Venture Debt Warrants

Venture Debt Warrants - When navigating venture debt fundraises, entrepreneurs may encounter warrants, which venture debt investors use to. Unlike equity financing, venture debt does not require giving up company ownership, but it often comes with warrants,. Warrants are a security that gives the holder the right (but not the obligation) to. Understanding warrants in venture debt is crucial because they provide lenders with equity upside potential, aligning their interests. A classic feature in venture debt deals are warrants.

A classic feature in venture debt deals are warrants. Warrants are a security that gives the holder the right (but not the obligation) to. Unlike equity financing, venture debt does not require giving up company ownership, but it often comes with warrants,. When navigating venture debt fundraises, entrepreneurs may encounter warrants, which venture debt investors use to. Understanding warrants in venture debt is crucial because they provide lenders with equity upside potential, aligning their interests.

Unlike equity financing, venture debt does not require giving up company ownership, but it often comes with warrants,. Warrants are a security that gives the holder the right (but not the obligation) to. Understanding warrants in venture debt is crucial because they provide lenders with equity upside potential, aligning their interests. When navigating venture debt fundraises, entrepreneurs may encounter warrants, which venture debt investors use to. A classic feature in venture debt deals are warrants.

What warrants mean for venture debt financing River SaaS Capital

When navigating venture debt fundraises, entrepreneurs may encounter warrants, which venture debt investors use to. A classic feature in venture debt deals are warrants. Unlike equity financing, venture debt does not require giving up company ownership, but it often comes with warrants,. Warrants are a security that gives the holder the right (but not the obligation) to. Understanding warrants in.

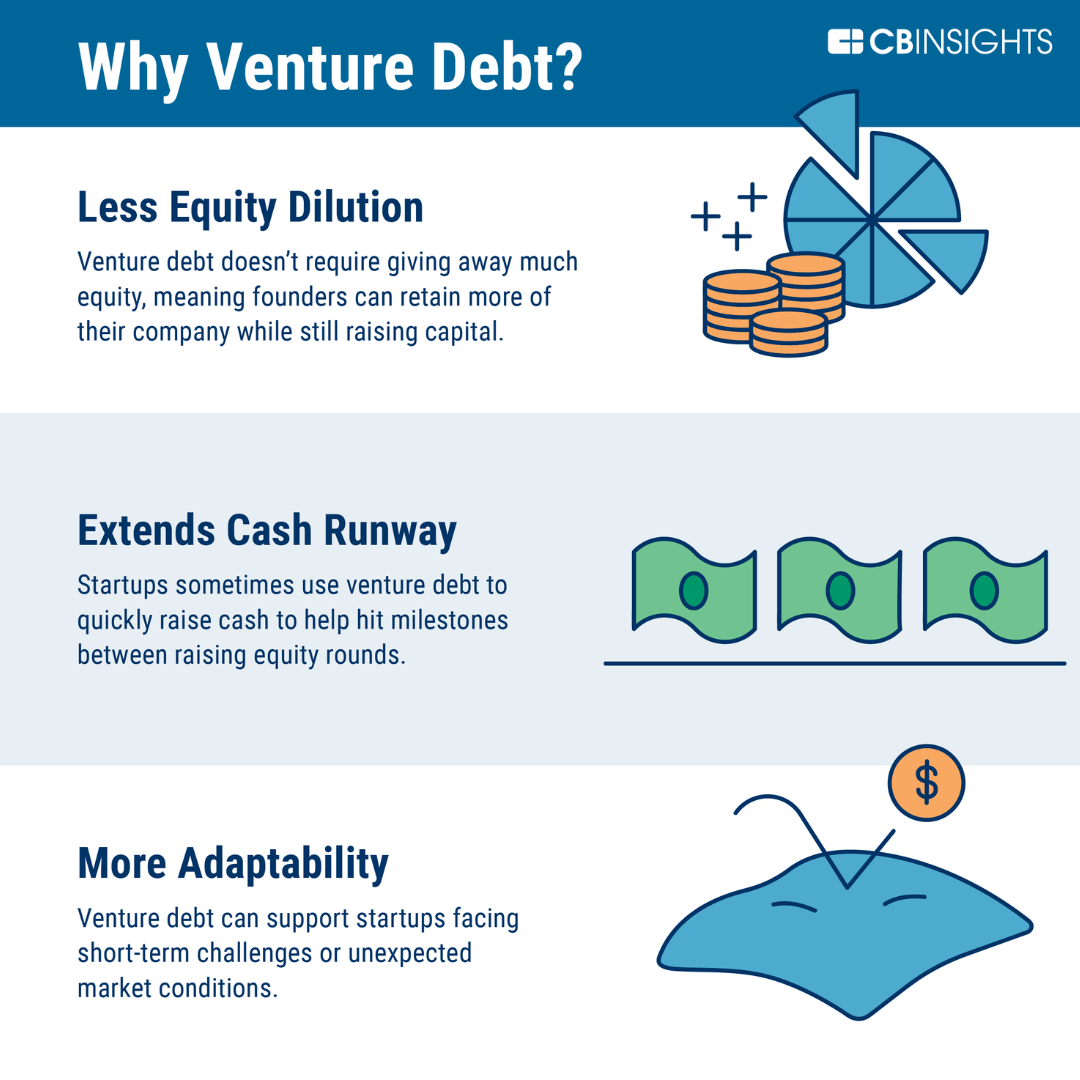

What Is Venture Debt? CB Insights Research

Understanding warrants in venture debt is crucial because they provide lenders with equity upside potential, aligning their interests. Warrants are a security that gives the holder the right (but not the obligation) to. A classic feature in venture debt deals are warrants. When navigating venture debt fundraises, entrepreneurs may encounter warrants, which venture debt investors use to. Unlike equity financing,.

Venture Debt Full Tutorial + Excel Example

When navigating venture debt fundraises, entrepreneurs may encounter warrants, which venture debt investors use to. Unlike equity financing, venture debt does not require giving up company ownership, but it often comes with warrants,. Understanding warrants in venture debt is crucial because they provide lenders with equity upside potential, aligning their interests. A classic feature in venture debt deals are warrants..

Avid Cost of Venture Debt With Warrants and Net Interest Template PDF

Understanding warrants in venture debt is crucial because they provide lenders with equity upside potential, aligning their interests. Unlike equity financing, venture debt does not require giving up company ownership, but it often comes with warrants,. A classic feature in venture debt deals are warrants. Warrants are a security that gives the holder the right (but not the obligation) to..

Thinking through venture debt what it is and how it works Airtree

A classic feature in venture debt deals are warrants. Understanding warrants in venture debt is crucial because they provide lenders with equity upside potential, aligning their interests. Warrants are a security that gives the holder the right (but not the obligation) to. Unlike equity financing, venture debt does not require giving up company ownership, but it often comes with warrants,..

What are Venture debt and warrants and how do they work?

When navigating venture debt fundraises, entrepreneurs may encounter warrants, which venture debt investors use to. A classic feature in venture debt deals are warrants. Warrants are a security that gives the holder the right (but not the obligation) to. Unlike equity financing, venture debt does not require giving up company ownership, but it often comes with warrants,. Understanding warrants in.

Venture Debt Warrant Coverage Upfront or On Usage YouTube

Understanding warrants in venture debt is crucial because they provide lenders with equity upside potential, aligning their interests. Unlike equity financing, venture debt does not require giving up company ownership, but it often comes with warrants,. A classic feature in venture debt deals are warrants. When navigating venture debt fundraises, entrepreneurs may encounter warrants, which venture debt investors use to..

Venture Debt A Guide to Venture Debt Financing (2023)

A classic feature in venture debt deals are warrants. Warrants are a security that gives the holder the right (but not the obligation) to. Understanding warrants in venture debt is crucial because they provide lenders with equity upside potential, aligning their interests. When navigating venture debt fundraises, entrepreneurs may encounter warrants, which venture debt investors use to. Unlike equity financing,.

Venture Debt Warrants Key Terms to Know NonDilutive Capital for

Unlike equity financing, venture debt does not require giving up company ownership, but it often comes with warrants,. Warrants are a security that gives the holder the right (but not the obligation) to. Understanding warrants in venture debt is crucial because they provide lenders with equity upside potential, aligning their interests. A classic feature in venture debt deals are warrants..

Decoding What is a Warrant Debt a Comprehensive Guide A Wonderfully

A classic feature in venture debt deals are warrants. Understanding warrants in venture debt is crucial because they provide lenders with equity upside potential, aligning their interests. When navigating venture debt fundraises, entrepreneurs may encounter warrants, which venture debt investors use to. Unlike equity financing, venture debt does not require giving up company ownership, but it often comes with warrants,..

Warrants Are A Security That Gives The Holder The Right (But Not The Obligation) To.

Understanding warrants in venture debt is crucial because they provide lenders with equity upside potential, aligning their interests. Unlike equity financing, venture debt does not require giving up company ownership, but it often comes with warrants,. A classic feature in venture debt deals are warrants. When navigating venture debt fundraises, entrepreneurs may encounter warrants, which venture debt investors use to.

.png)