Unused Line Of Credit On Balance Sheet

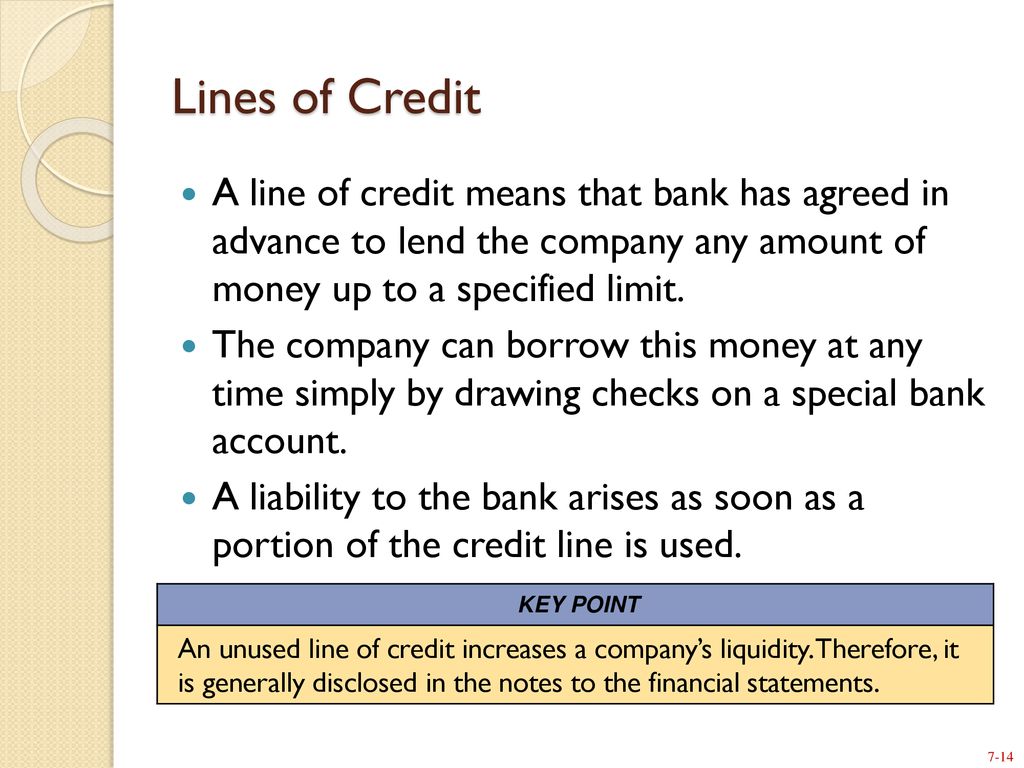

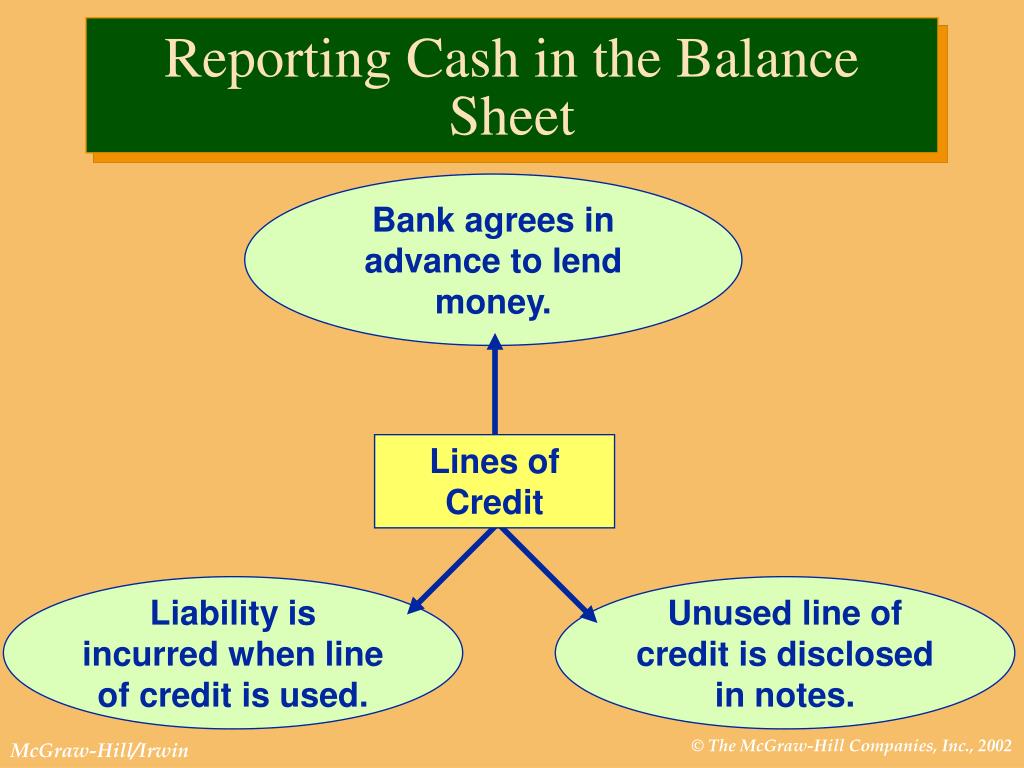

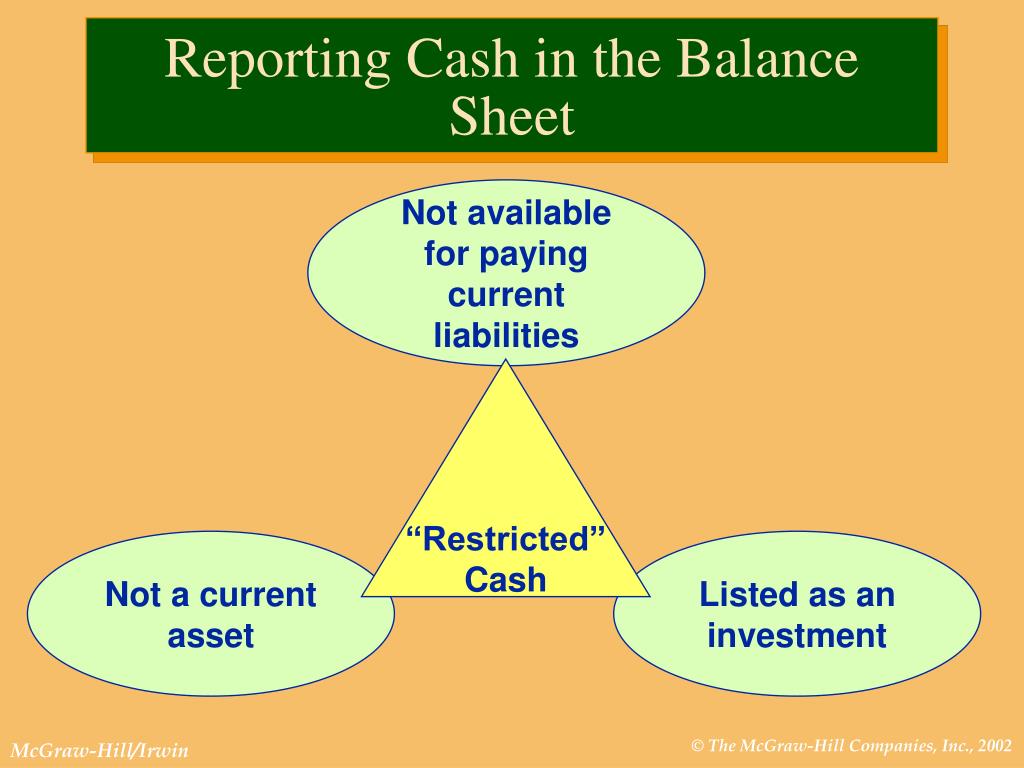

Unused Line Of Credit On Balance Sheet - This means that a reporting entity may have paid the fee to provide access to the revolving line of credit but may not have a liability on its books. If the line of credit has not yet been used, it is unnecessary to record entries on your general ledger. You do not need to reflect an. Open lines of credit do not need. Classify the outstanding borrowings as noncurrent only if it is reasonable to expect that the specified criteria will be met over the 12 months. Unused credit lines are noted in the footnotes of accounting documents to improve the perceived financial health of the company. If you have not yet used your line of credit, no journal entry is necessary to your accounting ledger.

Open lines of credit do not need. Unused credit lines are noted in the footnotes of accounting documents to improve the perceived financial health of the company. This means that a reporting entity may have paid the fee to provide access to the revolving line of credit but may not have a liability on its books. If you have not yet used your line of credit, no journal entry is necessary to your accounting ledger. Classify the outstanding borrowings as noncurrent only if it is reasonable to expect that the specified criteria will be met over the 12 months. If the line of credit has not yet been used, it is unnecessary to record entries on your general ledger. You do not need to reflect an.

Open lines of credit do not need. Classify the outstanding borrowings as noncurrent only if it is reasonable to expect that the specified criteria will be met over the 12 months. Unused credit lines are noted in the footnotes of accounting documents to improve the perceived financial health of the company. You do not need to reflect an. If you have not yet used your line of credit, no journal entry is necessary to your accounting ledger. If the line of credit has not yet been used, it is unnecessary to record entries on your general ledger. This means that a reporting entity may have paid the fee to provide access to the revolving line of credit but may not have a liability on its books.

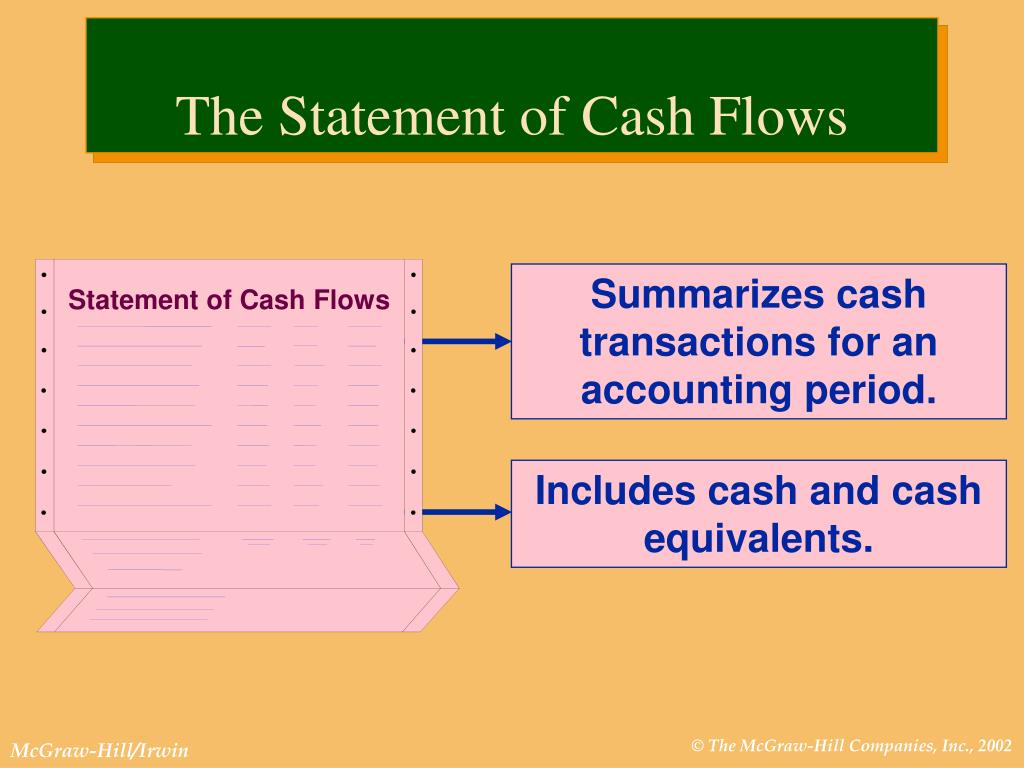

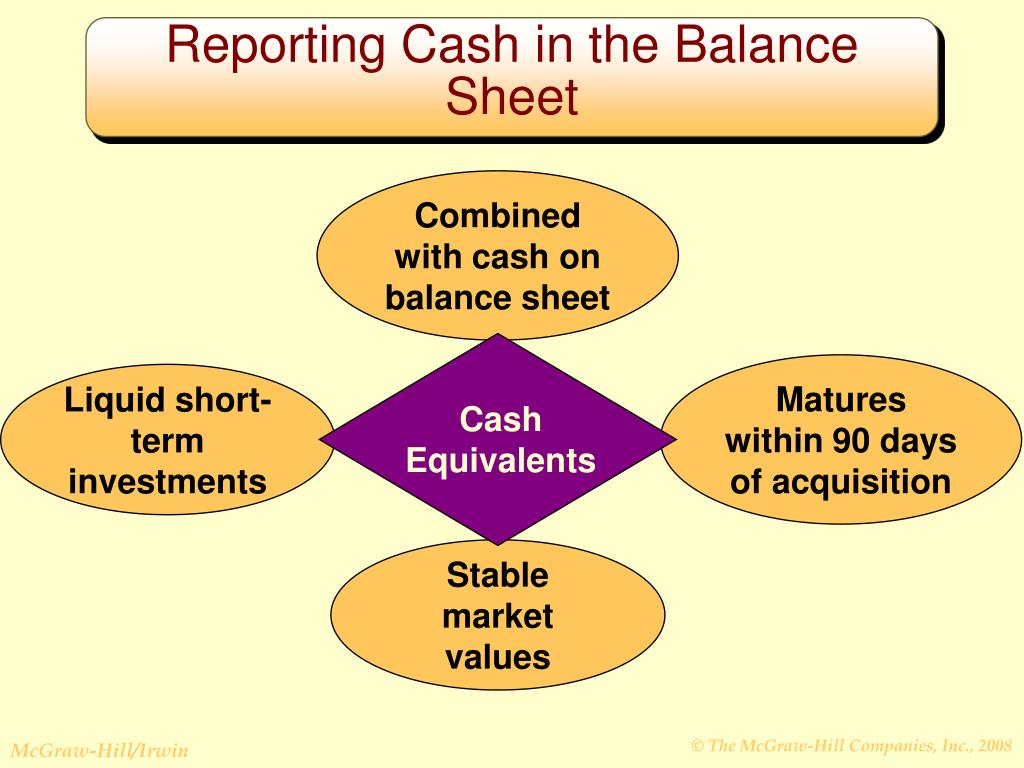

Chapter 7 Financial Assets. ppt download

Classify the outstanding borrowings as noncurrent only if it is reasonable to expect that the specified criteria will be met over the 12 months. Open lines of credit do not need. If you have not yet used your line of credit, no journal entry is necessary to your accounting ledger. Unused credit lines are noted in the footnotes of accounting.

PPT FINANCIAL ASSETS PowerPoint Presentation, free download ID5945026

Classify the outstanding borrowings as noncurrent only if it is reasonable to expect that the specified criteria will be met over the 12 months. This means that a reporting entity may have paid the fee to provide access to the revolving line of credit but may not have a liability on its books. If the line of credit has not.

PPT Financial Assets PowerPoint Presentation, free download ID626273

Classify the outstanding borrowings as noncurrent only if it is reasonable to expect that the specified criteria will be met over the 12 months. Unused credit lines are noted in the footnotes of accounting documents to improve the perceived financial health of the company. If the line of credit has not yet been used, it is unnecessary to record entries.

Financial Assets Chapter 7 Chapter 7 Financial Assets. ppt download

Open lines of credit do not need. You do not need to reflect an. This means that a reporting entity may have paid the fee to provide access to the revolving line of credit but may not have a liability on its books. If the line of credit has not yet been used, it is unnecessary to record entries on.

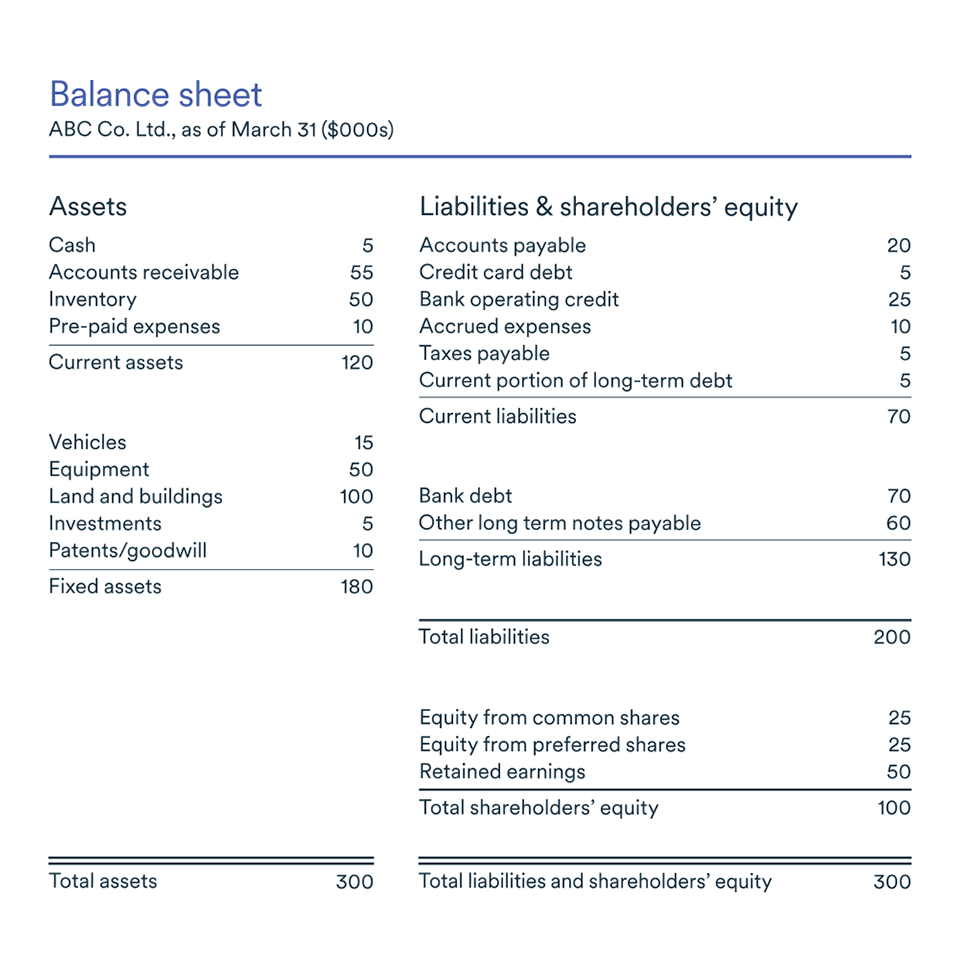

Glory Line Of Credit On Balance Sheet Marketing Expenses Statement

Classify the outstanding borrowings as noncurrent only if it is reasonable to expect that the specified criteria will be met over the 12 months. Unused credit lines are noted in the footnotes of accounting documents to improve the perceived financial health of the company. If you have not yet used your line of credit, no journal entry is necessary to.

Revolving Credit Facilities What Is It, Vs Term Loan

This means that a reporting entity may have paid the fee to provide access to the revolving line of credit but may not have a liability on its books. If the line of credit has not yet been used, it is unnecessary to record entries on your general ledger. Classify the outstanding borrowings as noncurrent only if it is reasonable.

What is a line of credit? BDC.ca

Classify the outstanding borrowings as noncurrent only if it is reasonable to expect that the specified criteria will be met over the 12 months. This means that a reporting entity may have paid the fee to provide access to the revolving line of credit but may not have a liability on its books. If the line of credit has not.

PPT FINANCIAL ASSETS PowerPoint Presentation, free download ID5945026

If the line of credit has not yet been used, it is unnecessary to record entries on your general ledger. If you have not yet used your line of credit, no journal entry is necessary to your accounting ledger. This means that a reporting entity may have paid the fee to provide access to the revolving line of credit but.

PPT FINANCIAL ASSETS PowerPoint Presentation, free download ID5945026

If the line of credit has not yet been used, it is unnecessary to record entries on your general ledger. You do not need to reflect an. If you have not yet used your line of credit, no journal entry is necessary to your accounting ledger. Unused credit lines are noted in the footnotes of accounting documents to improve the.

Solved The unused portion of a line of credit Multiple

Unused credit lines are noted in the footnotes of accounting documents to improve the perceived financial health of the company. Classify the outstanding borrowings as noncurrent only if it is reasonable to expect that the specified criteria will be met over the 12 months. If the line of credit has not yet been used, it is unnecessary to record entries.

You Do Not Need To Reflect An.

Open lines of credit do not need. Unused credit lines are noted in the footnotes of accounting documents to improve the perceived financial health of the company. This means that a reporting entity may have paid the fee to provide access to the revolving line of credit but may not have a liability on its books. If the line of credit has not yet been used, it is unnecessary to record entries on your general ledger.

Classify The Outstanding Borrowings As Noncurrent Only If It Is Reasonable To Expect That The Specified Criteria Will Be Met Over The 12 Months.

If you have not yet used your line of credit, no journal entry is necessary to your accounting ledger.