Truist Funds Availability Delay

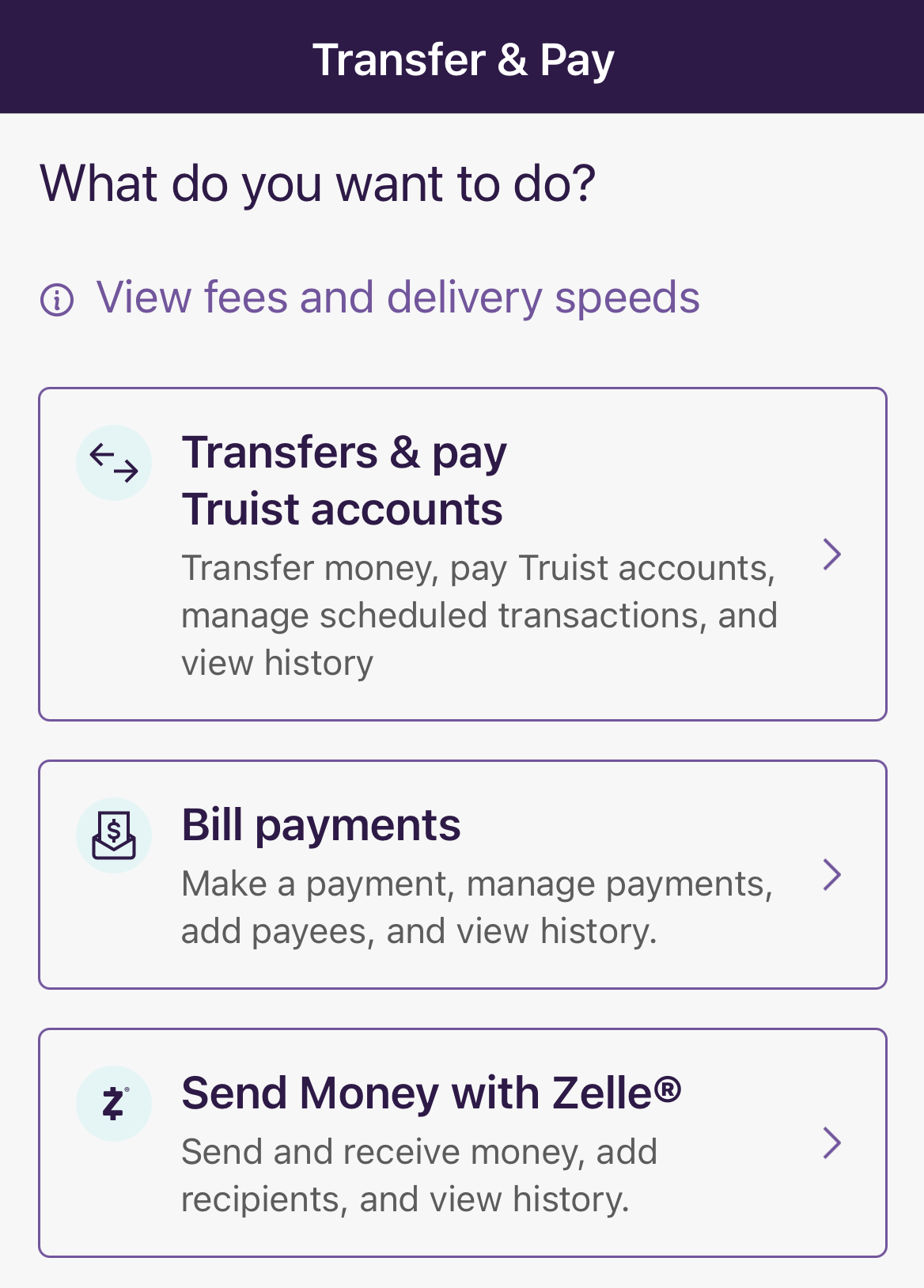

Truist Funds Availability Delay - Are dealing with deposit delays because of an error with a banking processing system on. While the next business day is the standard, truist (like all banks) can place holds on deposits, which will delay when those funds become. Many bank customers across the u.s. I deposited a check for 1000.00 and. For most check deposits made in person, the funds will typically be available the next business day after the. Standard availability (no fee) is generally available the next business day after the deposit is received. I regularly write checks to transfer money from my money market account to my truist checking account. Remember that truist may place holds on deposits, especially for larger checks or deposits from new customers.

While the next business day is the standard, truist (like all banks) can place holds on deposits, which will delay when those funds become. For most check deposits made in person, the funds will typically be available the next business day after the. I regularly write checks to transfer money from my money market account to my truist checking account. Are dealing with deposit delays because of an error with a banking processing system on. I deposited a check for 1000.00 and. Remember that truist may place holds on deposits, especially for larger checks or deposits from new customers. Many bank customers across the u.s. Standard availability (no fee) is generally available the next business day after the deposit is received.

I regularly write checks to transfer money from my money market account to my truist checking account. For most check deposits made in person, the funds will typically be available the next business day after the. While the next business day is the standard, truist (like all banks) can place holds on deposits, which will delay when those funds become. I deposited a check for 1000.00 and. Are dealing with deposit delays because of an error with a banking processing system on. Remember that truist may place holds on deposits, especially for larger checks or deposits from new customers. Many bank customers across the u.s. Standard availability (no fee) is generally available the next business day after the deposit is received.

How To Verify External Account on Truist Bank (EASY!) YouTube

Are dealing with deposit delays because of an error with a banking processing system on. Many bank customers across the u.s. Standard availability (no fee) is generally available the next business day after the deposit is received. I deposited a check for 1000.00 and. While the next business day is the standard, truist (like all banks) can place holds on.

Truist Savings Account Interest Rates Of 2025 Forbes Advisor

Standard availability (no fee) is generally available the next business day after the deposit is received. Many bank customers across the u.s. Are dealing with deposit delays because of an error with a banking processing system on. While the next business day is the standard, truist (like all banks) can place holds on deposits, which will delay when those funds.

Understanding the Cost of Delayed Investments Net Brokers

While the next business day is the standard, truist (like all banks) can place holds on deposits, which will delay when those funds become. I deposited a check for 1000.00 and. I regularly write checks to transfer money from my money market account to my truist checking account. Remember that truist may place holds on deposits, especially for larger checks.

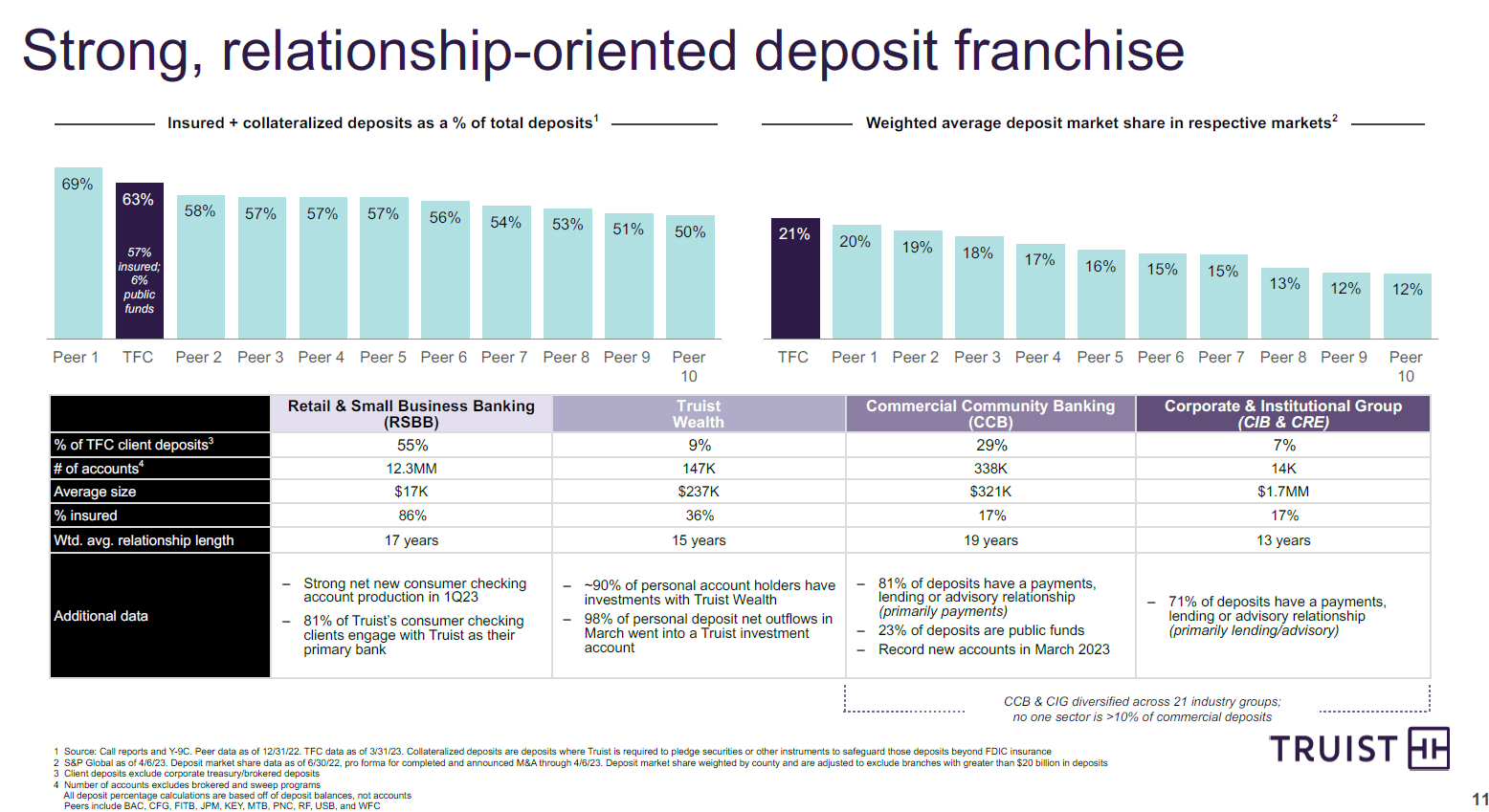

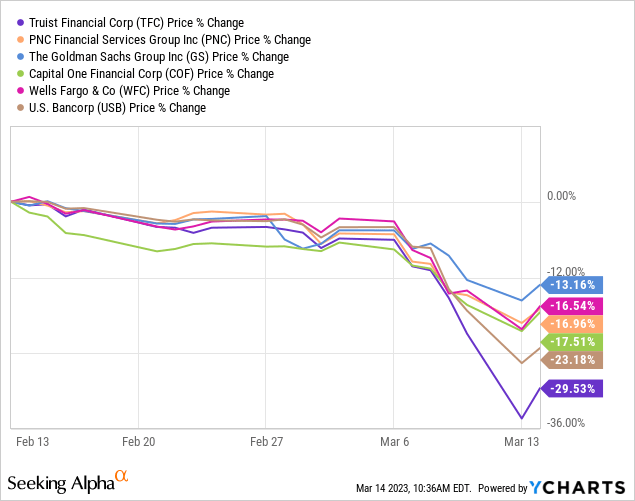

Truist Stock Priced For Disaster, Set For Recovery (NYSETFC

Many bank customers across the u.s. For most check deposits made in person, the funds will typically be available the next business day after the. Remember that truist may place holds on deposits, especially for larger checks or deposits from new customers. Standard availability (no fee) is generally available the next business day after the deposit is received. I deposited.

Truist Closing Branches 2025 Basia Carmina

Remember that truist may place holds on deposits, especially for larger checks or deposits from new customers. I deposited a check for 1000.00 and. For most check deposits made in person, the funds will typically be available the next business day after the. While the next business day is the standard, truist (like all banks) can place holds on deposits,.

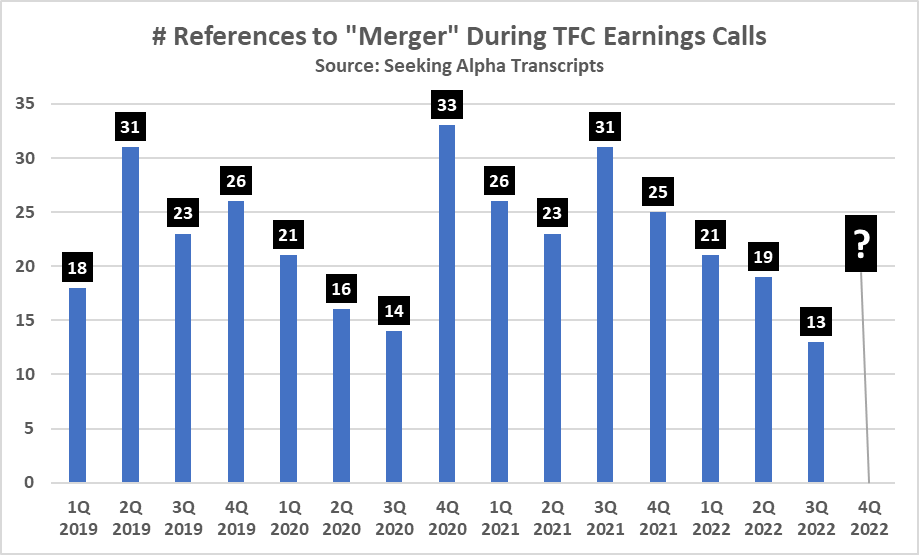

Truist The Problem And Opportunity In One Word (NYSETFC) Seeking Alpha

Standard availability (no fee) is generally available the next business day after the deposit is received. For most check deposits made in person, the funds will typically be available the next business day after the. Remember that truist may place holds on deposits, especially for larger checks or deposits from new customers. I regularly write checks to transfer money from.

Truist Bank Review How Do They Compare? Best Wallet Hacks

Remember that truist may place holds on deposits, especially for larger checks or deposits from new customers. I regularly write checks to transfer money from my money market account to my truist checking account. Many bank customers across the u.s. Are dealing with deposit delays because of an error with a banking processing system on. For most check deposits made.

Truist loses 600M wealth management team to RBC Triangle Business

While the next business day is the standard, truist (like all banks) can place holds on deposits, which will delay when those funds become. Standard availability (no fee) is generally available the next business day after the deposit is received. I deposited a check for 1000.00 and. For most check deposits made in person, the funds will typically be available.

Truist Bank vs. M&T Bank Which Bank Account Is Better?

Standard availability (no fee) is generally available the next business day after the deposit is received. I regularly write checks to transfer money from my money market account to my truist checking account. Many bank customers across the u.s. I deposited a check for 1000.00 and. Are dealing with deposit delays because of an error with a banking processing system.

Truist Immense Unrealized Bond Losses Threaten Core Equity … Seeking

Are dealing with deposit delays because of an error with a banking processing system on. I regularly write checks to transfer money from my money market account to my truist checking account. Standard availability (no fee) is generally available the next business day after the deposit is received. I deposited a check for 1000.00 and. While the next business day.

Are Dealing With Deposit Delays Because Of An Error With A Banking Processing System On.

I regularly write checks to transfer money from my money market account to my truist checking account. Remember that truist may place holds on deposits, especially for larger checks or deposits from new customers. For most check deposits made in person, the funds will typically be available the next business day after the. Standard availability (no fee) is generally available the next business day after the deposit is received.

Many Bank Customers Across The U.s.

While the next business day is the standard, truist (like all banks) can place holds on deposits, which will delay when those funds become. I deposited a check for 1000.00 and.