates & Examples ᐅ TemplateLab

Trade receivable is the amount the company has billed to its customer for selling its goods or supplying the services for which the amount has not been paid yet by the customers and is. Trade receivables can be found on a company’s balance sheet under. They are treated as an asset to the company and can be found on the.

Balance Sheet Kpis Tabular Form Cont Trade Receivables Ppt Powerpoint

Trade receivable is the amount the company has billed to its customer for selling its goods or supplying the services for which the amount has not been paid yet by the customers and is. Yes, it is an asset because the trade receivables’ amount is expected to be fully paid off within one year. In the general ledger, trade receivables.

Great Trade Receivables In Financial Statements From Passthrough

These amounts are expected to be settled in. Trade receivable is the amount the company has billed to its customer for selling its goods or supplying the services for which the amount has not been paid yet by the customers and is. Trade receivables consist of debtors and bills receivables. Trade receivables can be found on a company’s balance sheet.

Trade And Other Receivables Are Categorized Or Classified As Current Assets On The Company’s Balance Sheet At The Specific Reporting Period.

They are treated as an asset to the company and can be found on the balance. Trade receivables can be found on a company’s balance sheet under. In the general ledger, trade receivables are recorded in a separate accounts receivable account, and are classified as current assets on the balance sheet if you expect to. Yes, it is an asset because the trade receivables’ amount is expected to be fully paid off within one year.

Trade Receivables Arise Due To Credit Sales.

Trade receivables consist of debtors and bills receivables. Trade receivable is the amount the company has billed to its customer for selling its goods or supplying the services for which the amount has not been paid yet by the customers and is. These amounts are expected to be settled in.